I approach the subject of the physics of energy and the economy with some trepidation. An economy seems to be a dissipative system, but what does this really mean? There are not many people who understand dissipative systems, and very few who understand how an economy operates. The combination leads to an awfully lot of false beliefs about the energy needs of an economy.

The primary issue at hand is that, as a dissipative system, every economy has its own energy needs, just as every forest has its own energy needs (in terms of sunlight) and every plant and animal has its own energy needs, in one form or another. A hurricane is another dissipative system. It needs the energy it gets from warm ocean water. If it moves across land, it will soon weaken and die.

There is a fairly narrow range of acceptable energy levels–an animal without enough food weakens and is more likely to be eaten by a predator or to succumb to a disease. A plant without enough sunlight is likely to weaken and die.

In fact, the effects of not having enough energy flows may spread more widely than the individual plant or animal that weakens and dies. If the reason a plant dies is because the plant is part of a forest that over time has grown so dense that the plants in the understory cannot get enough light, then there may be a bigger problem. The dying plant material may accumulate to the point of encouraging forest fires. Such a forest fire may burn a fairly wide area of the forest. Thus, the indirect result may be to put to an end a portion of the forest ecosystem itself.

How should we expect an economy to behave over time? The pattern of energy dissipated over the life cycle of a dissipative system will vary, depending on the particular system. In the examples I gave, the pattern seems to somewhat follow what Ugo Bardi calls a Seneca Cliff.

Figure 1. Seneca Cliff by Ugo Bardi

The Seneca Cliff pattern is so-named because long ago, Lucius Seneca wrote:

It would be some consolation for the feebleness of our selves and our works if all things should perish as slowly as they come into being; but as it is, increases are of sluggish growth, but the way to ruin is rapid.

The Standard Wrong Belief about the Physics of Energy and the Economy

There is a standard wrong belief about the physics of energy and the economy; it is the belief we can somehow train the economy to get along without much energy.

In this wrong view, the only physics that is truly relevant is the thermodynamics of oil fields and other types of energy deposits. All of these fields deplete if exploited over time. Furthermore, we know that there are a finite number of these fields. Thus, based on the Second Law of Thermodynamics, the amount of free energy we will have available in the future will tend to be less than today. This tendency will especially be true after the date when “peak oil” production is reached.

According to this wrong view of energy and the economy, all we need to do is design an economy that uses less energy. We can supposedly do this by increasing efficiency, and by changing the nature of the economy to use a greater proportion of services. If we also add renewables (even if they are expensive) the economy should be able to get along fine with very much less energy.

These wrong views are amazingly widespread. They seem to underlie the widespread hope that the world can reduce its fossil fuel use by 80% between now and 2050 without badly disturbing the economy. The book 2052: A Forecast for the Next 40 Years by Jorgen Randers seems to reflect these views. Even the “Stabilized World Model” presented in the 1972 book The Limits to Growth by Meadow et al. seems to be based on naive assumptions about how much reduction in energy consumption is possible without causing the economy to collapse.

The Economy as a Dissipative System

If an economy is a dissipative system, it needs sufficient energy flows. Otherwise, it will collapse in a way that is analogous to animals succumbing to a disease or forests succumbing to forest fires.

The primary source of energy flows to the economy seems to come through the leveraging of human labor with supplemental energy products of various types, such as animal labor, fossil fuels, and electricity. For example, a man with a machine (which is made using energy products and operates using energy products) can make more widgets than a man without a machine. A woman operating a computer in a lighted room can make more calculations than a woman who inscribes numbers with a stick on a clay tablet and adds them up in her head, working outside as weather permits.

As long as the quantity of supplemental energy supplies keeps rising rapidly enough, human labor can become increasingly productive. This increased productivity can feed through to higher wages. Because of these growing wages, tax payments can be higher. Consumers can also have ever more funds available to buy goods and services from businesses. Thus, an economy can continue to grow.

Besides inadequate supplemental energy, the other downside risk to continued economic growth is the possibility that diminishing returns will start making the economy less efficient. These are some examples of how this can happen:

- Deeper wells or desalination are needed for water because aquifers deplete and population grows.

- More productivity is needed from each acre of arable land because of growing population (and thus, falling arable land per person).

- Larger mines are required as ores of high mineral concentration are exhausted and we are forced to exploit less productive mines.

- More pollution control devices or higher-cost workarounds (such as “renewables”) are needed as pollution increases.

- Fossil fuels from cheap-to-extract locations are exhausted, so extraction must come from more difficult-to-extract locations.

In theory, even these diminishing returns issues can be overcome, if the leveraging of human labor with supplemental energy is growing quickly enough.

Theoretically, technology might also increase economic growth. The catch with technology is that it is very closely related to energy consumption. Without energy consumption, it is not possible to have metals. Most of today’s technology depends (directly or indirectly) on the use of metals. If technology makes a particular type of product cheaper to make, there is also a good chance that more products of that type will be sold. Thus, in the end, growth in technology tends to allow more energy to be consumed.

Why Economic Collapses Occur

Collapses of economies seem to come from a variety of causes. One of these is inadequate wages of low-ranking workers (those who are not highly educated or of managerial rank). This tends to happen because if there are not enough energy flows to go around, it tends to be the wages of the “bottom-ranking” employees that get squeezed. In some cases, not enough jobs are available; in others, wages are too low. This could be thought of as inadequate return on human labor–a different kind of low Energy Return on Energy Invested (EROEI) than is currently analyzed in most of today’s academic studies.

Another area vulnerable to inadequate energy flows is the price level of commodities. If energy flows are inadequate, prices of commodities will tend to fall below the cost of producing these commodities. This can lead to a cutoff of commodity production. If this happens, debt related to commodity production will also tend to default. Defaulting debt can be a huge problem, because of the adverse impact on financial institutions.

Another way that inadequate energy flows can manifest themselves is through the falling profitability of companies, such as the falling revenue that banks are now experiencing. Still another way that inadequate energy flows can manifest themselves is through falling tax revenue. Governments of commodity exporters are particularly vulnerable when commodity prices are low. Ultimately, these inadequate energy flows can lead to bankrupt companies and collapsing governments.

The closest situation that the US has experienced to collapse is the Depression of the 1930s. The Great Recession of 2007-2009 would represent a slight case of inadequate energy flows–one that could be corrected by a large dose of Quantitative Easing (QE)(leading to the lower cost of borrowing), plus debt stimulus by China. These helped bring oil prices back up again, after they fell in mid-2008.

Figure 2. World Oil Supply (production including biofuels, natural gas liquids) and Brent monthly average spot prices, based on EIA data.

Clearly, we are now again beginning to experience the effects of inadequate energy flows. This is worrying, because many economies have collapsed in the past when this situation occurred.

How Energy Flows of an Economy are Regulated

In an economy, the financial system is the regulator of the energy flows of the system. If the price of a product is low, it dictates that a small share of energy flows will be directed toward that product. If it is high, it indicates that a larger share of energy flows will be directed toward that product. Wages follow a similar pattern, with low wages indicating low flows of energy, and high wages indicating higher flows of energy. Energy flows in fact “pay for” all aspects of the system, including more advanced technology and the changes to the system (more education, less time in the workforce) that make advanced technology possible.

One confusing aspect to today’s economy is the use of a “pay you later” approach to paying for energy flows. If the energy flows are inadequate using what we would think of as the natural flows of the system, debt is often used to increase energy flows. Debt has the effect of directing future energy flows in a particular direction, such as paying for a factory, a house, or a car. These flows will be available when the product is already part of the system, and thus are easier to accommodate in the system.

