There are many who believe that the use of energy is critical to the growth of the economy. In fact, I am among these people. The thing that is not as apparent is that growth in energy consumption is dependent on the growth of debt. Both energy and debt have characteristics that are close to “magic” with respect to the growth of the economy. Economic growth can only take place when growing debt (or a very close substitute, such as company stock) is available to enable the use of energy products.

The reason why debt is important is because energy products enable the creation of many kinds of capital goods, and these goods are often bought with debt. Commercial examples would include metal tools, factories, refineries, pipelines, electricity generation plants, electricity transmission lines, schools, hospitals, roads, gold coins, and commercial vehicles. Consumers also benefit because energy products allow the production of houses and apartments, automobiles, busses, and passenger trains. In a sense, the creation of these capital goods is one form of “energy profit” that is obtained from the consumption of energy.

The reason debt is needed is because while energy products can indeed produce a large “energy profit,” this energy profit is spread over many years in the future. In order to actually be able to obtain the benefit of this energy profit in a timeframe where the economy can use it, the financial system needs to bring forward some or all of the energy profit to an earlier timeframe. It is only when businesses can do this, that they have money to pay workers. This time shifting also allows businesses to earn a financial profit themselves. Governments indirectly benefit as well, because they can then tax the higher wages of workers and businesses, so that governmental services can be provided, including paved roads and good schools.

Debt and Other Promises

Clearly, if the economy were producing only items for current consumption–for example, if hunters and gatherers were only finding food to eat and sticks to burn, so that they could cook this food, then there would be no need for the time shifting function of debt. But there would likely still be a need for promises, such as, “If you will hunt for food, I will gather plant food and care for the children.” With the use of promises, it is possible to have division of labor and economies of scale. Promises allow a business to pay workers at the end of the month, instead of every day.

As an economy becomes more complex, its needs change. At first, central markets can be used to facilitate the exchange of goods. If one person brings more to the market than he takes home, a record of his credit balance can be kept on a clay tablet for use another day. This approach works as long as the credit can only be used at that particular market. If the credit balance is to be used elsewhere, or if the balance is to hold its value for a period of years, a different, more flexible approach is needed.

Over the years, economies have developed a wide range of debt and debt-like products. For the purpose of this discussion, I am including all of them as debt, broadly defined. One type is what we think of as “money.” Money is really a portable promise for a share of the future output of the economy. It can provide time shifting, if this money is held for a time before it is spent.

Another type of debt is a loan with a fixed term, such as a mortgage or car loan. Such a loan provides time shifting, allowing something to be paid for over a significant share of its life. Equity funding for a company is not really a loan, but it, too, allows time shifting. Those purchasing shares of stock do so with the expectation that they will be repaid in the future through price appreciation and dividends. It thus acts much like a loan, for the purpose of this discussion. There are many other types of promises regarding future funding that are closely related–for example, government loan guarantees, derivatives, ETFs, and government pension promises. All indirectly add to the willingness of people and businesses to spend money now–someone else has somehow made promises that remove uncertainty regarding future income flows or future payment obligations.

The Magic Things Debt Does

It is not immediately obvious how important debt is. In fact, neoclassical economists have tended to ignore the role of debt. I see several, almost magic, ways that debt helps the economy.

- Debt brings forward the date when an individual or company can afford to purchase capital goods. Without debt, the only way to afford such a purchase would be to save up the full price in advance. Using debt, a business can add a new machine to allow it to produce more goods before the business saves up money from its prior operations. A young person can afford to buy a house or car, long before he could save up funds for such a purchase. With the help of debt, the price of capital goods can be financed over much of their working life.

- Adding debt raises the prices of commodities. Commodities, such as lumber, iron, copper, and oil are what we use to make cars, houses, and factories. “Demand” for these commodities rises because more people and businesses can afford to buy capital goods that use these energy products. Often these capital goods also use energy products over their lifetime (for example, gasoline to operate a car), so there is a long-term impact on the demand for energy products, in addition to the demand associated with making the capital goods. Of course, with higher prices, it becomes profitable to extract oil and other energy resources from more marginal areas of production. More companies enter the field. As long as prices remain high, they are able to earn a profit.

- Adding debt stimulates the economy, almost like turning the heat up on a stove. When debt is added for any purpose–even starting a war–it starts a whole chain of purchases, each of which acts to stimulate the economy. If a young person takes out a loan to buy a car, the purchase of the car leads to the salesman having more money to buy goods for his family. The company selling the cars is able to make a bigger profit, which the business can reinvest or pay to shareholders as dividends. The purchase of the car leads to more demand for metals used to make the car, and thus tends to increase the number of mining jobs. Each new worker in turn is able to buy more goods and services, starting a beneficial cycle that gradually radiates out through the economy.

