A few days ago, I showed the close relationship between growth in world oil consumption and growth in world GDP. In this post, I will extend that analysis by building a model that shows how much of an increase in world oil supply is need for a given increase in world GDP. This model indicates that if we want the world economy to grow by 4% per year, world oil supply will need to grow by close to 3% per year. This is more than world oil supply has grown per year since the 1970s–giving a clue as to why the world is having so much problem with economic growth now.

Theoretically, the model should also be able to predict what would happen on the downside as well–what would happen if world oil supply should suddenly start to contract. We will talk about what these indications are, but also discuss why they are probably misleading. The result may very well be quite a bit worse than the model predicts.

In my earlier post, we saw that over time, both the rate of growth in oil supply was declining, and the rate of growth in GDP was declining. In both the previous and the current post, we are looking at “real” GDP growth–that is GDP growth, with the inflation component removed.

Figure 1. World Oil Supply Growth vs Growth in World GDP, based on exponential trend lines fitted to values for selected groups of years. World GDP based on USDA Economic Research Data.

In my earlier post, we looked at several groups of years, based on time periods when world oil supply was increasing. Let’s look at oil supply growth for the same ranges, on a year on year percentage growth basis. Note that the time periods are one year shorter (1969 -1973 becomes 1970 – 1973), because we are looking at year on year percentage increases.

Figure 2. Annual percentage increases in world oil supply with simple averages for the ranges indicated in Figure 1. Amount of colored line is simple average of amounts for range shown.

In Figure 2, notice that average oil supply growth is gradually becoming lower and lower, looking at the time periods down the side of the graph. This is similar to what we saw in Figure 1. computed on a slightly different basis.

If we look at annual changes in world real GDP, the indications are similar.

Figure 3. Annual percentage increases in world real GDP with simple averages for the ranges indicated, corresponding to the ranges shown in Figure 1.

Here again, as we go down the exhibit to later periods, we see declining average growth in real GDP. In fact, comparing Figures 2 and 3, we see that they are similar in several respects. Not only do they both tend to have growth rates that trend downward, but the “gaps” between the colored lines tend to be low on both graphs, indicating that when oil supply growth is low, world real GDP tends to be low as well.

In my previous post, we talked about the close link between oil supply and the economy. While many people believe that oil supply use grows because a growing economy gives rise to greater demand for oil, the reverse seems also to be the case. If there is short supply of oil, indicated by high price, people cut back on discretionary expenditures, and recession ensues.

Tentative Indications for the Future

We can use the relationships between the individual year changes in oil supply and real GDP to build a simple model showing how much of an increase in GDP can be expected to take place for a given increase in oil supply.

If we graph the annual percentage changes in real GDP versus the annual percent changes, what we see is the following:

Figure 4. An “X Y” graph showing the percentage changes in world real GDP that correspond to percentage changes in world oil supply, for the years 1970 to 2011.

It is clear in looking at the data (for example Figure 2) that the pattern in the earliest part of the period is different from that in the later periods. In the very earliest period (1970 to 1973), oil use increased more rapidly than GDP. Once we realized we had a problem, there was a mad dash to try to reduce usage. If we look at only the period since 1983, when there was more of a sustained attempt to transfer to lower priced fuel, this is what the graph looks like.

Figure 5. An “X Y” graph showing the percentage changes in world real GDP that correspond to percentage changes in world oil supply, for the years 1983 to 2011.

Using only the recent data, the R2 is similar (.53 for 1983-2011 data vs. .52 for 1970 to 2011), but the slope of the line is a little steeper. While at R2 of .52 or .53 is not exceptionally high, it does explain a significant portion of the total variance, so let’s look at what the indications of the trend lines are.

If the annual percent change in oil supply is 0.4% (as it seems to be now), the predicted annual increase in world real GDP is 2.5% per year using the 1970-2011 fit, or 2.2% using the 1983-2011 fit. Thus, both fits suggest that with the small increases we are seeing in oil supply currently (about 0.4% per year), we are already at a point where world real GDP can be expected to be much lower than most economists would prefer (2.2% or 2.5% per year).

The Figure 5 fit (using 1983 to 2011 data) would seem to be slightly better for predictive purposes, since it is more representative of the current situation.

If we want world real GDP to grow by 4.0% per year, the fit from Figure 5 (based on the equation y = 0.741 x + 0.0193) would suggest that world oil supply needs to rise by 2.8% per year. If we want world real GDP to grow by 3.0% per year, we need oil supply to grow by 1.4% per year.

Indications if Oil Supply is Decreasing

We can also look at what theoretically would happen if world oil supply starts declining (but here we are on shakier ground, because of many follow-on effects). If oil supply declines by 1.0% per year, the regression line in Figure 5 would suggest that world real GDP can be expected to increase, but by only 1.2% per year. If world oil supply declines by 2.0% per year, the model would suggest world GDP can be expected to increase by only 0.4% per year. If world oil supply declines by 4.0% per year, the model would suggest that world real GDP can be expected to decline by 1.0% per year.

In a decline situation, there would be very substantial changes of many types. Many countries and businesses would find their financial situations much worse. For example, oil exporters who discover large decreases in the amount of oil they export may be subject to political disruption or civil disorder, and oil supply could fall off further. Or buyers of oil might discover that their current financial problems have worsened. All of these thing point to the possibility that what started out as a small decline in oil supply could quickly become a much larger decrease. Or financial impacts could spread, if one bankruptcy leads to other bankruptcies.

Even without adjustment, the GDP indications if oil supply should decline are very concerning. They would seem to indicate long-term major recession or depression, especially in countries such as the United States and most European countries, which tend to have lower GDP growth rates below the world average.

World Real GDP Estimates Less than Perfect

I should point out that in this analysis I used real GDP data from the USDA Economic Research Service, in 2005$. The USDA data shows world real GDP growth of 4.10% for 2010, and projects 2.68% for 2011, 2.95% for 2012, and 3.59% for 2013.

There are other calculations of World Real GDP with somewhat different indications. In particular, I know that the International Monetary Fund indicates higher world GDP, especially on recent years. It is now showing 5.3% growth for 2010, 3.9% growth for 2011, and 3.5% for 2012, and 3.9% for 2013. (The IMF’s data only goes back as far as 1980, however.) The USDA report, which is the only one that I am aware of that is specifically in 2005 US$, indicates that its indications are based on “World Bank Development Indicators, International Financial Statistics of the IMF, IHS Global Insight, and Oxford Economic Forecasting, as well as estimated and projected values developed by the Economic Research Service all converted to a 2005 base year.”

As far as I can tell, part of the issue of multiple estimates of world GDP is that some methods give relatively more weight to emerging and developing economies in the calculation of the world average. This would tend to make their world average real GDP amounts higher. Developing real GDP indications for a country is not too difficult; it is that aggregation that is the problem.

I have tried to find out more about the issue. One economist told me, “World GDP is a difficult thing to compute, there are a number of aggregation issues that can be solved in a variety of ways.” Another told me “All such numbers need to be taken with a grain of salt.”