The use of increasing debt allows total “demand” for products of many kinds to be higher, because it directs both future flows and current flows of energy toward a product. Since factories, houses and cars are made using commodities, the use of an increasing amount of debt tends to raise commodity prices. With higher commodity prices, more of the resources of the economy are directed toward producing energy products. This allows for increasing energy consumption. This increased energy consumption tends to help flows of energy to many areas of the economy at the same time: wages, taxes, business profitability, and funds for interest and dividend payments.

The need for debt greatly increases when an economy begins using fossil fuels, because the use of fossil fuels allows a step-up in lifestyle. There is no way that this step-up in lifestyle can be paid for in advance, because the benefits of the new system are so much better than what was available without fossil fuels. For example, a farmer raising crops using only a hoe for a tool will never be able to save up sufficient funds (energy flows) needed to pay for a tractor. While it may seem bizarre that banks loan money into existence, this approach is in fact essential, if adequate energy flows are to be available to compensate for the better lifestyle that the use of fossil fuels makes possible.

Debt needs are low when the cost (really energy cost) of producing energy products is low. Much more debt is needed when the cost of energy extraction is high. The reason more debt is needed is because fossil fuels and other types of energy products tend to leverage human labor, making human labor more productive, as mentioned previously. In order to maintain this leveraging, an adequate quantity of energy products (measured in British Thermal Units or Barrels of Oil Equivalent or some similar unit) is needed.

As the required price for energy-products rises, it takes ever-more debt to finance a similar amount of energy product, plus the higher cost of homes, cars, factories, and roads using the higher-cost energy. In fact, with higher energy costs, capital goods of all kinds will tend to be more expensive. This is a major reason why the ratio of debt to GDP tends to rise as the cost of producing energy products rises. At this point, in the United States it takes approximately $3 of additional debt to increase GDP by $1 (author’s calculation).

Figure 3. Inflation adjusted Brent oil prices (in $2014, primarily from BP Statistical Review of World Energy) shown beside two measures of debt for the US economy. One measure of debt is all-inclusive; the other excludes Financial Business debt. Both are based on data from FRED-Federal Reserve of St. Louis.

Clearly one of the risk factors to an economy using fossil fuels is that debt levels will become unacceptably high. A second risk is that debt will stop rising fast enough to keep commodity prices at an acceptably high level. The recent slowdown in the growth of debt (Figure 3) no doubt contributes to current low commodity prices.

A third risk to the system is that the rate of economic growth will slow over time because even with the large amount of debt added to the system, the leveraging of human labor with supplemental energy will not be sufficient to maintain economic growth in the face of diminishing returns. In fact, it is clearly evident that US economic growth has trended downward over time (Figure 4).

Figure 4. US annual growth rates (using “real” or inflation adjusted data from the Bureau of Economic Analysis).

A fourth risk is that the whole system will become unsustainable. When new debt is issued, there is no real matching with future energy flow. For example, will the wages of those taking on debt to pay for college be sufficiently high that the debtors can afford to have families and buy homes? If not, their lack of adequate income will be one of the factors that make it difficult for the prices of commodities to stay high enough to encourage extraction.

One of the issues in today’s economy is that promises of future energy flows extend far beyond what is formally called debt. These promises include shareholder dividends and payments under government programs such as Social Security and Medicare. Reneging on promises such as these is likely to be unpopular with citizens. Stock prices are likely to drop, and private pensions will become unpayable. Governments may be overthrown by disappointed citizens.

Examples of Past Collapses of Economies

Example of the Partial Collapse of the Former Soviet Union

One recent example of a partial collapse was that of the Former Soviet Union (FSU) in December 1991. I call this a partial collapse, because it “only” involved the collapse of the central government that held together the various republics. The governments of the individual republics remained in place, and many of the services they provided, such as public transportation, continued. The amount of manufacturing performed by the FSU dropped precipitously, as did oil extraction. Prior to the collapse, the FSU had serious financial problems. Shortly before its collapse, the world’s leading industrial nations agreed to lend the Soviet Union $1 billion and defer repayment on $3.6 billion more in debt.

A major issue that underlay this collapse was a fall in oil prices to the $30 per barrel range in the 1986 to 2004 period. The Soviet Union was a major oil exporter. The low price had an adverse impact on the economy, a situation similar to that of today.

Figure 5. Oil production and price of the Former Soviet Union, based on BP Statistical Review of World Energy 2015.

Russia continued to pump oil even after the price dropped in 1986. In fact, it raised oil production, to compensate for the low price (energy flow it received per barrel). This is similar to the situation today, and what we would expect if oil exporters are very dependent on these energy flows, no matter how small. Oil production didn’t fall below the 1986 level until 1989, most likely from inadequate funds for reinvestment. Oil production rose again, once prices rose.

Figure 6 shows that the FSU’s consumption of energy products started falling precipitously in 1991, the year of the collapse–very much a Seneca Cliff type of decline.

Figure 6. Former Soviet Union energy consumption by source, based on BP Statistical Review of World Energy Data 2015.

In fact, consumption of all fuels, even nuclear and hydroelectric, fell simultaneously. This is what we would expect if the FSU’s problems were caused by the low prices it was receiving as an oil exporter. With low oil prices, there could be few good-paying jobs. Lack of good-paying jobs–in other words, inadequate return on human labor–is what cuts demand for energy products of all kinds.

A drop in population took place as well, but it didn’t begin until 1996. The decrease in population continued until 2007. Between 1995 and 2007, population dropped by a total of 1.6%, or a little over 0.1% per year. Before the partial collapse, population was rising about 0.9% per year, so the collapse seems to have reduced the population growth rate by about 1.0% per year. Part of the drop in population was caused by excessive alcohol consumption by some men who had lost their jobs (their sources of energy flows) after the fall of the central government.

When commodity prices fall below the cost of oil production, it is as if the economy is cold because of low energy flows. Prof. Francois Roddier describes the point at which collapse sets in as the point of self-organized criticality. According to Roddier (personal correspondence):

Beyond the critical point, wealth condenses into two phases that can be compared to a gas phase and a liquid phase. A small number of rich people form the equivalent of a gas phase, whereas a large number of poor people form what corresponds to a liquid phase. Like gas molecules, rich people monopolize most of the energy and have the freedom to move. Embedded in their liquid phase, poor people have lost access to both energy and freedom. Between the two, the so-called middle class collapses.

I would wonder whether the ones who die would be equivalent to the solid state. They can no longer move at all.

Analysis of Earlier Collapses

A number of studies have been performed analyzing earlier collapses. Turchin and Nefedov in Secular Cycles analyze eight pre-fossil fuel collapses in detail. Figure 7 shows my interpretation of the pattern they found.

Figure 7. Shape of typical Secular Cycle, based on work of Peter Turchin and Sergey Nefedov in Secular Cycles.

Again, the pattern is that of a Seneca Cliff. Some of the issues leading to collapse include the following:

- Rising population relative to farmland. Either farmland was divided up into smaller plots, so each farmer produced less, or new workers received “service” type jobs, at much reduced wages. The result was falling earnings of many non-elite workers.

- Spiking food and energy prices. Prices were high at times due to lack of supply, but held down by low wages of workers.

- Rising need for government to solve problems (for example, fight war to get more land; install irrigation system so get more food from existing land). Led to a need for increased taxes, which impoverished workers could not afford.

- Increased number of nobles and high-level administrators. Result was increased disparity of wages.

- Increased debt, as more people could not afford necessities.

Eventually, the workers who were weakened by low wages and high taxes tended to succumb to epidemics. Some died in wars. Again, we have a situation of low energy flows, and the lower wage workers not getting enough of these flows. Many died–in some cases as many as 95%. These situations were much more extreme than those of the FSU. On the favorable side, the fact that there were few occupations back in pre-industrial days meant that those who did survive could sometimes resettle with other nearby communities and continue to practice their occupations.