- Adding debt tends to lead to higher asset prices. Clearly, (from Item 2), adding debt can raise the price of commodities. Adding debt can also make it possible for more people to afford real estate and investments in the stock market. For example, Japan greatly ramped up its debt level between 1965 and 1989.

Figure 1. Annual growth in non-financial debt (in Yen), separated into private and government debt, based on Bank of International Settlements data.

During this time, a major price bubble occurred in land prices (Figure 2).

Figure 2. Land Prices in Japan. Figure from Of Two Minds by Charles Hugh Smith.

There is a reason why this bubble could occur. Because of the stimulating effect that debt had on the economy, more people had the wealth to buy real estate, especially if this too was sold on credit. Once private debt levels stopped rising rapidly, price levels crashed both for land and stock prices. TheBubbleBubble.com explains what happened: “By 1989, Japanese officials became increasingly concerned with the country’s growing asset bubbles and the Bank of Japan decided to tighten its monetary policy.” Doing so popped both the home and stock price bubbles.

- Adding debt adds to GDP. GDP is a measure of the goods and services produced during a period. Many of these goods and services are bought using debt, so it is not surprising that adding more debt tends to add more GDP. The amount of GDP added is less than the amount of debt added, even when inflation growth is considered as part of GDP.

Figure 3. United States increase in debt over five-year period, divided by increase in GDP (including inflation) in that five-year period. GDP from Bureau of Economic Analysis; debt is non-financial debt, from BIS compilation for all countries.

The general tendency is toward the need for an increasing amount of debt per dollar of GDP added. This is especially the case when oil prices are high. In the US, the ratio of non-financial debt to GDP added was almost down to 1:1 for a time, back when oil prices were less than $20 per barrel (in today’s dollars).

- Adding debt tends to increase wealth disparity. Adding debt tends to increasingly divide an economy into “haves” and “have-nots.” Many of the “haves” own the means of production, including an ever-increasing amount of capital goods, and thus can earn profits and dividends from these capital goods. Others are high-level officials in businesses and the government who earn high salaries. Interest payments also tend to transfer payments from the poor to the more wealthy. We might say that the common laborers are increasingly “frozen out” of the economy that otherwise is heating up. This shift started to take place in the United States about 1981.

Figure 4. Chart comparing income gains by the top 10% to income gains by the bottom 90% by economist Emmanuel Saez. Based on an analysis of IRS data, published in Forbes.

- Adding debt is something that governments can influence, either by lowering interest rates or by borrowing the money themselves. Actions by governments to reduce interest rates can be effective, because they lower monthly payments that borrowers need to make to take out a loan of a given amount. Thus, they tend to encourage more borrowing. In Figure 5, below, note that the decrease in interest rates in 1981 corresponds precisely with the rise in debt to GDP ratios is Figure 3 and the shift in income patterns in Figure 4.

Figure 6 later in this post shows that changes in Quantitative Easing (QE) (which affects interest rates and the level of the US dollar relative to other currencies) also correspond to sharp changes in oil prices. Changes in the level of the dollar also affect demand for oil. See a recent post related to this issue.

What Goes Wrong as More Debt Is Added?

It is clear from the discussion so far that quite a few things go wrong. These are a few additional items:

1. There are limits to government manipulation of debt levels. First, interest rates eventually drop so low that they become negative in some countries. Negative interest rates tend to cause bank profitability to drop and lead to hoarding by those who planned to use savings for retirement.

Second, government borrowing doesn’t work as well at stimulating the economy as investments made by the private sector. A likely reason is that private sector investments are made when the borrower believes that the return on the investment will be high enough to pay back the debt with interest, and still make a profit. Government investments often do not meet this standard. Some reports indicate that Japan’s government has used borrowed money to fund bridges to nowhere and houses with no one home. China’s centrally directed economy seems to lead to similar over-borrowing problems. Chinese businesses also borrow to cover interest on prior loans.

2. Ratios of debt to GDP tend to rise, worrying government leaders. Debt is a way of accessing the benefits of Btus of energy, in advance of the time they are really available. As the amount of easy-to-extract oil depletes, the cost of oil extraction gradually rises. Unfortunately, the amount of “work” a barrel of oil can perform–for example, how far it can make a truck travel–doesn’t rise correspondingly. As a result, the higher price simply reflects increasing inefficiency of extraction, and thus the need to use a larger share of the economy’s output to extract oil. The amount of debt needed to keep GDP rising keeps growing, in part because oil is becoming higher priced to extract, and in part because goods that use oil in their production also tend to rise in cost. As a result, the ratio of debt to GDP tends to spiral upward.