The relationships I have shown are based on USDA Economic Research Service world GDP numbers. To be made comparable to IMF world real GDP growth percentages, they might need to be adjusted upward by as much as 1.2%. Thus, for example, instead of saying, “If we want world real GDP to grow by 3.0% per year, we need oil supply to grow by 1.4% per year,” perhaps we should say, “If we want world real GDP to grow by the IMF’s 4.2% per year, we need oil supply to grow by 1.4% per year.” The principle would be the same, but the world GDP as reported by the IMF would be a little higher.

The problem with nlecuar power is that it cannot compete in the free, competitive marketplace without massive federal subsidies. It is the most subsidized energy industry in the country and is looking for even more federal subsidies in the energy legislation now before Congress. The true conservative position should be in opposition to all of the insurance, tax, loan guarantee, waste disposal and other taxpayer-provided subsidies that so distort conservative economic decision-making. It is simply laughable to equate free enterprise with the heavily subsidized government-supported nlecuar industry.

Pingback: Degrowth, Expensive Oil, and the New Economics of Energy | The Simplicity Collective

To come back to your question on the impact on food items, higher energy prices affect production costs (directly through fuel and fertilizers), as well as due to the higher the cost of moving food from the farmgate to the market. Obviously, the effect will be less for commodities with a high value and low weight and vice versa. Estimates suggest that a 10% increase in energy prices is associated with a 2 to 3% increase in the prices of grains and vegetable oils (also see Commodity Annex, P10 http://siteresources.worldbank.org/INTPROSPECTS/Resources/334934-1304428586133/GEP2011bCommodityAppendix.pdf ). Note also that over the longer term, high energy prices tend to affect food prices through the biofuel channel.

Thanks for the link! Food, of course, has other influences in its cost besides energy prices (particularly oil prices). You mention the conflict with biofuels driving up prices. So some of the links are longer term.

Another big issue is weather conditions. If we are looking ahead over the longer term, these will make a big difference. There seems to recently be a change in patterns, with the drought we are having in the Midwest, the lack of monsoons in India, and the extra rain in Britain and China. Our agriculture depends on having rain of the appropriate amounts, and not too high temperatures. I expect food prices will go higher in the future, because of a growing mismatch between what agriculture has planned for, and what happens.

Pingback: Vancouver Peak Oil » Evidence that Oil Limits are Leading to Limits to GDP Growth

How do stories like this fit into “peak energy”. These production numbers are amazing.

http://www.bloomberg.com/news/2012-07-23/u-s-says-shale-gas-output-rose-24-in-may-from-year-earlier-1-.html

Stories like those fit into the peak energy story quite nicely. The fact that we are producing energy trapped in shale means we are near the bottom of the barrel of quality energy sources. Welcome to the beginning of the end; don’t count on the end lasting very long either.

I am afraid we are getting close to peak energy. It seems like it may be the financial crisis, brought on by high oil prices, that brings it on.

What does “the bottom of the barrel of quality energy sources” mean exactly?

I think shale gas clearly yields a higher energy quality than coal mining, which fueled the bulk of the industrial revolution.

Coal, particularly as it has been used throughout human history, is an incredibly crude energy source. Most of the BTUs are simply wasted. Wheras natural gas can be used very efficiently — it is the opposite of coal.

Of all the fossil fuels, gas is the fuel source that allows us to use the highest proportion of total BTUs for productive work.

What a funny idea, calling gas low quality. No engineer worth his salt would ever say that.

I would just observe that relative to other types of natural gas, shale gas is the bottom of the barrel, because it is more expensive to extract and uses fracking. The comparison doesn’t have to be to coal.

Dear Gail

Thinking some more about the relationship between the price of oil and the growth of GDP. A couple who are friends recently moved to Ghana. Just before they left, I said ‘I hope you enjoy it over there’ and the husband replied ‘we will…there is a lot less entropy’. Keep that thought in mind. Then take a look at the per capita CO2 emissions by geographic area in Robert Rapier’s post today:

http://www.energybulletin.net/stories/2012-07-24/global-carbon-dioxide-emissions-%E2%80%94-facts-and-figures

(Robert has copyrighted the chart, so I don’t think I should copy it and reproduce it.)

I have previously remarked that the first 10 energy slaves that a person commands are probably much more productive than an increase from 990 energy slaves to 1000 energy slaves. So…if it is true that there is less entropy in Ghana than in the US, and if they are currently commanding roughly 50 energy slaves while the US is commanding 1000 energy slaves, how much can Ghana afford to spend for the incremental energy slave (otherwise known as fossil fuels)?

We might get a clue by looking at the early history of the US and Britain, which were the two most prominent countries in the early evolution of the industrial age. I don’t have any numbers, but I believe that the real price of oil and the price of coal was very much higher in the latter half of the 19th century than it is today. Yet both countries consumed as much of the resources as they could get, and both grew rapidly. In a word, the marginal productivity of the energy slaves was very high and exceeded even the high prices that the slaves commanded.

So it may be true that Africa and Central and South America might be able to grow in a world with high energy prices because they are still so high on the marginal productivity curve. The US and to a lesser extend Europe and Japan will have to prune the non-productive uses of energy and will see their economies shrink.

On the other hand, the EROEI of coal and oil in the late 19th century was probably quite high. It may be true that the EROEI of unconventional sources of fossil fuels is so low that the ability of Africa and Central and South America to pay will simply not be comparable to that of Britain and the US in the late 19th century. Another possibility is that technological advances in the early 20th century produced very high EROEIs (higher than those of the late 19th century) and that the US and Europe and later Japan were uniquely situated to take advantage of the abundance (Africa and Central and South America were, in effect, raw material producing colonies). In this scenario, the technology driven high EROEIs produced a bubble which was appropriated by the US and Europe and later Japan. But with the prospect for low EROEIs in the future, Central and South America and Africa will simply not have the same opportunity. It could be that the US, Europe, and Japan suffer a 75 percent loss in living standard while the other countries remain roughly where they are now–taking a higher percentage of a declining world production.

Yet another scenario would assume that technology rules and we are on the verge of figuring out how to cheaply get all the hydrocarbons that are locked up in the Earth and there is going to be abundance for everyone. And we will geoengineer the climate so that everyone has beachfront property in San Diego. If I were a politician, I think I know what I would promise (if you send me enough money to get me elected).

Do these questions make sense?

Thanks…Don Stewart

I think what you say more or less makes sense, but BP does publish inflation adjusted historical oil prices, so we don’t need to speculate.

While there was a spike in oil prices during the civil war (to the equivalent of $115.45 / barrel), prices were generally low in the late 19th century and early 20th century. Oil prices were typically in the $20 barrel range, or even less. From 1927 to 1973, prices per barrel were mostly in the $10 to $18 range. When people say our country was built on cheap oil, they were pretty much right.

Gail

I am reading Kjell Akelett’s Peeking At Peak Oil. In a couple of places he refers to Sheikh Yamani’s statement that ‘The Stone Age did not end for lack of stone, and the Oil Age will end long before the world runs out of oil.’

On page 146 Kjell comments as follows: ‘If Sheikh Yamani meant by his comment that the Oil Age will end while producible oil remains then he was wrong. However, if he meant that the Oil Age will end while most of the world’s oil remains unproduced because we could not extract it then he is correct. But that does not mean that we have something superior to oil waiting for us just around the corner.’