Joseph Tainter in The Collapse of Complex Societies talks about the need for increasing complexity, as diminishing returns set in. This would seem to correspond to the need for increased government services and an increased role for businesses. Also included in increased complexity would be increased hierarchical structure. All of these changes would leave a smaller share of the energy flows for the low-ranking workers–a problem mentioned previously.

Dr. Tainter also makes the point that to maintain complexity, “Sustainability may require greater consumption of resources, not less.”

A Few Insights as to the Nature of the Physics Problem

The Second Law of Thermodynamics seems to work in a single direction. It talks about the natural tendency of any “closed” system to degenerate into a more disordered system. With this view, the implication is that the universe will ultimately end in a heat-death, in which everything is at the same temperature.

Dissipative systems work in the other direction; they create order where no order previously existed. Economies get ever-more complex, as businesses grow larger and more hierarchical in form, governments provide more services, and the number of different jobs filled by members of the economy proliferate. How do we explain this additional order?

According to Ulanowicz, the traditional focus of thermodynamics has been on states, rather than on the process of getting from one state to another. What is needed is a theory that is more focused on processes, rather than states. He writes,

. . . the prevailing view of the second law is an oversimplified version of its true nature. Simply put, entropy is not entirely about disorder. Away from equilibrium, there is an obverse and largely unappreciated side to the second law that, in certain circumstances, mandates the creation of order.

We are observing the mandated creation of order. For example, the human body takes chemical energy and transforms it to mechanical energy. There is a dualism to the entropy system that many have not stopped to appreciate. Instead of a trend toward heat death always being the overarching goal, systems have a two-way nature to them. Dissipative systems are able to grow until they reach a point called self-organized criticality or the “critical point”; then they shrink from inadequate energy flows.

In forests, this point of self-organized criticality comes when the growth of the tall trees starts blocking out the light to the shorter plants. As mentioned earlier, at that point the forest starts becoming more susceptible to forest fires. Ulanowicz shows that for ecosystems with more than 12 elements, there is quite a narrow “window of viability.”

Figure 8. Illustration of close clustering of ecosystems with more than 12 elements, indicating the narrow “window of viability” of such ecosystems. From Ulanowicz

If we look at world per capita energy consumption, it seems to indicate a very narrow “window of viability” as well.

Figure 9. World energy consumption per capita, based on BP Statistical Review of World Energy 2105 data. Year 2015 estimate and notes by G. Tverberg.

When we look at what happened in the world economy alongside the history of world energy consumption, we can see a pattern. Back prior to 1973, when oil was less than $30 per barrel, oil consumption and the economy grew rapidly. A lot of infrastructure (interstate highways, electric transmission lines, and pipelines) was added in this timeframe. The 1973-1974 price shock and related recession briefly brought energy consumption down.

It wasn’t until the restructuring of the economy in the late 1970s and early 1980s that energy consumption really came down. There were many changes made: cars became smaller and more fuel efficient; electricity production was changed from oil to other approaches, often nuclear; regulation of utilities was changed toward greater competition, thus discouraging building infrastructure unless it was absolutely essential.

The drop in energy consumption after 1991 reflects the fall of the Former Soviet Union. The huge ramp-up in energy consumption after 2001 represents the effect of adding China (with all of its jobs and coal consumption) to the World Trade Organization. With this change, energy needs became permanently higher, if China was to have enough jobs for its people. Each small dip seems to represent a recession. Recently energy consumption seems to be down again. If we consider low consumption along with low commodity prices, it makes for a worrying situation. Are we approaching a major recession, or worse?

If we think of the world economy relative to its critical point, the world economy has been near this point since 1981, but various things have pulled us out.

One thing that has helped the economy is the extremely high interest rate (18%) implemented in 1981. This high interest rate pushed down fossil fuel usage at that time. It also gave interest rates a very long way to fall. Falling interest rates have a very favorable impact on the economy. They encourage greater lending and tend to raise the selling prices of stocks. The economy has received a favorable boost from falling interest rates for almost the entire period between 1981 and the present.

Other factors were important as well. The fall of the Soviet Union in 1991 bought the rest of the world a little time (and saved oil extraction for later); the addition of China to the World Trade Organization in 2001 added a great deal of cheap coal to the energy mix, helping to bring down energy costs. These low energy costs, plus all of the debt China was able to add, allowed energy consumption and the world economy to grow again–temporarily pulling the world away from the critical point.

In 2008, oil prices dropped very low. It was only with QE that interest rates could be brought very low, and commodity prices bounced back up to adequate levels. Now we are again faced with low prices. It looks as if we are again at the critical point, and thus the edge of collapse.

Once a dissipative structure is past its critical point, Roddier says that what is likely to bring it down is an avalanche of bifurcations. In the case of an economy, these might be debt defaults.

In a dissipative structure, both communication and stored information are important. Stored information, which is very close to technology, becomes very important when food is hard to find or energy is high cost to extract. When energy is low-cost to extract, practically anyone can find and make use of energy, so technology is less important.

Communication in an economy is done in various ways, including through the use of money and debt. Few people understand the extent to which debt can give false signals about future availability of energy flows. Thus, it is possible for an economy to build up to a very large size, with few realizing that this approach to building an economy is very similar to a Ponzi Scheme. It can continue only as long as energy costs are extremely low, or debt is being rapidly added.

In theory, EROEI calculations (comparing energy produced by a device or energy product to fossil fuel energy consumed increasing this product) should communicate the “value” of a particular energy product. Unfortunately, this calculation is based the common misunderstanding of the nature of the physics problem that I mentioned at the beginning of the article. (This is also true for similar analyses, such as Lifecycle Analyses.) These calculations would communicate valuable information, if our problem were “running out” of fossil fuels, and if the way to mitigate this problem were to use fossil fuels as sparingly as possible. If our problem is rising debt levels, EROEI and similar calculations do nothing to show us how to mitigate the problem.

If the economy collapses, it will collapse down to a lower sustainable level. Much of the world’s infrastructure was built when oil could be extracted for $20 per barrel. That time is long gone. So, it looks like the world will need to collapse back to a level before fossil fuels–perhaps much before fossil fuels.

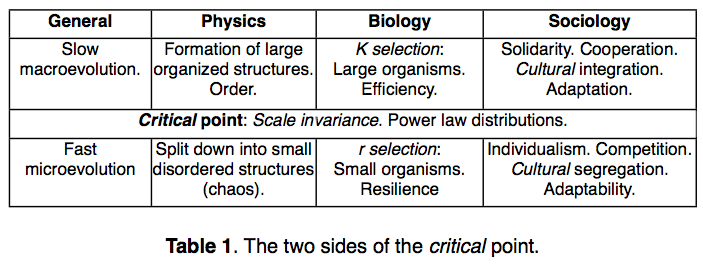

If it is any consolation, Prof. Roddier says that once new economies begin to form again, the survivors after collapse will tend to be more co-operative. In fact, he offers this graphic.

Figure 10. F. Roddier view of what happens on the two sides of the critical point. From upcoming translation of his book, “The Thermodynamics of Evolution.”

We know that if there are survivors, new economies will be likely. We don’t know precisely what they will be like, except that they will be limited to using resources that are available at that time.

Some References to Francois Roddier’s Work (in French)

THERMODYNAMIQUE DE L’ÉVOLUTION “UN ESSAI DE THERMO-BIO-SOCIOLOGIE” -The Thermodynamics of Evolution – Book, soon to be translated to English. Will at some point be available from the same site in English.

Roddier writes:

This is a talk I gave at the CNAM (Paris) on December 2, 2013. The title is:Thermodynamique et économie ; des sciences exactes aux sciences humaines

In this talk, I show that Per Bak’s neural network model can be used to describe an economic system as a neural network of agents exchanging money. The paper gives a brief explanation on how economies collapse.