3. Rising debt allows for a temporary false valuation of the benefit of energy products. The true value of oil and other energy products comes primarily from the Btus of energy they provide, such as how far a truck can be made to travel. Thus we would expect that the true value of energy products would remain relatively constant over time. If anything, the value of energy products will tend to rise by a small amount (say, 1% per year) as technology improvements lead to growing efficiency in their use.

What we think of as the magic hand of the economy determines a price for commodities at all times, based on “supply” and “demand.” This price clearly is not very close to the future energy profit that the energy products will actually provide, because it tends to vary widely over time. We don’t know what the true value of a barrel of oil to society is. If the true value is $100 per barrel (in today’s money), then back when oil prices were $10 or $20 per barrel (in today’s money), there would have been $80 to $90 (equal to $100 minus the actual price) of “energy profit” that could be pumped back into the economy as productivity gains for workers, interest on debt, and dividends on stock, tax revenue, and money for new investment. The economy could (and did) grow quickly. There was less need for added debt, because goods made with oil were cheap. Wages for workers could rise rapidly, as they did in the 1950 to 1968 period (Figure 4).

If prices approach the true value of oil (assumed to be $100 per barrel), the extra energy profit would pretty much disappear. The economy would increasingly become “hollowed out.” Productivity gains that lead to wage gains would mostly disappear. Businesses would find it hard to earn adequate profits, and would cut back on dividends. Some companies might need to borrow money in order to pay dividends. World economic growth would slow.

Prices can even temporarily overshoot their true value to the economy, then drop sharply back. This happens because prices are set by demand, and demand depends on a combination of wage levels and debt levels. Oil prices can be high for a while, if borrowing is temporarily high, and then fall back as it becomes clear that profitable investments are not really available if oil is at such a high price level.

4. Wages of non-elite workers tend to drop too low. Workers play a very special role in the economy: they both (a) provide the labor for the economy and (b) act as consumers for the economy. If workers aren’t earning enough, there is a problem with many of them not being able to buy the goods and services the economy produces. This is especially the case for purchases such as homes and cars, which are often bought using debt. Indirectly, this lack of ability to afford the output of the system puts a downward pressure on the price of commodities, particularly energy commodities. Prices may fall below the cost of production, or may not rise high enough.

The reason that wages of the less educated, non-managerial workers tend to lag behind is related to the issue of diminishing returns. A workaround is a more “complex” society, with bigger businesses, bigger government, more capital goods, and more debt. In some cases, manufacturing is shifted to parts of the world with lower wages. Non-elite workers increasingly find themselves with too small a share of the output of the economy. Figure 7 shows some influences that tend to lead to too low wages for non-elite workers.

Figure 7. Illustration by author of why an economy that doesn’t grow leads to falling wages for workers. All amounts are guess-timates, to show a general principle.

When wages for a large share of workers drop too low, there is a problem with workers not having enough money to buy goods like cars and houses. The economy tends to contract. This is a different form of too low Energy Return on Energy Invested (EROEI) than most people think of. In my view, low return on human labor is the most important type of EROEI. Falling wages of a large share of workers can lead to economic collapse, because there are not enough buyers for the output of the system.

5. Eventually, debt defaults become a problem. As the world becomes more divided into “haves” and “have-nots,” falling ability to repay a debt becomes more of a problem. To some extent, this happens at the individual level, with auto loans, student debt, and mortgages. If commodity prices fall or stay too low, it happens to commodity producers, including oil producers. It also happens to countries, especially to those who are dependent on commodity exports.

The rise in the cost of oil extraction is another factor. As the cost of extraction begins to exceed the benefit of oil to the economy (assumed above to be $100 per barrel), the energy profit from oil is no longer sufficient to allow the economy to grow as in the past. Without economic growth, it becomes much harder to repay debt with interest.

Figure 8. In a period of economic decline (Scenario 2), the amount a debtor has left over after repaying debt plus interest is disproportionately large, leaving the debtor with inadequate funds for paying other expenses. In a period of economic growth (Scenario 1), the overall growth in incomes tends to compensate for the need to pay back the debt with interest.

6. At some point, we reach peak debt. The economy acts like a pump. As long as there are sufficient energy profits coming through the system (based on $100 per barrel minus the actual oil price, in our example), wages can rise and corporate profits can rise. Asset prices can rise, and energy prices can stay high. Once these energy profits start falling back, wages stagnate and business profits decline. Businesses cut back on borrowing, because they see fewer profitable opportunities for investment. Individuals cut back on borrowing, because with their lower wages, it becomes more difficult to buy a house or car. Governments try to fight declining demand for debt, but eventually reach limits of the economy’s tolerance for negative interest rates.