I find Kjell’s statement to be broadly consistent with your views of the future. I would state it as follows:

Oil is the most financially valuable energy source we have ever discovered or will ever discover. We have always used all of it we could extract. We have attempted to take oil from other people by force. The huge increases in oil production have fueled the current precarious state of population density, globalization, loss of Nature’s productivity and our lost skill in directing Nature’s productivity, fostered an epidemic of chronic disease, has helped destabilize Earth’s climate, and has propelled the creation of a highly leveraged debt based financial system. As oil declines, many of these systems will fail–probably the financial system first. But oil will remain the financially most valuable energy source on Earth and so we will see increasing struggles to control whatever remains until the civilization oil built vanishes. If humans are wise, we will practice Triage to use the remaining oil most productively. But humans are seldom wise.

Don Stewart

I pretty much agree with you.

I think the amount of oil that is “left” for us to extract will be determined by financial, political, and systems (no parts available for the drilling rig, no expert that can travel to the distant overseas site) issues. Oil supply may drop off very quickly, for these reasons. I am not sure that we have any idea what uses are most “productive”. For example, using the oil to build fancy electrical train systems, if we will be too poor to ever operate them, would be a waste. We need to be planning our oil use for what we will be able to maintain in the future, and I am not certain we know what that is.

Gail

I am just back from spending a couple of days at an intentional community. A few notes about triage–but I will say up front I have no idea how we would get agreement in terms of triage.

The community I spent time in has no electricity, no sewer system, and no central water supply. It does have telephone service and people do have access to the internet. Electricity is generated by solar PV by each household independently. All the building have metal roofs with cisterns for water storage. Drinking water, however, is frequently bought in bottles from the store or brought from town. Some households filter their water to drinking quality. Toilets are composters. Houses are all homemade. They are generally pretty intelligently laid out. It was very hot, but I was reasonably comfortable sleeping at night with good cross ventilation in a 144 square foot dwelling.

The community was founded by people with an early 70s mentality and ethics. But now it is occupied mostly by young couples in their late 20s and early 30s. Most all of them have paying jobs which require them to drive to someplace not very close by. My host needed to go to the doctor–30 miles away.

One of the most elaborate sets of homes are some condominums which sell for around 40,000 dollars. They were all built by hand. The owners have terraced the mountainside (using power equipment) and have turned it into a productive fruit and vegetable garden. They also have a pasture with a milk cow and chickens (which support each other). The owners are the type of people who believe they have the right to drink raw milk (and thus would be subject to prosecution in some places).

As I was driving home this morning, I passed a big billboard advertising ‘mountain top living in a golf community’. And on the car radio, Duke Power was assuring a Mother who needed to be busy making some cupcakes for the PTA meeting that she was entirely too busy to be worried about where her power was coming from. Obviously, it came from the switch on the wall–that’s all she needed to know.

While I was at the village, I read James Howard Kunstler’s latest book where he speculates about what will survive the energy crunch and what will fail. Here is my own set of speculations:

1. Mountaintop golf communities will utterly fail except for the super rich or for warlords. The Social Security and Annuity schemes which the residents are relying on to keep them at the top of the economic heap will fail. And there is zero resilience in the place they have chosen to live.

2. Duke Power–as most of corporate America–just wants people to go back to sleep and leave everything to their betters. Best not to think about poisoning young children with sugary treats and best not to think that an energy intensive way of life will fail. I predict disaster for anyone who listens to Duke.

3. The community I visited is full of healthy, happy people. I saw only one overweight person–a middle aged woman. Children roam freely and are articulate and intelligent and helpful to strangers. In a crunch, the jobs in town will likely fail, but the community has the basic skills to provide some electricity, water, heating (wood), and sewage (compost toilets) and could also probably multiply food production by 3 to 4 times relatively quickly. People would no longer drive to work–they would garden. A person could think up scenarios in which this community meets disaster–but I think they stand a pretty good chance.

Underlying my optimism for them is the fact that if you only spend a couple of days there, you become intimately aware of where your energy, your water, your food, and your waste is going. You are also constantly presented with the picture of people working together in small groups to get things done. And the intelligent use of salvage and natural raw materials is all around you. Just about the opposite of Duke Power.

Don Stewart

Thanks for your comments.

One of my concerns about intentional communities is that they often don’t have enough capacity to produce food and other basics for the group that live there. Too often, they only cover a small percentage of calories for the community. Before I moved to one of them, I would want to make certain that they were able to produce 150% of what the community needed–so there would be the ability to trade for other needed goods/services, plus some room for downside and the ability to store up for bad years. Just barely covering food needs doesn’t work, it seems to me.

Yes. I was talking with one of the old timers who was out weeding. We got to talking about ‘the thin margin between survival and perishing’. I pointed to a weed I don’t recognize and said that I read recently that a Cherokee woman knew the uses for 600 plants. I said survival depends on knowing whether that weed is edible and becomes a food plant. He agreed. He said that one of the things the community needs to do is harness animals more effectively. They have more land than they can manage with the available workforce. (For example, the chickens and the milk cow and the sun and rain and grasses are an ecological unit which produce a surplus for humans–milk and eggs and some occasional stew meat.)

My surmise that they might do OK is based on the fact that they are demonstrating their abilities with plants on a modest scale, they have additional land, they can leverage their work with animals, they have plenty of water (near the head of a mountain stream). So…losing your town job and more intensively gardening your land (with help from animals) might leave you better off than most people.

This particular community has a lot of land because 1) they bought it years ago and 2) it is far from town. I was mentally contrasting town based groups I know with these far rural communities and comparing their survival chances. Not the least consideration is security. Mobs and outlaws are a lot more likely in large towns. So there aren’t any guarantees. But I had recently read Peter Bane’s book where he emphasizes self-reliance for energy, water, sewage, and food and it struck me forcefully that someone (or group) who is mastering those things now IS likely to be far better off.

Don Stewart

Just to flesh out the experience of living in a small dwelling totally dependent on today’s sunshine plus a small storage in a battery (which you want to save for rising before dawn). Here is Tom Murphy’s current post on his experience. I agree with it. In addition, my host at the intentional community questioned me about notorious energy hogs such as hair dryers. In fact, I rather enjoy watching the sun set over the mountains and going up to bed with the last light. And letting the early morning spreading grayness wake me up. I did not see a single television antenna in the community. That fact alone might convince some of you that an energy crisis might be a good thing!

Don Stewart

Having such a small system, I had to be vigilant about energy use in the living room. The energy I was using had become very personal. I felt it was my energy in a way that I had not remotely felt before. I paid more attention to the weather, and to the forecast (boring as this tends to be in Southern California). Cloudy periods meant we should ration our television watching. A sunny afternoon when the batteries had reached full charge meant “free” energy that otherwise would go unused. Break out the movie!

The kind of energy awareness that accompanies personal on-site energy production—even if representing a small fraction of total use—turns out to have tremendous leverage. That’s because increased awareness and the resulting behavioral shifts transfer to all sectors. You’ll never look at energy the same way. Energy becomes personal; precious. Once you’ve experienced horror at realizing you’ve left the solar-powered lights on while out of the room (unnecessarily draining batteries and making the system’s job that much harder the next day), you’re unlikely to ever do it again, and that much less likely to perpetrate the same crime on any lights anywhere.