The other talk is one I gave in Paris on March 12, 2015, for Jancovici’s Shift Project. The title is:

La thermodynamique des transitions économiques

A video of this talk is available on the web at the following address:

https://www.youtube.com/watch?v=5-qap1cQhGA

In this talk, I describe economy in terms of Gibbs-Duhem potentials (akin to chemical potentials). Money flows measure entropy flows (with opposite sign). The cost of energy plays the role of an inverse temperature. I show that economic cycles are similar to those of a steam engine. They self organize around a critical point.

Always amusing to read what the idiots who inhabit the comments section of ZH have to say about FW articles…

http://www.zerohedge.com/news/2016-02-10/physics-energy-economy

Too long, didn’t read.

When do I get MY free Obamaphone, that’s what I want to know.

I agree with you, Fast Eddy, regarding those making jabs at FW and Gail herself there. Noticed you may have used a new avatar image/name at Zero Hedge…Mr. Magoo!

That fits perfectly, hopefully we will have the same fortune and walk through the chaos untouched as Mr Magoo does in the cartoon. I doubt it.

Word for word

Magooo’s picture

Or in other words:

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH

For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil production has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

BUT OIL COMPANES NEED $100+ OIL

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

Nice try, Fast Eddie, but you were ignored.

We cannot just think of a society of frugal farmers reaping what the sun provides. In such a society a band of robbers would be extremely successful eliminating the farmers. History of technology is also history of wars. What will happen if some countries still have access to cheap oil while others have not? Safety reasons could soon be the limiting factor of human existance. And that’s not only in respect of the refugees coming to Europe.

Dear Gail and Finite Worlders

This post is consistent with what I said regarding some of the thermodynamic models (I won’t name names):

steve from virginia says:

02/10/2016 AT 5:56 PM

Everyone and their brother keep saying how crud(ish) prices are going to be higher after ____ months/years. Salvation: when enough drillers fail and get out of the business. There will be shortages and … higher prices!

What these experts don’t ever say is HOW the prices are going to be higher!

Where is the money going to come from?

Money is credit: what group/organization/banking sector/finance is going to lend to ordinary end users when these same users cannot earn a penny by burning their fuel?

Leave out farmers, deliverymen, bus drivers and bulldozer owners. A person does not fly to Disney World to pay for the fuel used in the airplane, he does something else. The commuter does not drive back and forth to work in order to pay for his commute, he does something else. A businessman does not waste fuel to pay for it; all of these folks borrow, either directly from their own lenders, or indirectly by way of their bosses’ companies … or the governments in their place. No borrowing, no fuel buying.

Somehow or other a shortage of fuel is going to render these hapless borrowers able to borrow when a ‘glut’ of fuel cannot.

What Jeffrey Brown points out over and over is the so-called ‘glut’ is simply another finance industry -slash- media narrative, a pleasant lie that glosses over the fact that fuel supply is declining, that purchasing power is declining along with it and that no easy solutions to these declines exist. (The only solution is stringent conservation — getting rid of the cars).

Underway is a structural breakdown of the fuel financing regime. It is not going to ‘unbreakdown’ itself, any shortages will make matters worse.

Back to me. I was looking at WTI futures. I believe the 2019 December future is only 45 dollars. I don’t think very many people can go out and find any new oil at that price. I doubt that tar sands and Orinoco heavy can be produced at that price. I doubt that fracking pays at that price. Some in-fill drilling might pay at that price, because the infrastructure is basically already in place. Tending many existing wells will make sense at that price.

So the choice we have is to either use the oil remaining in the way we have been using it, which seems to be taking us over the Seneca Cliff. The alternative is to ration oil (in one way or another) to the most valuable uses, which I think would involve building infrastructure which will survive after the Oil Age is over. If we choose the latter option, we have to get busy immediately, because we have an awful lot to do.

Don Stewart

Yes, I generally agree with Steve Ludlum.

Gail

Relative to cooperation vs. competition. Rob O’Grady, in 150 Strong, reports on Kropotkin’s study of pioneers settling the American West. Initially in a new settlement, things tilted toward cooperation, apparently because everyone had very little…just what they were able to bring in a wagon or maybe on foot with a pack animal. After a few years, as the people in the group got a little richer, cooperation declined. Kropotkin showed that cooperation almost always yielded better results in small groups. I would speculate that, after self-reliance becomes possible, the aggravations of trying to get along with other people swing the participants toward avoiding the hassles of cooperating.

At any rate, just based on the evidence I have, I would think that Janine Benyus may be closer to the truth than Roddier. Tough times favor cooperation.

Don Stewart

I suspect the found it useful to cooperate to kill the threat of the native tribes….

My son spent a year on an Israeli Kibbutz, which had lost it’s socialist ideals and was privatizing. He said “Poverty is easier to share than poverty.”

Whoops! I meant “Poverty is easier to share than prosperiy.”

lnterguru

I knew what you meant. I had heard the phrase before…possibly from you.

Thanks…Don Stewart

Good point!

Bonjour Don,

you seem to be very focused on the Dunbar number, these days!

I agree it looks like the most efficient organisation, if you don’t need high-tech devices.

Also agree that Kropotkin had a whole lot of very wise statements.

My final take on cooperation is that grouping happens (and lasts) only if the group yields more energy than the sum of separate individuals.

Merely staying alive being the first condition to achieve that.

As for Roddier, I think there’s a slight misunderstanding. Don’t know when they expect to publish his book in English version…

Stefeun

The book ‘150 Strong’ is provocative. For example, I am going to our annual Farming and Climate Change conference in about a month. A soil scientist from Asheville is always there. She and I were talking back in October at another farm conference about carbon sequestered in the soil….which helps with myriad problems we face.

Albert Bates and others have written about attempts by the United Nations to promote soil sequestration as a solution. The 150 Strong book got me thinking about it from the other end of the spectrum.

Could we not, right here in our little town, get 147 consumers and 3 farmers to buy into a group of 150 which agrees to a CSA (consumer supported agriculture) model whereby the 3 farmers agree to adopt good practices and transparently give us reports on how they are doing. The 147 agree to purchase their farm products. If we can do it cheaper or for the same amount of money as present, no problem. Even if it costs 10 percent more, I think we could find the 147 people. Pretty quickly, I believe, the costs on the carbon farms would decline below what the cost is today. It’s just getting over the initial conversion that is the barrier for a cash-poor farmer.

I have proposed it to the soil scientist. We’ll see what she has to say.

Don

https://www.youtube.com/watch?v=eZeYVIWz99I

Or else

http://www.thirteen.org/13pressroom/files/2014/02/Livingstone-0637.jpg

I have a version of the text of his book. In my opinion, it still could use more editing. The other point is that the book is really more about evolution than it is about economies and how they work.

I have other unpublished material of his that is more about an economy as a dissipative structure.

Why?

Is Gail six months earlier than the “experts” in reporting trends?

http://www.zerohedge.com/news/2016-02-10/bps-stunning-warning-every-oil-storage-tank-will-be-full-few-months

Not quite six months ahead, but far enough.

New York State government is preparing for disruption by making sure police and government will not be without power.

http://documents.dps.ny.gov/public/Common/ViewDoc.aspx?DocRefId={F3E1213D-89D6-4151-AE5E-DC8EF1F7D7FC}

“The Company states that the primary design objective of the Potsdam project is to develop utility services allowing the microgrid to deliver electricity to microgrid-connected customers for up to two weeks, during widespread power outages that would otherwise leave those customers

without power, thereby allowing essential services to continue. For this demonstration, the focus is on customers and services that include the State University of New York, Potsdam (SUNY Potsdam), Clarkson University, gas stations, banks, grocery stores, drug stores, and critical facilities such as local police, fire, hospital, shelters, water and sewer, and governmental facilities

(collectively referred to as critical services for the purpose of this document).”