Once debt begins contracting, the contraction tends to bring down commodity prices. This is a huge problem for commodity producers, because they need prices that are high enough to cover their cost of production. Ultimately, falling debt, together with falling wages, and lack of energy profit have the potential to bring down the system.

Conclusion

The situation we are facing today is one in which growing debt has been holding up oil prices and other commodity prices for a long time. We are now reaching limits on this process, as evidenced by growing wealth disparity, low commodity prices, and the frantic actions of government leaders around the world regarding slow economic growth and the need for more stimulus. These issues are becoming major ones in the upcoming US political election.

Those studying oil issues from an EROEI perspective tend to miss the connection with debt, because EROEI analysis strips out timing differences. In my view, debt is essential to oil extraction, because it brings forward an estimate of the value of the oil and other energy products, so that businesses of all kinds can make use of the “energy profit” in paying their employees and in paying their taxes. Most people don’t think of the issue this way.

In this article, I suggest a different way of thinking about the limit we are reaching–oil prices can’t rise above some price limit without adversely affecting the economy. It is the savings below this limit that aid productivity growth and government funding. Perhaps researchers should be examining this price limit approach more carefully. This is not the same approach as EROEI analysis, but has the advantage of having fewer “boundary issues.” It also offers a check for reasonableness of EROEI indications developed through conventional analysis. If an energy product needs a government subsidy, it is doubtful that that energy product is really providing an energy profit.

When things get serious you have to lie – Junker

http://www.zerohedge.com/news/2016-05-04/central-bank-war-savers-big-lie-beneath

“Actually, that’s a bald faced lie. The household savings rate in the eurozone has been declining ever since the inception of the single currency. And that long-term erosion has not slowed one wit since Draghi issued his “whatever it takes” ukase in August 2012.”

I am planning on being available to answer questions this Saturday evening between 7:00pm and 9:00 pm Eastern Daylight Time in a “Redditt AMA” session sponsored by the Collapse section of Redditt. As I understand it, the format is simply written questions and responses. This is my first experience with this.

Thanks Gail for your time to be available for our inquiries. Hope to be there along other regulars….should be “fun”…

In law there is a concept called promisory note; forcing a little, every economic relationship is a promisory note; i promise to work for thirty days, you promise to pay me every thirty days defines employee-boss relationship.

Debt is close enough to a promisory note, but what happens when corelated obligations are not met? Default. And default rates right now are soaring, especially in the energy sector. at every level of the sector. And, most unfortunately, a major crisis in this sector has the potential to drag the whole economy with it, because the world economy is now immensly interconnected both vertically and horizontally.

IMO a lot of resources are to stay in the ground. Since we claimed all low hanging fruits, we are now forced to use a ladder. But going up and down eats so many resources that in the end a good portion of the fruits remain in the tree, unless you cut it, and that is improbable, at best, because if you cut it, you kill yourself. In other words, diminishing returns and low wages of the 99% is killing demand so fast, that the offer will die eventually.

Just look at the oil glut and the fight for extra storage capacity, you just know that oil industry will come to an abrupt halt sooner than later and probably only the conventional oil and gas will be still extracted until that too will halt, cause there will not be any more BUYERS.

That what a lot of people don’t get: you need to have money to buy. And when you are not having a way to get them, either by ever higher wages or by taking debt, you don’t buy anymore, restricting your expenses to basics: food, clothing, heating, cable tv maybe. Economy – a nice pile of ruins and trash, cause you can’t eat iphones!

And all of these because of a guy called Watt?!!!

I’m going to take this to an extreme logical conclusion:

Assume finance goes completely offline.

No further capex on oil exploration, production or refining is possible.

Oil production falls at around seven percent per annum, taking all economic activity down with it, because people expect things to get worse.

Now, because finance – credit – is offline, and because of the massive inventories of oil and other commodities, the consumption of petroleum products falls faster than their production, leading to Hill’s modelled price declines.

However, debt remains in place, except where relief is sought via the legal system, hence debt continues to increase at a near exponential rate.

The result is zero wage rates, zero employment, and infinite debt.

The debt is cancelled because there is no possibility of recovery without this.

At that point, government creates and spends some money, and the cycle repeats.