Easy credit has cretaed the mess and it will only be Volker-esque measures which will restore sanity to the R.E. marketplace. Home values were about 31% higher than that which the average income of Americans could suppport. Either income had to go up (productivity issue) or property prices had to come down (affordability issue).Going back to the B.C.’s (1980), FNMA requirements were:Conforming: $203KLTV & Ratios as aboveSo Allowing for inflation and with the excess value wrung out of R.E., set the guidelines of yesteryear and make loans to persons who qualify. Local lenders are aware of utility costs and other miscellany which impact upon loan decision making.Uncle Sam, please butt out!

Pingback: Commentary: How much oil growth do we need to support world GDP growth? : ASPO-USA: Association for the Study of Peak Oil and Gas

Hi Gail

Just used one of your graphs to illustrate a theme I have been meaning to blog on for a while.

Silver is looking very good, check the price at the end of August.

http://slightlypreoccupied.blogspot.co.uk/2012/07/all-is-young-no-more-than-this-tide.html

Hi Gail,

I’d like to point you to some work by Dargay and Gately looking at the asymmetric effects of changes in oil price (and in income) on oil demand. It’s kinda looking at things from the opposite perspective to you (where you are looking at the effect of oil supply on “income”), but it useful to bear in mind the potential asymmetric effects. For example, your simple scatterplots show a very different slope during times of oil supply contraction.

Here’s the paper: http://emf.stanford.edu/files/pubs/22466/OP50.pdf

Thanks for the link!

I expected asymmetric effects, which is why in my previous post (Evidence that Oil Limits are Leading to Declining Economic Growth, which is why I excluded the periods when oil supply was contracting from the periods I chose for my exponential growth fits. The thought occurred to me to exclude them in the analysis in the current post, but I didn’t get that far.

Dear Gail

I have been pondering this question:

How can a product which costs less than a solution of sugar in water (a Coca Cola) be critical to the economy? How can a 2 percent decline in the supply of that very cheap product cause chaos? Why do people in the aggregate consume as much of that product as the world can produce? Will the supply of the product eventually level out such that everyone in the world will have an equal supply? What does a decline in the supply of the product imply about human health and happiness?

The product is, of course, crude oil…and more broadly industrial energy–nuclear, oil, gas, coal, and hydro.

Here is the way I am thinking about it. Industrial energy is like having energy slaves. Ordinary citizens in wealthy countries may easily employ 1000 industrial energy slaves. We can think of this in the same way as financial leverage. A bank may be leveraged by 50 to 1–so that if the value of its assets decreases by 2 percent, the bank is insolvent. If my ability to personally command 1000 energy slaves reduces to, say, 900 energy slaves, then my way of life will be ‘insolvent’ and I will have to make some possibly painful changes. And, just as a bank sees leverage as a magical potion which generates wealth, if I am able to increase my energy slaves to 1100, then I will almost certainly do so. Which probably explains why ‘efficiency’ is not a solution to an energy problem. If I don’t use the available slaves in one place, I will undoubtedly use them somewhere else.

If we think broadly about energy, we find that there are a number of different forms of energy that are useful to humans. First is solar energy as captured by plants and transformed into useful things to eat, pollinator insects, soil microbes which aid plant growth, wood for fuel, and animals which are both edible and make valuable manures. The second aspect of solar energy is its ability to lift water vapor from the oceans (while leaving the salt behind) and dropping it on land in the form of rain which grows crops and also provides the raw material for hydro power. The water vapor and methane from animals are also greenhouse gasses and keep the Earth from becoming an ice cube. The third aspect of solar energy is its ability to warm anything it falls upon–which keeps our fuel needs manageable.

The second major form of energy is fossil fuels. Fossil fuels provide the bulk of the energy slaves at our disposal. They enable the industrial civilization which has developed enormously since 1800. While the fossil fuels are not exact substitutes for each other, they can generally be made to serve similar purposes. The conversion of one fossil fuel to a different purpose (e.g., coal to liquids) may be expensive.

The third major form of energy is nuclear. It is facilitated by the availability of fossil fuels. Nobody thinks that, if fossil fuels had not been exploited around 1800, we would have nuclear power plants today.

While we can learn something from looking at the gross energy statistics, what we really need to know is the Net Energy. For example, if we do an experiment where we put humans on bicycle driven electricity generators and count the number that are required to light a room, we can easily ignore the fact that the humans must be fed. And the production of food requires both solar energy and industrial energy. So in a perfect study we would estimate how much total energy is required to keep the bicyclist pedalling.

If we look at the dominant thrust of policy in the OECD countries, it is aimed at increasing gross energy and also increasing efficiency. There seems to be no recognition of the concept that a decline in Net Energy will necessarily mean a reduction in Net Slaves and therefore a reduction in Net Stuff (GDP). Increasing efficiency may make the decline in Net Energy more bearable by softening the effect on our bodies and minds, but it does not result in ‘economic growth’. If there is no economic growth, then the financially leveraged system will be under severe stress.

We can also follow through the logic to think about the distribution of economic activity across the globe. For historic reasons, the OECD countries have had many more energy slaves than poor countries. And for geological reasons, certain countries have been favored with fossil fuel deposits. There has been an increasing trend for the fossil fuel rich countries to keep for their own citizen part of what they produce. So we encounter the Export Land phenomenon. Fossil fuels available for import may decline more rapidly than fossil fuel production in total. In terms of the distribution of the energy slaves across the world, we now have a globalized system driven by corporations with zero loyalty to their existing workforces and their host countries. These corporations are easily capable of moving production any place in the world. We can assume that each additional energy slave is subject to the laws of diminishing returns. The first 10 are a lot more valuable than an increase from 990 to 1000. Since the corporations will seek the maximum marginal return, we can expect a flattening of energy slaves across the globe. What this means is that the OECD countries will continue to lose slaves, while the poor countries will gain slaves.

So the citizens of the OECD countries face a big Reset. They may have to figure out how to make do with half as many energy slaves (to pick a number out of the hat).

So how big is the world industrial energy pot likely to be in 2050? As I interpret Robert Hirsch, he thinks it may be pretty large. He comments that we will face a chaotic transition away from crude oil, but that the petroleum companies are very well positioned to build the facilities required to supply alternative fuels such as tar sands oil, Orinoco oil, gas to liquids, and coal to liquids and beyond all that, methane hydrates. The question we need to ask here is ‘how much Net Energy?’ For example, some people say that the Tar Sands have a very low Net Energy once the cost of production has been subtracted. As I see it, this is a technology question that I am not sure about. If World Net Energy is likely to be 50 percent below current levels in 2050, and if we have 9 billion people on the planet, and if the corporations have levelized consumption, then lifestyles in the OECD countries are going to have to change radically.