Individual citizen do not make the cut.

I checked about timing. It is still at least a couple of years away in timing. In fact, it looks like it still has to be built starting about mid 2017.

Staff has determined that the Potsdam Resiliency

Project will be implemented within a reasonable timeframe.

National Grid expects both the conceptual design to be completed

and the audit-grade detailed engineering study to begin by June

2016. The preliminary service proposals and rate designs will

then be developed and presented to the Potsdam microgrid

customers by the end of 2016. The Company indicates that over

the first six months of 2017, affected parties within the

Potsdam community will evaluate and compare National Grid’s

offerings, and the financial/business plans will be finalized.

Therefore, the total duration of the demonstration is expected

to be one and a half years.

“simply has concentrated the inflation to the sorts of assets the monied set buys: private jets, penthouse apartments, fine art, large gemstones, etc. So yes, their efforts produced price inflation; just of the wrong sort.”

“Keyenesians” will tell you that this is exactly the right thing to do, everybody should have gold taps in their bathroom. It’s the primary bankers hogging all the credit that causes the problems. 😉

The following was from peak prosperity, found on on peak oil dot com, and is a really good read, dovetailing well with Gail’s posts.

http://peakoil.com/business/the-return-of-crisis

“The public has yet to wake up to the mathematical reality that over $200 trillion in debt and perhaps another $500 trillion of un(der)funded liabilities really cannot ever be paid back under current terms. However, this fact is dawning within the minds of more and more critical thinkers with each passing day.

In order for these obligations to be reset to a reality-based level, something has to give. The central banks have tried to modify the phrase “under current terms” by debasing the currency these obligations are written in via inflation. Try as they have, though, they’ve been unable to create the sort of “goldilocks” low-level inflation that would slowly sublimate that massive pile of debt into something more manageable.

Wide-spread inflation has not happened. Why not? Because they’ve failed to note that plan of handing all of their newly printed money to a very wealthy elite — while a socially popular thing to do among the cocktail party set — simply has concentrated the inflation to the sorts of assets the monied set buys: private jets, penthouse apartments, fine art, large gemstones, etc. So yes, their efforts produced price inflation; just of the wrong sort.

Even worse, all the central banks have really accomplished is to assure that when the deflation monster finally arrives it will be gigantic, highly damaging and possibly uncontrollable. I’ll admit to being worried about this next crash/crisis because I imagine it will involve record-setting losses, human misery due to lost jobs and dashed dreams, and possibly even the prospect of wars and serious social unrest.

Let me be blunt: this next crash will be far worse and more dramatic than any that has come before. Literally, the world has never seen anything like the situation we collectively find ourselves in today. The so-called Great Depression happened for purely monetary reasons. Before, during and after the Great Depression, abundant resources, spare capacity and willing workers existed in sufficient quantities to get things moving along smartly again once the financial system had been reset.

This time there’s something different in the story line: the absence of abundant and high-net energy oil. Many of you might be thinking “Hey, the price of oil is low!” which is true, but only momentarily. Remember that price is not the same thing as net energy, which is what’s left over after you expend energy to get a fossil fuel like oil out of the ground. As soon as the world economy tries to grow rapidly again, we’ll discover that oil will quickly go through two to possibly three complete doublings in price due to supply issues. And those oil price spikes will collide into that tower of outstanding debt, making the economic growth required to inflate them away a lot more expensive (both cost-wise and energetically) to come by.

With every passing moment, the world has slightly less high-net energy conventional oil and is replacing that with low-net energy oil. Consider how we’re producing less barrels of production in the North Sea while coaxing more out of the tar sands. From a volume or a price standpoint right now, the casual observer would notice nothing. But it takes a lot more energy to get a barrel of oil from tar sands. So there’s less net energy which can be used to grow the world economy after that substitution.

Purely from a price standpoint, our model at Peak Prosperity includes the idea that there’s a price of oil that’s too high for the economy to sustain (the ceiling) and a price that’s too low for the oil companies to remain financially solvent (the floor). That ceiling and that floor are drawing ever closer. When we reach the point at which there’s not enough of a gap between them to sustainably power the growth our economy currently is depending on, there’s nothing left but to adjust our economic hopes and dreams to more realistic — and far lower — levels.

When this happens most folks will undergo a “forced simplification” of their lifestyles (as well as their financial portfolios), which they will experience as disruptive and emotionally difficult. That’s not fear-mongering; it’s just math.”

My only reservation of that information from peak prosperity, is the following:

“As soon as the world economy tries to grow rapidly again, we’ll discover that oil will quickly go through two to possibly three complete doublings in price due to supply issues.”

I doubt there is enough flexibility in the global economy to sustain doubling to tripling of oil price without immediate contraction. But I suppose that depends on how low the price goes. If it goes down to 15 a barrel, it could double to 30 and triple to 45. That’s possible, but forget 80-120 again.

My prediction for the next oil price peak, $60/barrel. I do not think it will hold for long, maybe four months. When will it happen, 2020.

I don´t understand how we could get to 2020 http://www.bloomberg.com/quote/BDIY:IND

What I see is a Mega- Giga-Titanic sinking. The sinking has started and now the only way to go is down. Sometimes faster, sometimes slower, but down and down we go.

It´s weird to watch this behemoth slowly dying. Some seem to have some comprehension about the situation, but others seem unable to see what will follow “Wow, look at that arterial wound, it must be pumping that blood 3ft high, at least, cool!”

If you have any great ideas how the heck this beast of ours could get to 2020, then please share.

Van Kent

I’m not Ed and this won’t save the Beast….but might amuse you for a few minutes.

I am thinking that things might really be different this time, in a different way. First, I think it is true that the economy is really a double entry bookkeeping sort of operation. There has to be production, but the ordinary person has to be provided with income in order to buy the products and services produced. If the balance between the debits and the credits goes awry, things go wrong.

Yet humans may very well be losing the competition with the machines. For example, consider this post:

http://howtosavetheworld.ca/2016/02/08/a-theory-of-no-mind/

Not necessary to parse it all closely….just note that humans are deemed to be pretty delusional, and it is built into the kind of critters we turned out to be.

Now if you want to make a product or service, which will you favor:

*A machine which does what it is programmed to do, without complaint, low maintenance?

*A high maintenance, delusional human?

As our ability to make machines whose capabilities are expanding steadily, it seems that the humans are demoted to every lower status jobs…the by now expected monthly addition of waiters and bartenders to the payrolls. Even in professions which seem like they might be immune to some of the stresses, things can be bad. I was visiting with a PhD in Nursing who took early retirement from a local University Hospital. She was fed up, and couldn’t see punishing herself anymore. She now works as a gardener. She said ‘all the nursing is now done by nurses aides’ and ‘RNs don’t really do the work anymore’. Might it be true that RNs, being a little more extensively educated, might have ideas they are not supposed to have, so work is devolved down to lightly educated nurses aides so that instructions are followed? Next best thing to a robot?

I only add this to the list of problems…I do not offer it as a Complete Explanation of Everything.

Don Stewart

Van Kent and et.al.,

Once again it depends on whether you cling to the fast collapse or slow collapse model in whether we get to 2020 with an intact economy and civilization or not. I was struck by the graph in Gail’s post from Roddier regarding the Critical Point. There is Slow Macroevolution–same as slow collapse, where we end up with survivors engaging in Collaboration and adaptation. This is my bet on how things will unfold. Or, we will have Fast Microevolution which has survivors reverting to Individualism and adaption. This is Fast Eddy’s bet on how things will unfold.