The government collapses. Electricity goes offline, and all debt is cancelled.

debt isn’t cancelled–it becomes unpayable

no matter—invest your money here folks:

http://www.planetaryresources.com/#home-intro

That is an excellent explanation of what happens when we get the much discussed ‘debt jubilee’

It’s probably not what most proponents of a debt jubilee are expecting

Thanks for your comment. I especially like your analogy of needing to use a ladder after we claimed all of the low-hanging fruit, and the fact that we must go up and down the ladder eats so many resources that in the end, a good many resources remain on the tree.

I didn’t write the article so don’t shoot me – it’s from Zero Hedge. Sounds a bit premature, but if my prediction of oil price going up to the $60-80 a barrel range occurs in the 2nd half of 2016 then the fracking will resume, no doubt. Where there’s a buck, people chase it.

http://www.zerohedge.com/news/2016-05-03/its-about-get-crazy-again-north-dakota-official-exalts-oil-boom-coming-back-rush

It’s About To Get Crazy Again – North Dakota Official Exalts Oil Boom “Is Coming Back With A Rush”

It’s not a matter of if- it’s about to happen and there’s no stopping it. Oil prices are on the rebound finally. Oil reached its highest level it’s seen in the last 6 months just yesterday. It’s the light at the end of the tunnel we’ve all been waiting for. Get your resumes out, get your work gear out, things are about to get crazy again.

With oil prices climbing higher and higher we are about to see the oil patch fire back up. Drilling crews are going to kick it into high gear. Many companies will be entering back into the Bakken looking to make up lost time. Thousands of workers will be needed in every part of the oilfield.

OilJobFinder.com notes that according to Helms he’s projecting Williston will support 40,000 permanent oil jobs. This will put the towns population over 80,000. Right now estimates are Williston has about 30,000 residents. It’s time to make room for an in-flux of 50,000 workers. We are going to see Williston explode in population growth.

It is amazing how optimistic the oil industry can remain. The oil service companies have temporarily cut their rates, so that they can get at least some revenue. With these low rate, and prices that seem to be moving a little higher, it looks like, “Happy Days are here again.”

I’m trying to get my county to save money, and spend it only on what is most strategic and low energy.

Sorry. Meant to put this comment somewhere else.

” It is the savings below this limit that aid productivity growth and government funding. ”

Seems as though all but the most essential expenditures (and there has been no rational debate as to what these should be) must be foregone if the government is to have some level of funding to manage agreed-to essentials? And there might be widely different versions of productivity and growth?

What happens is that eventually governments collapse, when funding falls too low.

The magic hand is what works out all of the equations; it is not up to economists and their view of what productivity and growth might be. Perhaps legislators try to work out details of what programs the government can afford. When there is not enough energy profit to go around, this becomes evident in many ways at once: too many debt defaults; too little profit for companies; too low wages for workers.

http://www.zerohedge.com/news/2016-05-03/massive-fire-burns-gateway-town-albertas-oilsands-30000-evacuated

Massive fire burns at Gateway Town in Alberta’s oilsands, as 30,000 evacuated. Now that messy stuff is on fire? It already wasn’t making money and now this?!

It’s the surrounding forests that are on fire, not the oil/tar sands.

But this spring has been early, about three weeks, unsettlingly so, and the weather has been unseasonably warm lately. I’m not blaming it on climate change as eastern Canada has seen the opposite end, but it definitely causes one to pause and consider what things will be like in the future.

Was it the end of last year or beginning of this, that two rainforest started to burn and catched fire really well due dryness. One in USA and another in Tasmania. Global food storages has been going down for years as population growth is +80million a yar and same year crop losses in main grain producing areas. If the monsuun rains fail this year in Asia, half of the Asia would be soon starving.

Good to hear it’s not the oil on fire – that would have been hard to stop.

The fire has nothing to do with the oil sands which are located far away.

Over the past several year there have been many lighting related fires in this area.

A record high temperature in Alberta was reached yesterday which broke a 119 year old record for Calgary.

Many have been relating this to a trend in warming. However, look at this way… 119 years ago, it was also this hot. 🙂

A bit of polishing for my comment above: It isn’t just the surrounding forests that are burning. Much of Fort McMurray is burning too. There has been a large evacuation as well. As of early this morning, the city is no longer on fire, but a good deal of it was burning yesterday and over-night. Here’s the link: http://www.cbc.ca/news/canada/edmonton/wildfire-rages-in-fort-mcmurray-as-evacuees-settle-in-edmonton-1.3565573

The dry conditions that led to the fire are predicted to be more common, and are now more common, for our area, and much of the world. That was the sobering lesson I took away from a college level course in climate change and another in water issues, completed a couple months back. It is something that I spend a lot of time thinking about while I’m enjoying gardening two weeks earlier than I normally do.