Is there some way to begin to think about the change which may be required. I have found it helpful to do three things. First is to remember my very early childhood, when energy was scarce. I am old, and most people in the United States can’t do that because they have never experienced energy scarcity. One can also study evidence from books and films from that era. Second, one can make a point of visiting people who are choosing to live (or being forced to live) with very little Industrial Energy. Third is to take a look at Permaculture. Permaculture is a system of ethics and practices which aims to fully utilize the Net Energy producing capacity of the sun, plants, animals, microbes, water, humans, the built environment, etc. While Permaculture is seldom described this way, it is partially an effort to substitute human labor and ingenuity as well as the natural productivity of Nature for fossil fuels. As the number of Energy Slaves at our disposal decreases, then any lessons learned in the Garden are likely to be quite valuable.

Don Stewart

Don–thanks for all of your observations.

YOu mention that nuclear energy depends on fossil fuels. A lot of people don’t realize that pretty much any kind of energy we use today (solar PV, wind, water power, geothermal, tide, waste) depends on fossil fuels because we need fossil fuels to build and maintain electrical wires, and because we need fossil fuels to build and transport the initial generating unit. Creating transmission lines that we use today requires fossil fuels. Admittedly, much smaller units perhaps could be built without fossil fuels, but as soon as there is a need for metals, the likelihood that fossil fuels will be needed goes we up.

Without fossil fuels, we can perhaps reuse some metals, but they generally won’t be pure metals. It will be much harder to make anything complex, like a computer.

Gail

I always like to make a distinction between solar PV and other kinds of solar. I agree that solar PV is fossil fuel dependent. Heating water with the sun is pretty simple as long as there are empty barrels to forage. Fill them with water, place them in the sun, and you have warm water. Hikers can hang a metal can in a sunny spot and have a sort of shower with at least tepid water.

And when you get into the built environment, intelligent use of the sun and of earth as insulation become important in a low energy world. For example, excavating a cellar not only stores roots over the winter, it also provides a cool retreat when it is 110F outside.

Our ancestors used solar heating and spring houses and cellars for cooling long before they had electricity.

Don Stewart

Agreed. I said solar PV because I make the distinction as well.

Pingback: How much oil growth do we need to support world GDP growth? | Conscious Travel | Scoop.it

This is a nice post, Gail.

Clearly, there is a historical linkage between oil and GDP. But this linkage today must be tested assuming a constrained oil supply. So, the question is not, “what’s the historical linkage of oil to GDP?”, but rather “given that we appear to be structurally short of oil, how fast can the economy adapt?” Thus, the more trenchent question revolves around the speed of effiency gains. If these can be accelerated, then the linkage of oil to GDP will be comparatively weak. If efficiency gains are hard to achieve, then changes in the oil supply will transmit more or less directly into GDP.

So the issue to examine, I think, is the dynamics of GDP elasticity with respect to oil consumption, that is, change in GDP/GDP/change in oil consumption/oil consumption. What can this number be, short term and long term, when the economy is under active pressure to reduce oil consumption?

I think that is true to some extent. One issue with efficiency gains is the rebound effect. You may have seen the report that was in the news yesterday, from the Institute for Energy Research called The Paradox of Energy Efficiency. You may also have also noticed my post about historical declines in real GDP seeming to parallel energy decline, a few days ago called, Evidence that Oil Limits are Leading to Declining Economic Growth.

I would guess that there are far too many people in second and third world countries that are demanding more oil, largely as a result of development brought on by globalization with its’ resultant economic development, who will demand more oil at a rate far greater than efficiencies can save it in the rich countries that already use a lot of oil per person. There are too many of them vs. too few of us, for our savings to ever offset their exploding oil demand. Nearly everyone in rich countries who wants a car has one, but we are a small fraction of humanity. Think of the billions of people in Asia, Africa, even South America, who would like to have their own car, but can’t yet afford to buy one. No way we could save enough to balance that coming demand increase. China alone is projected to be producing 30,000,000 cars a year by 2020. Already they are selling more than the USA. That will add up fast. That is why they are locking in long term oil (and any other resource they can) contracts everywhere they possibly can. They believe in long range planning because most of their leaders are engineers. Ours are lawyers and politicians whose time horizon is the next election and who can’t even agree on a budget.

I would agree. I have made some of those same points in a few of my posts. For example, Is it really possible to decouple GDP growth from energy growth? and Thoughts on why energy use and CO2 emissions are rising as fast as GDP.

If I use IMF WEO data then,

based on market exchange rate, World GDP growth exceeded 3.4%…

– 4 times in the 1980s

– 1 time in the 1990s

– 5 times in the 2000s

If I use IMF WEO data at constant prices, world GDP growth averaged

– 3.2% in the 1980s

– 3.1% in the 1990s

– 3.7% in the 2000s

So, while I also believe that oil matters for GDP, we need to be a careful about the relationship, and if I have to choose between the IMF and the USDA, you know where I come out.

I personally believe that economies will adjust faster when pressured to do so, but no one, to my mind, has written really well about just what that speed limit might be, how it might change, or what pace might be sustainable.

The Paradox of Energy Efficiency applies only to a non-constrained world. It speaks to budget constraints–that is, we have a budget constraint of 4% of GDP for crude oil consumption, then, if we are consuming under that level, we will tend to take efficiency increases as increased features and capabilities (like higher horsepower), rather than lower spend. If we are consuming above the budget constraint, we will reduce consumption. This is a central idea underpinning the notion of carrying capacity, about which I write regularly. Now, if you’re in the peak oil camp, almost by definition, you’re assuming we are being forced to reduce consumption–and that’s what the data shows. If we are being forced to reduce consumption, it’s because we’ve blown through the limits of our carrying capabity. thus we will be–as a nation–trying to reduce consumption.

So the question you have to answer is not “How much will we reduce consumption during business as usual?” but rather, “How fast can we reduce consumption and maintain a standard of living when we really have to?” We have three periods in the US to consider: mid-1980 to mid-1981; April 2011-December 2011 (more or less), and Jan. 2012 to the present. All other periods of reduced oil consumption were accomplished through recession. Indeed, 1981 also ended in recession. Thus, we have no examples except the last year for consumption reduction without a recession.

Can we continue to grow and reduce oil consumption at the same time, or does this period end in recession as well?

For the US, we have good data for all these periods, including oil and gasoline consumption, GDP growth and things like vehicle miles traveled and airline departures or seat miles. So, you might consider doing a piece peeling the onion another layer down. I’d be curious to see what you come up with.

Thanks for your idea.

World real GDP is a difficult to deal with, because of the varying interpretations of the correct numbers. I notice that the IMF also shows at the bottom of its PDF a different item, “World Growth based on Market Exchange Rates,” which looks a lot like the USDA numbers.

I expect that USDA numbers are based on Market Exchange Rates while the IMF’s are based on something else. It is a little frustrating working with the IMF’s data, because they don’t fully disclose all of their assumptions (or at least I haven’t figured them out). Clearly one of their assumptions is that different exchange rates should be used than what the market provides. It would seem as though this would leave lots of room for manipulation, if an agency was inclined in that direction. Of course, it might produce “better numbers” if it is done correctly (and consistently correctly).

I agree that efficiency is a different issue in an energy constrained world. People purchase what their salaries permit, and efficiency would allow their salaries to go farther (if the efficiency definition is correct).