The CEO of Deutsche Bank (DB) came out today and said “we’re rock solid.”

Alan Schwartz at Bear Stearns said the same thing to his traders and to the public two days before Bear Stearns went bankrupt.

Everything is rock solid — and then it’s not…

Jean-Claude Juncker : ‘When it becomes serious, you have to lie’.

When I smell smoke and I read that there’s nothing to worry about from a politician or a business leader — I get my fire extinguisher ready…..

I feel a straight line extrapolation is just to simple. It is a big complex system with many layers and many smart people and many ruthless people. I can see lots of triage by 2020. One group US, Canada, UK, France, Germany, Scandinavia, Russia, China, Japan, Oz and NZ. The other group the rest of the world. First, the survivors in the ROW learn to farm. Sure, by 2030 we all learn to farm.

Yes, the financial system will be dead before 2020 but there are other layers.

Indeed, when looking at past records $60 oil did not last long. My latest post:

9/2/2016

IEA in Davos warns of higher oil prices in a few year’s time

http://crudeoilpeak.info/iea-in-davos-2016-warns-of-higher-oil-prices-in-a-few-years-time

My guesstimate has also been to hit $60, but the timing may be as soon as sometime in the latter half of this year, but even if it does there is no way around what it says in the article, i.e.; There’s a price of oil that’s too high for the economy to sustain (the ceiling) and a price that’s too low for the oil companies to remain financially solvent (the floor). That ceiling and that floor are drawing ever closer.

The floor differs depending on producer, but the point is oil we can still go after is restricted to costs below the ceiling. It may be the ceiling has already dipped below many non-conventional sources thus restricting URR. That’s something a lot of people do not get – they think oh, there’s 1.7 trillion barrels of oil that is URR, but that all depends on what’s above the floor and below the ceiling. With that range narrowing, the available new net energy sources are quickly moving out of our reach, precipitously dropping URR. It will be a terrible feeling to for producers to know all that energy is right down there, yet uneconomical to extract.

Do you want to observe cognitive dissonance’s head coming out of his shell?

Show this to someone — then ask them to explain how we fix this — and what the implications are of not fixing it.

I’ve dropped this onto a few sites and that puts an end to the comments section — I dip onto Wolf Street from time to time — and now my comments are all held for moderation …. on the orders of cognitive dissonance….

HOW HIGH OIL PRICES WILL PERMANENTLY CAP ECONOMIC GROWTH For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil production has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies. http://www.bloomberg.com/news/articles/2012-09-23/how-high-oil-prices-will-permanently-cap-economic-growth

THE OIL INDUSTRY NEEDS $100+ OIL Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

The Bloomberg article is by Jeff Rubin–another person I haven’t seen in a long time. Worked at a big bank in Vancouver, until he got fired for his peak oil beliefs.

He was chief economist of CIBC …. a large Canadian bank…..

Right. I should remember that. I was too lazy last night to look it up.

Agreed. Or if it gets down to $5, it could double to $10 or triple to $15.

I am afraid that the time when there was an overlap between what citizens can afford and oil companies need is long gone. It is wishful thinking that we will ever get the price up high enough, for long enough, that the system will restart again. Also, all of the oil, gas and renewables are leading to a whole lot of debt. We should have stopped a while ago, if we wanted to keep the debt at a reasonable level. There are a lot of similarities to the thirties, but we don’t have cheap oil and the possibility of war funded by debt to get the oil flowing. Also, the oil then was very cheap to extract.

“We should have stopped a while ago,”

Gail, the central banks should have that framed in their offices – lol.

Yes really good read Stil but I was already scared, the next step I suppose is I turn catatonic.

Yeah bandits, it seems like so many bits of information have come together, like nails in a coffin the only thing to do is wait and see when s actually h the fan. The reactions of those that bought ‘Recovery’ ought to be a fun consolation prize.

http://www.reuters.com/article/us-usa-fed-idUSKCN0VJ1F2

Rather a fascinating set of quotes from Yellen, parsing her words regarding future outlook due to global economic weakness. What an interesting situation she finds herself; wanting to raise interest rates but not really finding a lot of reasons to do so.

‘Fed’s Yellen says global risks could pose U.S. growth threat’

But Yellen acknowledged that some of the weaknesses in the global economy have become self re-enforcing, with weak growth in major manufacturers like China and oversupply on commodity markets rattling the world’s oil and mineral exporters. A broad sense of a world slowdown, in turn, and uncertainty about the depth of China’s problems, has tightened financial conditions for U.S. businesses.”

“These developments if they prove persistent, could weigh on the outlook for economic activity and the labor market,” Yellen said in remarks prepared for her semi-annual appearance before the House Committee on Financial Services. A hearing before the committee began at 10 a.m..

An accompanying report said the U.S. financial sector “has been resilient” to stress from oil and weakening corporate debt markets around the world, with “limited” exposure among large U.S. banks. But “if conditions in these sectors worsen…wider stresses could emerge.”

FE, any insight on the US banks?

That’s a very kind way to tell us that the hurricane is on the way…

When the banks go down will it be the First National Bank of the United States by Bernie Sanders or the Trump Bank of Manhattan? 😉

I watched the victory lap speeches last evening during the New Hampshire primary. Bernie was claiming he could start a revolution for the people and Trump was claiming he had connections with business people to make deals to make America great again.

Oh the stuff politicians will conjure up to entice registered voters is really remarkable – lol!

I love that graph too — but do I think that is how the end game plays out — not in a billion years….

I am not sure why they even reference this with the word ‘collapse’ – collapse is by definition fast.

I am in the Korowicz camp…… where once the party gets started — we go from having food and power and water and sewage and medical care to nothing — in a period of a few weeks.

Thanks! I hope she (and other world financial leaders) sits down and read the list of problems Deutsche Bank said needed to be fixed.

http://www.zerohedge.com/news/2016-02-09/deutsche-bank-terrified-here-what-needs-be-done-its-own-words

Gail, fixed as in kicking the can down the road? Then, I’m all for it! Next stop, ban cash! Bankster bonuses must live on! lol

If the Elders have determined that cash must be banned to keep BAU going awhile longer…. then go right ahead and ban cash…

Of course Stockman and Roberts and Zero Hedge are going to scream blue murder over this ….. they are very good at channeling and diffusing the sheeple’s angst….

That is their role in all of this … they are just as necessary as Krugman….

As sure as night follows day the ban on cash WILL happen, they are already trial ballooning the concept, if we haven’t collapsed first. The all your money will be theirs, well it was always theirs, since bank depositors are considered as unsecured creditors. F#cken Lol…

See the War on Cash, http://goo.gl/qzp8TS

Speaking of banning cash. I noticed that the parking meters and vending machines accept credit cards now

Where I am public transport no longer accepts cash either. Need a card.

Starting to get scary now

http://www.zerohedge.com/news/2016-02-10/bps-stunning-warning-every-oil-storage-tank-will-be-full-few-months

http://www.bloomberg.com/quote/CL1:COM

Add to that the price of WTI at the moment is 27.89!

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2016/02/03/20160205_cush.jpg

That’s the graph shown for Cushing oil storage in Oklahoma, from that article, thestarl. It’s currently at 64174 with a capacity of 73014, which means it is at 88% of capacity. Apparently that’s the reason for the recent downturn in WTI price as shown in my following post. They caution if capacity is reached, oil price will tumble into the teens.

The amount of fill (crude oil + products) seems to vary by week. A huge amount was added a week ago (9.6 million barrels), but hardly anything this week (0.3 million barrels). Cushing been quite full for a while now. There is theoretically a fair amount of products storage available, but companies may not to spend the money on refining oil, and then store it. Also, gasoline sold in the summer is a different blend. I can’t imagine that anyone wants to hold over a lot of winter gasoline, when summer gasoline is needed.