So no, now is not the time for the public or their elected officials or anyone else to ask for a moratorium on mentioning global warming, as Fort McMurray burns to the ground. There has never been a better time to point at this preventable misery and use it as a prime example of what not to do when faced with an existential nightmare. Everyone knows that Fort McMurray should never have been built in the first place.

If we deal honestly and productively with this incontrovertible fact, and horrific event, maybe we’ll never build another one.

http://www.huffingtonpost.com/scott-thill/stop-running-away-from-gl_b_9851672.html

Now all we need to worry about is the toxic waste, air pollution, ect that is not only destroying the environment, but causing illness among the local native peoples. But they, of course, don’t count because they are on the fringe…..

The so called tar sands will enable Joe six pack and company (rich CALIFORNIA bimbos)

To drive their pickups or sports car on the freeways for a few more precious years.

How wise….

https://m.youtube.com/watch?v=jiNgiPkF0TY

What goes around comes around….

https://m.youtube.com/watch?v=sjfBCuXo2Rg

I don’t expect tar/oil sands development to increase again for at least a couple of years, probably more. The current situation has exposed the cash-flow issues of unconventional oil operations even when prices are strong. Investors will be very cautious when oil prices rise. The local environment and the native population are getting a much needed reprieve.

Got to watch…whatever it takes!

https://m.youtube.com/watch?v=UAlSskuIWHE

BAU lives!

Come on now….how many decades has it been that the scientific community been out front and center about all this and us sheeple just been going with the flo!

NOT COOL….PLEASE….what goes around comes around….that is just the way it is Bro…grow up.

“What goes around comes around….”

Vince,

So are you saying that the people this city are getting what they deserve because they my have worked in an industry ( or a city) where they have no control over the policies and decisions made by the corporate elite.? How could a familyies who lose their home and all possessions equate to some sort of circular punishment for living in an area where Oil Sands are mined ? Really ?????

So, Veggie are you implying we are simply mindless creatures that have no control over our lives and we are tossed along by the Fates? If that is so, I stand by my statement,

What goes around comes around…..

Mindless?…no. Many are there in order to find gainful employment both within and outside the oil industry.

While the livelihoods of the majority of people in that city may directly depend on oil, there are many thousands who do not. Farming, food supply, medical, and education workers are in this disaster. To suggest that this disaster is some fitting payback and that these people and their children should suffer total loss is a bit sick IMHO.

Your logic suggest that everyone (and their families as well as supporting systems like medical and schooling) who work in town supported by a local open strip mine, nuclear plant, fishery, beef slaughter house, corporate farm, or anything damaging to the environment should be burned by some reverse act of fate.

Not cool !

You must be quilty of something!

We are all prisoners of BAU and will taken down….

https://m.youtube.com/watch?v=mEosb2zCqQY

Best to take it like here.

These Guys don’t have a friggin clue…..

Hedge Funds Under Attack as Steve Cohen Says Talent Is Thin

http://www.bloomberg.com/news/articles/2016-05-03/hedge-funds-under-attack-as-cohen-says-skilled-people-are-scarce

Steve Cohen, the billionaire trader whose former hedge fund had racked up average annual returns of 30 percent before pleading guilty to securities fraud three years ago, became the latest critic of the business, saying he’s astounded by its shortage of skilled people.

“Frankly, I’m blown away by the lack of talent,” Cohen said at the Milken Institute Global Conference in Beverly Hills, California, on Monday. “It’s not easy to find great people. We whittle down the funnel to maybe 2 to 4 percent of the candidates we’re interested in. Talent is really thin.

Cohen’s comments come after billionaire Warren Buffett said over the weekend that large investors should be frustrated with the fees they pay hedge funds, which fail to match the returns of index funds. Daniel Loeb, founder of hedge fund Third Point, said last week that industry performance this year was “catastrophic” and that funds were in the early stages of a “washout.”

Cohen said at the conference one of his biggest worries last year was that his firm might become the victim of an indiscriminate market selloff as other funds endured troubles and reduced risk. He said his worst fears were realized in February when his firm lost 8 percent. Global stocks fell about 1 percent that month.

Cohen said most people at his Stamford, Connecticut-based firm are not very good at timing when to invest or exit markets, though they are adept at picking stocks. He said external hires account for 20 percent of headcount at Point72, which prefers to groom analysts and money managers internally.

No doubt better luck having this fella running things

https://m.youtube.com/watch?v=bZCtec7k-pE

Now, that’s TALENT

When there are very few investments that really produce adequate returns, people need to be really talented (or lucky) to get desired returns.

Wonderful analysis! Than you Gail.