I’l have to think about the “can we grow and reduce energy consumption” issue, in a place like the US. If it is possible to switch to more of a service economy, then this is true. If world use of energy starts contracting, it would seem as though services would contract more than goods (people would get fewer haircuts and facials, so they can buy groceries). Thus, even if we get more efficient at using energy, we could still find that this savings is not really reflected in GDP growth/ shrinkage.

Kjell Akelett’s just published Peeking at Peak Oil has some interesting evidence of the close connection between GDP and oil consumption. From pages 293 and 294:

In 1945 Sweden was quite a poor nation. However, in subsequent decades its GDP increased dramatically so that by 1970 it was the world’s third wealthiest nation on a per capita basis. In the period between 1945 and 1970 Sweden’s use of energy increased fivefold which corresponds to a 7 percent increase per year for 25 years. This energy came primarily from cheap oil imported from the Middle East.

He shows graphs of oil use and GDP for China, India, and Sub-Sahara Africa from 1980 to 2005. China shows dramatic increases in both oil use and GDP, India less spectacular increases, and Sub-Sahara Africa no increases at all. By eye, I estimate that the relationships are pretty much in line with Gail’s estimates for the world.

I find the cross sectional evidence, coupled with Gail’s work on the global trends, quite convincing.

If you want to see how Sweden looked in 1945, perhaps a good place to start is Ingmar Bergman’s film Sawdust and Tinsel about a traveling carnival. If you watch carefully, you will understand what is necessary to live in a low energy world.

Don Stewart

Pingback: How much oil growth do we need to support world GDP growth? « 3E Intelligence

Pingback: How much oil growth do we need to support world GDP growth? | The Great Transition | Scoop.it

I think such analyses are interesting and helpful but how accurate can they be? GDP figures are calculated in slightly to very different ways in each country, so is it accurate to just lump them together? That economist who told you that world GDP is a difficult thing to compute was right. Can any GDP figure be taken at face value? Also, the oil supply figure needs to be changed to an energy supply from liquid fuels figure. I haven’t seen a chart for that, and it would be very difficult – even “the easy oil” comes from EROEI sources that probably vary from 80:1 to 20:1, then there are all the liquids worse than that, including some that may have EROEIs less than 1:1. It would be interesting to see a chart of liquid net energy, rather than barrels per day.

I agree that the world GDP numbers are pretty iffy. The numbers for Europe and for the US are better, and even for the remainder of the world (that I showed in my previous post). A big question is how to weight them together.

The oil consumption number I used is as close as I could get to an “Energy supply from liquids fuels” number. BP takes the amounts of various types of consumption, and weights them to get “barrels of oil equivalent”. In its spreadsheet, it shows approximate conversion factors. I don’t have enough information to verify that everything has been done correctly, but the intent is that low energy products get less credit than high energy products. I would think that ethanol would get less credit than gasoline, for example.

The EROEI calculations have a lot of “issues”. One is that they are not very comparable from energy source to energy source, because there as different costs/energy inputs that have not been included. They really work best for say, comparing one wind turbine to a similar wind turbine. Another issue is that they do not handle timing at all–make it look as if energy sources with big up-front costs and unknown lifetimes are equivalent to products where the return is more spread out. We have very severe limits on how much we can invest, and even if we do find funds to invest, the cost of this investment is deemed to have no energy cost. I would argue that there is a real cost involved–those receiving the interest payments will take trips with the money, and otherwise use the funds to buy fossil fuels. Another issue is that liquid fuels are in many ways far more valuable than other forms of energy. The market prices this in, but EROEI does not. EROEI calculations can even make it look like it is worthwhile to burn oil to replace natural gas (in the case of wind energy).

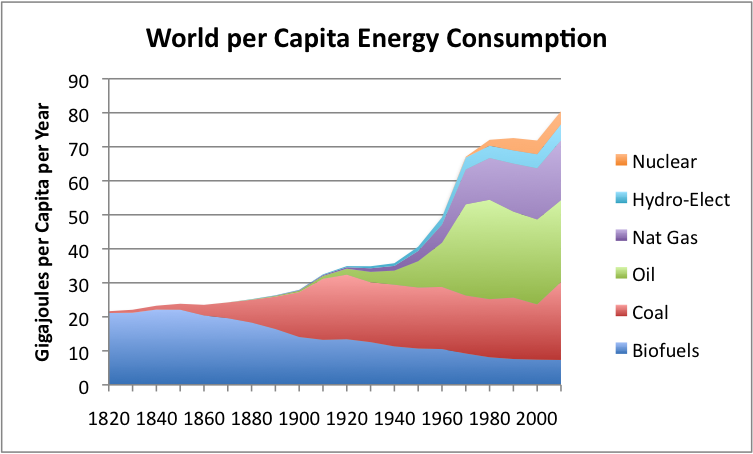

Another issue is what average EROEI level the world needs in order to live. It is far higher than 1.0. I would argue that society is pretty much using all the energy we give it today. We don’t have a good calculation of net energy per capita, but gross energy per capita on a world basis continues to set record. I haven’t updated these charts to 2011, but the 2011 value seems to be higher than 2010. The growth in energy consumption is taking place in China, India, the oil exporters, and the rest of the world that I recently called “The Growing Part of the World”. As we add more energy, we seem to add more people. Subtracting people is a problem.

[caption id="attachment_16902" align="aligncenter" width="448"] Figure 2. Per capita world energy consumption, calculated by dividing world energy consumption shown in Figure 1 by population estimates, based on Angus Maddison data.[/caption]

Figure 2. Per capita world energy consumption, calculated by dividing world energy consumption shown in Figure 1 by population estimates, based on Angus Maddison data.[/caption]

[caption id="attachment_16921" align="aligncenter" width="448"] Figure 10. Year by year per capita energy consumption, based on BP statistical data, converted to joules.[/caption]

Figure 10. Year by year per capita energy consumption, based on BP statistical data, converted to joules.[/caption]

I’m not sure what you mean by “better” when referring to US and European GDP data. More accessible, maybe, but many people think US official data is rigged, in some way. As for energy, yes, I looked at the BP data but it still seems to treat all oil as the same. As we’re talking about liquid fuels here, that’s what I’m concentrating on. All liquid fuels, even in the BP data are not equal in energy content, so the term “BOE” is not helpful is figuring out the rate of increase (or decrease) of liquid fuel supply. EROEI is certainly another factor and I agree that liquid fuels are seen as more valuable than other forms of energy, so EROEI doesn’t tell the full story. But, it would be interesting to see a chart that tries to take into account all of the factors that affect the real amount of liquid fuels available to grow the economy.

US real GDP data incorporates inflation estimates which are quite noisy. In my opinion, nominal GDP data is much less noisy.

Quite possibly. Another main factor with US GDP is hedonistic adjustments (which also affects inflation figures). Some of that goes on here in New Zealand, too, though not as much as in the US.

What Experiments? Many of us have done experiments where they have haesrnsed the energy that flows continually onto the earth from the sun. There were one or two experiments done to work out the right way to basically gather the daylight. First off, with the solar power experiments, you know it has been shown the solar electricity can be employed for everything that coal or other energy can be employed for.

If your DIY solar cell ignited and led to fire prombels with your house, your insurer might be a little averse to pay out for a fire due to a solar energy panel that didn’t have UL authorization. DIY could be a great intro to understanding what it implies to have a solar power house, but it’s not a feasible alternative choice to factory made solar energy panels. If you’d like to make a solar energy panel as a science project, consider purchasing one of the how too make solar panels’ guides.