I agree. When storage for natural gas is full, the price can go to $0, or even negative. There is a problem for oil as well.

NG going negative, interest rates going negative, … and then all the rest?

Are we entering into some kind of ‘reverse economy’, in which producers pay for consumers?

In some way, it’s already the case, if oil producers are selling at a price lower than their cost (same with other commodities?).

The catch is that someone has to pay fo the gap, eventually.

According to Deutsche Bank, that should be ‘the savers’ (funny guys!). OK, why not, but it can only last for so long; who’s next?

http://youtu.be/zYMD_W_r3Fg

Are we entering into some kind of ‘reverse economy’

Good is bad… decent results = end of stimulus

Bad is good…. = collapsing companies grab zirp cash and buy back shares and their stock price rises..

Black is white… up is down… in is out…. crazy is sane… sane is crazy….

The horror…the horror…..

Rather bizarre, isn’t it?

Just in case anyone is interested, Seneca’s original Latin (Epistula XCI {91:6} — with a slight modification of the orthography and punctuation by me) is: « Esset aliquod imbecillitatis nostræ solacium rerumque nostrarum, si tam tarde perirent cuncta quam fiunt; nunc, incrementa lente exeunt, festinatur in damnum. »

It does indeed look like we are beginning the descend into the dreaded “bottleneck” of which biologists and paleoanthropologists speak. We are not exempt from the laws of nature.

Thanks! I did have a little high school Latin. Google translate will give a translation of the whole thing, or of individual words.

Pingback: The Physics of Energy and the Economy | Green e...

So, thou wouldst frighten us all to death, Nemesis: most evil man in the whole history of the known multiverse! But fear not, for little baby Jesus will surely save us all. 🙂

There are no happy endings – collapse is preferable to all-out nuclear war. I think The Empire may have miscalculated financial collapse which is upon us now.

Here’s a question; on the Seneca Cliff where are we currently? My best guesstimate is 4 gray vertical bars back from the far right black border, where it meets the blue line. Any other guesstimates?

A reader sent me this image, which he had made from one of my graphs. I thought it was pretty good!

The resolution is a little better in the original. He has connected the line that goes through the 2020 consumption amount, with the 1925 consumption amount, showing that he expects those two amounts to be equal.

I have always like this graph. If the crisis part of the cycle is as long as 20-50 years and we are in year 10, I consider that to be slow collapse.

From a personal perspective, the “slower” the collapse the better. But 20-50 years in the history of a civilisation, it’s but a blink in time.

Didn’t want to scare folks too much. Losing electricity or banks would be a much quicker problem.

We are at the end of a system, not the end of history. Though I have to admit, things look pretty bad this time.

Our present system is determined by Judeo-American control of global politics and markets. We are moving to a multi-polar world and a much slower world, not dissimilar to how things were hundreds of years ago.

Interesting, but true.

With a lot of luck, we are moving to a system from hundreds of years ago. The catch is that we are not adapted for such a system–few horses, no buggies, way too many people, buildings too large to heat with local materials, businesses not of the right kind or set up to operate without electricity. More likely, we are a lot worse off than folks were a few hundred years ago. It may, in fact, be the end of history. If there are a few people left, they may not be able to preserve books and writing. History may go the way of the floppy disk.

We may go back to the stone age, but without knowing how to shape the stones…

A magnificent post — all-star post!

Thanks FE,

not sure I want to be one of those clueless naked apes…

… but it won’t matter, since there will no longer be any animal left to kill.

(longpork, maybe)

You are far too optimistic…. we are on the cusp of extinction ….. or if not …. a world of dire suffering for anyone who survives….

Dear Finite Worlders

The continuing adventures of Marjorie Wildcraft among the Tarahumara in Mexico. Off the grid, but with a single government supplied solar panel plus a light bulb. Handmade baskets rather than plastic buckets. Hand cranked metal corn grinder. Looks like adobe buildings, but recently lived in caves. Mix of traditional and western style dress…I imagine industrial cloth, probably from SE Asia. Use of carefully collected manure. Children have specific jobs.

Don Stewart

And here’s Mr Martenson selling more snake oil….

http://www.zerohedge.com/news/2016-02-09/return-crisis

But It Gets Worse; A Lot Worse

If only the greatest near-term risks were limited to the bad actions of the banks. But that’s sadly not the case.

The collapse in the price of oil has been vicious, but it’s likely not done. The oil patch has morphed into a capital-destruction zone for many drillers and as we have been warning all last year, the fallout is going to be worse than we can imagine. And it’s just getting underway.

In Part 2: The Breakdown Has Begun, we lay out our prediction for the terrifying wave of defaults that will swamp the energy sector soon, as well as the many, many related industries that service it. Avoiding losses during this period will be the key priority. And precious metals will regain their role as a preferred save-haven asset class — a victory long-suffering bullion holders should cheer.

We are now in the chaos management phase of this story. Take care to make smart choices now. Your future prosperity depends on it.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

So we are out of cheap oil …. fantastic… so I wonder what I get if I pay to enrol…. is he going to tell me to buy guns and ammo and 500 cases of beans?

Or is he going to tell me to enjoy my final days — along with some advice on how to max out the credit cards along with strategies to leave the bank hanging until the SHTF?

Dear Fast Eddie;

My favorite uncle has a heart problem that guaranteed him 4F status for WWII. In fact, the doctors said that he would never see 40. So, he lived for the moment. His dad died at about 50, and all his brothers did as well. When he turned 50, he reasoned that it was time to live life to the fullest. He had a good amount saved up, so he bought an RV and hit the road. Life was good, he and my Aunt saw all 50 states, and lived well.

Then the money started to run out, no matter, social security would keep them set for the few years he had left. Then his wife died. “No worries”, said he, “I haven’t got long before I am with her.” But with her death, his social security went to about $500/month.

He is 90 now.

Predictions are hard, especially about the future. If you are not just being dramatic, you could easily find yourself poor and old as BAU continues.

Not presciently yours,

Pintada

“It’s tough to make predictions, especially about the future.”

– Yogi Berra

That may be apocryphal – Neils Bohr is credited with the same.

Probably been doing the rounds since 3000 BC: no less true for all that…..

Quantum mechanics is really surprising, sometimes.

Pintada,

“Predictions are hard, especially about the future. If you are not just being dramatic, you could easily find yourself poor and old as BAU continues.”

Be careful, now, with all of that reasonableness. I’ve been saying the same thing on this site for years now, so I’m a troll. Unfortunately, the absolute metaphysical certitude about the future on this site is mind-boggling.

Don’t worry about Fast Eddy … Fast dances while the music plays…. Fast is going down with the ship with a glass of champagne in hand — you can bet the house on that

https://www.youtube.com/watch?v=RZxGElvaea0

Fast will not live till 90… Fast will be lucky to be alive in 2017.

Can you name even one profession that does not involve snake oil?

We are born into a tub of snake oil, we breathe it, we drink it.

The term snake oil implies that there are honest professions and dishonest.

The reality is all of our control of resources comes from use of force.

We may do wonderful lovely things with the resources under our control art, music charity science you name it. The truth of it is its all blood money. And that goes for every individual, political system, and nation on the planet.

I have sympathy for those here interested in providing basic needs in a way not perceived as using force,

They work the land but then they do something like have a half dozen children.

Force

It is all our species knows.

“The term snake oil implies that there are honest professions and dishonest.”

Yes. A person whose entire profession is selling a product that they know does not do what they claim it does, is a dishonest profession. There is no honest way to succeed at selling snake oil elixers. Snake oil cannot cure every illness / reverse aging / whatever.