Glad you liked it. This is a fairly difficult post. I expect that many people, coming from a mainstream view, wouldn’t understand it at all.

Debt existed well before fossil energy sources. I agree that the huge growth allowed by coal and oil has been fuelled by debt, til the point that the financial economy has overcome its initial intent. But there have been economic systems running with lower debt availability, meanwhile fossil energy allowed for industrial deployment (for instance, the Soviet Unión).

So I do not completely agree that it is debt the key factor in our economic development; I would say rather the contrary: the incredible potential unveiled by the fossil energy sources allowed for an enormous increase of the debt capabilities

U.S energy expenditures as share of GDP started to climb after the U.S reached peak oil.

http://www.instituteforenergyresearch.org/images/energy-expenditures-percent-GDP.jpg

Energy expenditures climbed to 14 percent in the 80’s, about the same time as the elite and non-elite wages diverged. It was also the time when the U.S started its deindustrialization and Japan started to boom.

The non-elite wages then stagnated and held the oil prices low for almost two decades.

Then China joined the WTO and the energy expenditures started to climb again and caused a financial crisis in 2008 after conventional oil peaked in 2005.

http://gregor.us/wp-content/uploads/2010/07/United-States-Energy-Expenditures-as-a-Percent-of-GDP-1999-2008.jpg

After the financial crisis the Fed started the QE program which created the shale revolution. Today the U.S shale producers need higher oil prices to survive.

A reindustrialization of the U.S would lead to rising non-elite wages and would also lead to more debt creation to households who now could afford to take on more debt.

The question is of course: when will shale oil peak ?

Perhaps the Fed and Wall Street will just keep the shale oil producers alive with more debt and hedges ?

US shale oil HAS peaked

30/3/2016

US shale oil peak in 2015

http://crudeoilpeak.info/us-shale-oil-peak-in-2015

Was the limit not 5%?

Why Low Oil Prices Haven’t Helped The Economy

11/4/2016

http://oilprice.com/Energy/Energy-General/Why-Low-Oil-Prices-Havent-Helped-The-Economy.html

Thanks! I see that US net imports of crude oil and oil products are up in both January and February for the first time. http://www.eia.gov/dnav/pet/pet_move_neti_a_ep00_IMN_mbblpd_m.htm At his point, the change is mostly inside the error band of monthly variation, but the general trend should help take the pressure off the rest of the world that declining US net imports had been creating.

Looking only at crude gives a slightly misleading impression of the timing of the net import change. Overall production didn’t start dropping enough to affect imports until Jan-Feb. 2016.

Australia joins club deflation, cuts cash rate.

The Reserve Bank of Australia on Tuesday cut the cash rate to a record low of 1.75 per cent in a bid to head off falling prices and an economic downturn.

The cash rate is now easily at its lowest level under the current system of monetary policy setting.

The cut, the first in a year, came less than a week after a shock drop in core inflation to well below the central bank’s 2 per cent to 3 per cent target band.

In a statement on today’s monetary policy decision, the central bank noted:

Inflation has been quite low for some time and recent data were unexpectedly low. While the quarterly data contain some temporary factors, these results, together with ongoing very subdued growth in labour costs and very low cost pressures elsewhere in the world, point to a lower outlook for inflation than previously forecast.

Expect more cuts in the months ahead…What, China pipe dream is crumbling and you didn’t expect any fallout. Although we ain’t seen nothing yet. Australia is nowhere near a recession yet, let alone crashing. But when it happens, you will be able to see the implosion from space. The country is so up the creek without a paddle…

Dear Gail

I have a somewhat different take on debt.

Debt requires the deferment of current consumption in return for a promise to pay in the future. For example, if I have a hundred dollars my default action is to spend it. But suppose I meet you and you tell me of your wonderful idea for starting a new business which will make lots of money over a period of years. So I loan you the hundred dollars, and get from you a promise to repay me with interest or dividends. You will invest in capital equipment and training workers and all that sort of stuff, but the vacation that I had intended to take does not happen.

What has happened is that I have chosen between a promise of future consumption and present consumption. My hundred dollars would have been spent in any event, but by our actions you and I are investing the money differently than I had intended.

A bank loan is different in that the bank creates the money which is loaned out of thin air. However, in order to get the loan, I typically have to put up collateral. My default option is to sell the collateral and use the proceeds to consume something. But by pledging the collateral, I postpone the current consumption so that I can get the money to invest in a new business opportunity. I could, theoretically, have sold the collateral and used the proceeds to invest in the new business opportunity. But if I can persuade the bank to let me keep control of the collateral while also getting the money to start the new business, I have expanded my empire. I now have control over the collated plus the new business.