Another interesting pallarel is that the last time government spending passed the annual 40% of GDP marker was during WWII. However, nothing today can justify the similar confiscation of nearly half of the people’s resources. Certainly this spending may show up in the GDP number, however it is clearly unsustainable. Now only if congress would just sustain from spending.

I can’t help but note that GDP is of interest mostly to those who live in the world of money. Those who live in the Real World have other things to think about. For example, consider this announcement from the local Community College a couple of days ago:

Learn how to build your own Small House. The era of bigger is better is losing ground in new home construction. More people are turning toward a smaller housing footprint to conserve energy and materials cost.

Central Carolina Community College, Chatham Campus has initiated a small house program that allows individuals to participate directly in the construction of a real Small House, of only 500 sq ft.

Learn how to build your own home! The learning objectives for this course cover safety, tool use, energy efficient design, indoor air quality, and hands on construction of a Small House.

Course work is composed of 25% class style instruction, and 75% hands on execution The class meets from 08/17/12 to 12/14/12

Textbooks: Toward a Zero Energy Home – Johnson & Gibson; Graphic Guide to Frame Construction – Thallon

Back to me. So…if one is getting a comfortable small home that is built by hand (albeit using industrial materials), then what is the problem? Well, GDP is very, very small. There are very few ‘jobs’ involved, although there is considerable work (mostly with a group of friends) and considerable celebration afterwards (with home brew beer and home grown food). But GDP definitely does take a hit. So no respectable person in DC or Corporate America approves of such nonsense. A Real American buys a house that is way too big with money they don’t have and thus consigns themselves to a lifetime of slavery trying to get out of debt.

I will also note that 500 square feet is about the minimum that can meet the building codes. But I know people who live in 12 by 12’s (144 square feet) which are classified as ‘agricultural outbuildings’ and thus are immune from the building codes. Some of those houses have been built for less than a thousand dollars.

My point here is that there is a Real World for those who can perceive it and live in it and then there is Fantasyland for those who are immersed in the world of debt and status and conspicuous consumption.

Don Stewart

Per square foot, you get better insulation with larger structures. An apt building is very fuel efficient, because your downstairs neighboor heats your floor, and you heat the floor of your upstairs neighbor.

Increasing fuel efficiency by creating smaller free standing structures is basically the wrong idea. The smaller the structure, the more surface area there is relative to volume. You increase the fuel efficiency of dwellings by making them bigger, and then moving many, many people into them.

Packing people together closely in apartment buildings is the way the Russia has done things. I understand individual homes are not permitted in Moscow.

I think that as a practical matter, most of the world’s population has always lived in warm areas, where heating/ cooling isn’t a consideration. Population in cold areas was always very low, until fossil fuels came along. The need for sturdy, insulated homes and fuel for heating such homes has always been a problem. Without fossil fuels, it seems like cold climates will again be at a big disadvantage.

Well, there is no coal shortage, nor spike in coal prices, and you can always heat your house with electricity from coal, and a heat pump (reverse AC) running off of electricity.

They have air to air heat pumps that are cheap to install, and work pretty well down to 20F or so. Even in VT, that system would cover a lot of your heating. Would only need a couple cords of wood after that, or some baseboard heaters and sweaters.

In North Carolina it is quite possible to live in a 12 by 12 with no heat and no air conditioning.. I know an MD who does so.

As for apartments. There are different ways to solve problems. The thing is to achieve what Peter Bane calls ‘self reliance’. By that he means that you are relying heavily on your own efforts to meet your essential needs, including co-operative ventures with neighbors. A typical US apartment building puts you squarely in the mode of being dependent on the financial world. You can’t grow your own food, you can’t provide your own fuel, and you can’t provide your own water.

A small house or 12 by 12 with a metal roof and a home-made cistern can, in the Eastern US, supply you with plenty of drinking water. The cautious will also use a Berkey water filter. If you own a little property around your small house you can have a garden and a root cellar. Plus a little space to practice some part time profession to make the money you need.

If you think of it in terms of complexity, an apartment building or co-housing is always more complex than an individual dwelling. While it is usually true that a communal water supply will be more economical than an individual water supply, the added complexity may offset any savings. Same with a communal garden. The best solution will frequently be individual gardens with gifting of surplus. There is a difference in human perception of going out to weed a communal garden which is ‘not mine’ and freely giving the surplus of my own garden which I weeded myself to a neighbor who didn’t contribute any weeding labor to my garden. Each household and each community have to find the right solutions for their own situation.

But dependency on the ‘global financial system’ or ‘government help’ or similar fantasies isn’t very smart.

Don Stewart

Good points. It is hard to argue that cities are very sustainable in a downturn. If nothing else, transmission of illnesses becomes a real problem, as ability to process water and wastes goes downhill, and access to antibiotics decreases. There is also the issue of reprocessing of gardening and human wastes, if everything is shipped off to a city somewhere. If harvests are poor, or there is a transportation interruption, cities are likely to supper. Of course, with the industrial farms we have today, the food produced is simply corn for ethanol or for animals, so would not work well as human food.

You are right. GDP and all of the goofy definitions of what go into it are primarily of interest to economists and a few others.

If we look at homes people lived in a couple hundred years ago, most were much smaller, and many were built by hand. I expect that if people find they need to live in rural areas again (to grow their own food) they will either need to occupy existing housing (perhaps with more than one family to a house), or they will need to build something simple and small.

Thank you. Your posts are thought-provoking and always appreciated.

What is your comment on the following comment from a recent study?

‘Contrary to what most people believe, oil supply capacity is growing worldwide at such an unprecedented level that it might outpace consumption. This could lead to a glut of overproduction and a steep dip in oil prices.’

The argument presented is that, with the oil price being so high, massive investments in alternative oil resources have been made in recent years, and we are soon to reap the benefits.

Maugeri, Leonardo. “Oil: The Next Revolution” Discussion Paper 2012-10, Belfer Center for Science and International Affairs, Harvard Kennedy School, June 2012.

http://belfercenter.ksg.harvard.edu/files/Oil-%20The%20Next%20Revolution.pdf

Maurgeri does not realize that the new techniques are expensive, and need high prices to keep production going. I don’t think he has ever stopped to work through the details of what would be involved–such as how many more drilling rigs would be needed, how many people would have to start working in the oil industry and the timing for training them, and the details of where all of the investment in new high priced production would come from. If, in fact, prices did drop as he said, the new supply would suddenly contract. (The US natural gas industry seems to be headed this way.)

To me, what Maugeri is talking about is a poorly thought out dream, that has a 99.9% chance of not happening.

So – high prices bad, low prices…. also bad.

Shortage bad … glut, also bad.

No matter what — it will be bad.

Interesting.

That is what happens when you run out of CHEAP oil. It will be bad.

Cheap oil but not cheap natural gas, nor cheap coal. (Not in N. America, anyway).

Doesn’t the US get more fuel from coal and gas combined than oil? I believe that is now the case. And the oil usage is dropping significantly (mainly with higher mileage cars)

Well you gave a very good model there. Why do you think a mediocre R^2 was evident in the regression analysis you provided? Was there a “good” P-value / T-stat evident?