If I sell firewood, it is going to be the thing described, it will do the thing advertised – it will burn to generate heat. A dishonest person could rip you off on the quantity sold, or by adding in hidden fees. There can be dishonest people working within an honest profession, but that does not make the profession itself dishonest.

Thank you for the perfect example. The firewood seller takes a finite resource and steals it from the forest. No it is not a renewable resource. Deforestation occurs much much faster than forests grow. In theory it is a renewable resource in practice just another aquisition of a resource using force.. Here is the first gallon of snake oil the fairy tale of the forest being a renewable resource. Just kill the tree and all of the life forms that depend on the tree.- ITS RENEWABLE. Kill and consume everthing! Nature will provide. Massive amounts of fossil fuel ala liquid force are used to carve the wood up. Then massive amounts of liquid force are used to transport it. Then some lucky human gets to indulge in fire worship and quicly release the carbon.

Not that I have anything against wood cutters. They are no more or no less of a snake oil profession than any other. I hang out with woodcutters more days than not and we get along just fine.

There is no “honest profession”. Yes if your applied force-money- gets you the agreed upon BTUs you are satisfied. What is the dishonest is that their is no acknowledgment that every single profession is a explicit use of force to consume finite materials. The dishonesty is considering one profession as means of obtaining the force ala $- used to sponsor more acts of force- honest while another is not.

Your definition of honesty is the most common one. I got what I wanted so everything is kosher. Yes from a honor among thieves (humans) standpoint this is a definition of honesty but the real honesty, the truth is that all professions are entitlement pure and simple.

Im sure you will find many lies on your google searchs that dispute what I say. After all your honest.

‘Deforestation occurs much much faster than forests grow’

If that were the case the world would long ago have resembled Easter Island…. there are plenty of examples of sustainable forestry management around the world

Will Deutsche Bank Be The Trigger?

https://2.bp.blogspot.com/-ZbCmYenASrM/VrpjXGMHvDI/AAAAAAAAufY/oyC9loT-jPE/s640/deutsche_bank.png

Stock at $15. Down -40% since 2016…

http://www.zerohedge.com/news/2016-02-09/deutsche-bank-terrified-here-what-needs-be-done-its-own-words

Absolutely NOT! (sarc)

Deutsche Bank Selling Resumes After CEO Assures Employees Bank Is “Absolutely Rock Solid”

http://www.zerohedge.com/news/2016-02-09/deutsche-bank-selling-resumse-after-ceo-assures-risk-positions-rock-solid

All we need now is for Cramer to urge the sheeple to buy DB — and we’ll know the end game is imminent..

Lol!

Deutsche Bank stock rallied 5% today.

No doubt on the assumption of a bail out….

Gail, your use of the Seneca Cliff description of how societies collapse reminds me of a section of the Panarchy model developed by Buzz Hollings. Panarchy explains how systems cycle through growth, collapse and replenishment. Our economic system, anarchy says, has been on the upslope of growth for a longer period than normal, because of the input of energy from fossil fuels. Consequently, we can expect the collapse prior to rebuilding to be sharper and deeper than normal.

There is nothing we can do about this, and putting off the collapse will only make it deeper and steeper.

We need a way of living that accommodates this natural cycle, not one that attempts to break free of it. We call this sustainability….

Gunderson, Lance H. & Holling C.S. (2002), Panarchy: Understanding Transformations in Human and Natural Systems, Island Press

http://www.sustainablescale.org/ConceptualFramework/UnderstandingScale/MeasuringScale/Panarchy.aspx

That is an interesting observation. I have heard about the Panarchy model before. I have also heard the idea that prior small collapses relieved the stress of overpopulation and allowed farmland to lie fallow and forests to regrow. Soil could also regenerate, through the wearing down of base rock. Thus, the collapses were good for the overall world ecosystem. New economies that built up would be better adapted for changing conditions.

In fact, the collapse of the Former Soviet Union left some of the oil that we are now extracting to be left in the ground. If it weren’t for that collapse, the big collapse would have come sooner.

Now there is a great deal of emphasis on preventing bad impacts on oil companies using derivatives, and preventing banks from failing thanks to new rules. The new rules may slightly put off collapse, but they make the inevitable collapse worse. (If worse is possible.)

Gail

Your on point great posts but why? Academic curiosity? So a few see the pit what glory is that? Obviously we’re beyond recovery. If Ourfiniteworld is all there is then eat and drink and die. I will not believe that or express that. However any rational mind will conclude that if there is a solution its outer earthly.

Why seek any knowledge?

Why not just sit in front of the tee vee and american idol reruns…. eat 3for1 pizza and guzzle family sized colas — then jump onto facebook to check out videos of cats being chased by dog up trees….. so long as the welfare cheque and food stamps make ends meet….

Not that a) is necessarily a better scenario that b)….. in fact it could be argued that b) is the preferred scenario…..

Is this not better than sitting on death row for years?

https://www.youtube.com/watch?v=Xy3MtznDeqg

But for some b) is not a choice…. you cannot unsee what you have seen…. you cannot beat curiousity out of someone…..

That said – curiousity lead us to where we are….. (it also killed the cat….)

I agree if three is a solution, it is “outer earthly.” And I won’t rule that possibility out.

There are at least a few people who are curious about the issue I am researching. Somehow, I have figured out a whole lot of things that people haven’t understood, or have misunderstood. It is a little like figuring out a big puzzle.

If the alternative is developing insurance models that basically deny the problems we are approaching, then I consider what I am doing right now to be more worthwhile. I won’t get any acclamation from the insurance industry, or from people whose theories I have disagreed with, but that is OK. I have met some interesting people along the way, including many people who make comments here.

Great article, Gail! Thank you again.

I had an idea for you for the next article – real share of energy in global economy. Usually, the economists use monetary turnover as a share of total GDP. It gives aroudn 5% for “developed economies” and even 19% for energy producers (Norway in this case).

http://www.statista.com/statistics/217556/percentage-of-gdp-from-energy-in-selected-countries/

We know it is not true. Actually the energy is in every product we consume in different forms – from extraction and processing of raw materials/resources, manufacturing, transportation and marketing. It looks unquantifiable like the real EROEI calculation. After simple mind experiment I got the feeling that the only way to make this calculation viable is to analyse “industrial” energy production to actual human work ratio (100W for physical tasks). The problem occurs when you try to include the “intellectual work” factor. Humans are still more efficient in most abstract processes than computers, although we are getting too costly for many global corporations. This ratio is decreasing through automation / robotisation / digitalization.

Just a thought. Maybe this could be interesting inspiration for analysis.

Already done, kesar0,

see https://ourfiniteworld.com/2015/09/14/how-our-energy-problem-leads-to-a-debt-collapse-problem/, especially in the appendix the link to a paper by Gaël Giraud, related to your questions.

The elasticity of energy to GDP is in the range of 60 to 70% (cost share is meaningless), and the gain in efficiency (improved technology) is in the range of 1% per year.

Thanks, Stefeun. This analysis deals with GROWTH of GDP divided between efficiency gains and increased energy consumption.

I think my idea is a little different, though. I would like to see analysis of human vs. non-human (ff) work. The efficiency gains was described many times by Gail, like globalization, off-shoring, digitalization, robotisation, etc. There must be some limits to this process in mathematical model perspective.

I think it might show some interesting conclusions. Just a guess.

If I get it correctly this time ;), now you’re talking about the “energy slaves” topic.

The figure I have in mind is 200 as a world average, meaning it’s like if each of us had 200 slaves (not eating, not resting) permanently at her/his service. Of course there’s a tenfold gap between the US and India.

I know there are other calculations that give slightly different result.

Exactly, I’m curious how this looks in global scale.

Thanks for reminding us of his paper. I know you have mentioned it before.

Thanks for the idea!