I didn’t do much analysis beyond that shown. You can get the oil consumption data from BP Statistical Review 2012 from the historical data downloads. It is in “barrels of oil equivalent”. The USDA Economic Research Service GDP data is the first file from this link.

Regarding the reason for the low R^2. The data we are working with are fairly noisy:

(1) The oil supply data changes depending on how a person looks at it–which agency prepares it (BP, EIA, IEA), when it prepares it (2012, 2011, 2010, etc.). Even within the BP 2012 report itself, it is not clear there is perfect consistency (although a person can’t really tell, because for example, production and consumption are defined slightly differently, so can be expected to match up exactly). Also, oil supply in a given year depends on a variety of things. US production may be taken down significantly by hurricanes in some years for example. Workers strike can affect other countries. It is not at all clear that reporting is honest and accurate–some countries have an interest in making things look better than they really are.

(2) The real GDP data is also very noisy, for reasons I partially explained in my post Evidence that Oil Limits are Leading to Declining Economic Growth . There are many other reasons as well. GDP can be distorted by things like the quantitative easing program in the US, and all of the deficit spending that allows government employees to stay in jobs, for example. There are also the world aggregation issues that I mentioned in my latest post.

In addition, as I pointed out in the earlier post, there has been an attempt to switch away from oil for years, because while it is the “best” energy source for many applications, it is also the highest cost application. The intensity of this effort has varied over time, depending on the relative prices of the various fuels, and other considerations–government subsidies and taxes for example.

As an actuary, I would consider each year’s value of oil supply and GDP amounts as variables with quite a bit of “noise” attached. Calculating year to year changes reduces the number of estimates by one. It takes the ratio of two noisy amounts, and thus has even more random variation than the underlying numbers. So I wouldn’t expect a very high R^2.

(Edit: I should add that there are other kinds of energy that economies run on besides oil. Coal is the next biggest one, then natural gas. These have been growing in importance recently.)

“The latest World Economic Outlook projects that the global economy will grow 3.5 percent this year….and 3.9 percent in 2013..”

http://www.imf.org/external/pubs/ft/survey/so/2012/new071612a.htm

So following these figures; the IMF should expect global oil supply to grow by approximately 2.6% in 2012 and 3% in 2013. Nearly 6% in 2 years! According to our global economic partners the pie just keeps on getting bigger !! Wish they cooked in my house.

I suspect that as the oil peak becomes obvious and the price of oil explodes, the coming switch from oil to natural gas in some transportation, when combined with the increased use of natural gas for power generation, will deplete the supply of natural gas a lot faster than many people now realize. It takes a lot of gas to replace the energy in a barrel of crude oil because oil is a liquid, which is far denser than a gas. And all but the most enormous gas deposits, like they have over in Qatar, Iran and Russia, deplete quite rapidly. Many oil fields pump for decades, fewer gas fields do that. And it cost just as much to drill a gas well as an oil well.

Replacing oil with liquid fuel made from coal, on the scale needed once the oil peak is passed, would require trillions of dollars of investment and take a couple of decades. I doubt it will be possible to build enough plants to stay anywhere near ahead of the oil decline. Just look at the graph that the Shell dude, Hubbert, developed. Once that decline gets going, it goes down fast! Globally, that will be a lot of oil. Think how many plants you would need to replace all that oil. They would cost a significant fraction of the entire global output. And you would need to do it while the cost of oil is constantly increasing. I wonder if the Federal Reserve Bank creating a few hundred trillion dollars might create a little inflation?

I suspect that an attempt will be made to first substitute natural gas -to -liquids for oil, and that by the time a natural gas shortage becomes obvious, it will be too late to construct the coal- to- liquid plants on the scale needed to prevent an economic collapse.

I really doubt we will even get that far. A few years after the peak is passed, the price of oil will wreck the economy before the physical shortage of oil becomes a life threatening problem.

I think the high price of oil is already close to wrecking the economy. We have managed to apply band aids to it, to hold things together. It is only a matter of time until the band aids fail. So I am not sure that we will get as far as you suggest with, for example, natural gas to liquids. Building one of these plants takes years, and a huge amount of investment capital.

With respect to Hubbert’s posts, see my post Will the decline in world oil supply be fast or slow? Hubbert was making his remarks in the context of an assumed other fuel (nuclear at first, it is less clear what else later) that would take over, so that the world’s population could be supported on the down-side, with another fuel. In this context, it made sense to show a graph of a more or less symmetric curve. I don’t think such a curve is justified without something else to take over.

Reblogged this on eamonnodonovan.

Excellent post Gail. Great use of regression analysis to illustrate your point. With growing indicators of ecological impact from climate change becoming ever present, it is obvious we need become much more efficient in our energy use and shift our fossil fuel energy sources to indigenous low carbon energy supplies where natural renewable sources allow; – wind, wave, bioenergy, solar, hydro, tidal, geothermal etc, etc.

The argument for an end to growth also continues.

The end of growth was foreseen by the founding fathers of economic theory. From John Stuart Mills in 1848…..

“The increase in weath is not boundless. The end of growth leads to a stationary state. The stationary state of capital and wealth…..would be a very considerable improvement on our present condition”.

In 1776 Adam reasoned that that all economies would eventually reach a “stationary state” when “they had acquired the full compliment of riches which the nature of its soil and climate, and its situation with respect to other societies allowed it to require, which could therefore advance not further and which was not going backwards”.

“The End of Growth” paper written in 1972, and the recent follow ups by Heinberg et al are just rethinkings of the original idea on how to conclude the cycle of capitalism. There is nothing new in it, we have just lost the original blueprints, and therefore lost our way. An image of a snake eating its own tail comes to mind. We are all a part of it.

Zen master, Thich Nhat Hanh in 2010 and at the age of 84 summed it up…

“The situation the Earth is in today has been created by unmindful production and unmindful consumption. We consume to forget our worries and anxieties. Tranquilizing ourselves with over consumption is not the way”.

Thanks! Oil consumption is tied in with so much of what we do, that it is hard to switch away. Real GDP growth seems to need oil growth.

By the way, it seems like some economist would disagree with me. They think that a person can simply isolate a few countries (US and Europe for example), and say that they can grow on services, while the rest of the world grows on construction of goods. It seems to me that we need goods for doing services–for example, people working in the financial industry need computers, heated and lighted offices, and transport to work. Some of these services may go away, as oil becomes more restricted, because for example, debt cannot be repaid, or because it no longer makes sense to spend huge amounts on super-specialized medical providers, often at long distance from patients. If the world economy shrinks, I expect that services will be harder hit than goods, so this strategy may not be protective. It is goods production, especially food and basic clothing that is primary.

I keep saying that we cannot become rich by cutting each others hair, or painting our nails. It is the growing of food, the digging up of minerals and the making of things which we require, that generates true wealth. Making steel and building things from it, or raising trees and building things from them, makes things we need and houses to live in. Financial services are a mediator, not a creator of wealth. No one seems to listen though.

Pingback: How much oil growth do we need to support world GDP growth? | Sustain Our Earth | Scoop.it