Some business owners use the business as collateral to allow them to increase current consumption. For example, there is considerable distress in the midwestern farm world right at the moment because of low prices for commodity crops and also for beef. Some expect a wave of bankruptcies to rival the 1980s. While there are some farmers who may have taken on a lot of debt to acquire a farm, many of the farmers simply discovered that banks were willing to loan them money and thus they could increase their standard of living. Now, of course, ownership may pass to the bank and the farmers will be penniless. The trade-off here, for the farmer, was never really about ‘debt for seeds’, it was really about ‘debt for a winter vacation’. Many farmers will discover the downside of leverage.

I suggest that you take a look at this article:

https://www.project-syndicate.org/commentary/us-trade-deficit-low-domestic-saving-by-stephen-s–roach-2016-04

‘Total US saving – the sum total of the saving of families, businesses, and the government sector – amounted to just 2.6% of national income in the fourth quarter of 2015. That is a 0.6-percentage-point drop from a year earlier and less than half the 6.3% average that prevailed during the final three decades of the twentieth century.

Any basic economics course stresses the ironclad accounting identity that saving must equal investment at each and every point in time. Without saving, investing in the future is all but impossible.’

The article shows how global savings must equal global investment. But the deck chairs can be moved around. The US, by virtue of owning the reserve currency, can run trade deficits with practically every country in the world.

Debt can be used to facilitate more investment, globally. If the people of the world decide that they are willing to cut consumption and invest in promising capital projects, then the POTENTIAL for future returns on those capital investments exists. However, the investments may also turn out to be mal-investments and the savers of the world may have just lost their money and with it the possibility of some consumption. Many people now perceive shale oil and gas to have been a gigantic mal-investment.

Whether the investments will turn out to be mal-investments is heavily dependent on future availability of energy (or exergy) and the efficiency with which the economy extracts useful work from raw energy. You prefer EROEI measures, but I believe that a better way to gauge the probability of future useful work from energy is through thermodynamic modeling. Or people may come up with other methods of gauging the future of energy and work. For example, the dream of decoupling.

So while it is true that growth requires debt in the sense of deferred consumption, it is also true that people will not be willing to defer consumption unless they believe that the future will include an economic environment which will reward the savings and investment. In my opinion, the willingness to defer consumption to reap future benefits is the key…and the outlook for energy and useful work is a key to the perception of the future.

Energy and useful work are not the only key to expectations for the future. For example, the extraordinarily high savings rate in China was probably just a mistake, as much of the investment out-ran the headlights of the global ability to consume all that production. Both Stephen Roach and the ordinary Chinese people may very well be mistakenly projecting past experience into the future, and it may be true that present investments are unlikely to be rewarded. (Some exceptions might include water control earthworks which will yield increased crops for thousands of years.) Taking a look at thermodynamic models of energy (exergy) are a prerequisite to making good investment decisions, in my opinion.

Don Stewart

Dear Readers

I suggest reading this exchange:

http://peakoil.com/forums/viewtopic.php?f=1&t=72540

If you look at the pie charts, you see that an awful lot of oil consumption is accounted for by ‘light vehicles’. Now, in the United States, that means a lot of people are driving vehicles and are not producing anything while they are driving. It is pure consumption.

We can try to rationalize some of that consumption as ‘but they have to get to work’. Which is true, and is the kind of thing that James Kunstler has railed about for years…the insanity of suburbia. If you combine the observations about the precarious nature of the dollar as a reserve currency, with the thermodynamic models which indicate that we can no longer afford the waste associated with using an ICE to get to work or play, and the notion that perhaps some people can actually produce useful products without that heavy reliance on light vehicles, then you come out with some ideas about how the world might get turned on its head. With some survivors and some victims. You also begin to grasp the magnitude of the mal-investment that Kunstler has been writing about until people are sick of hearing it.

Don Stewart

transport is the consumption of energy for the express purpose of consuming still more energy

that applies whether youre driving a food truck, tractor or just commuting to work or even on holiday by plane.

put in suburban transport systems and you might stretch the problem into the future a bit, but it won’t go away.

Eventually our use of wheels will cease.

Shanks’s Pony for us all……

Thanks a lot, Don. This way of writing is something I can understand (somewhat). Still a bit long, but that’s more my problem than yours perhaps. (Although I think most lay people are “impressionistic” and need more the feeling, the trend lines, the poetic essence than they need the facts. Best wishes.

Artleads

In his book The Organized Mind, Daniel Levitin is describing ‘What To Teach Our Children’. He recounts the science that ‘conclusively … we remember things better, and longer, if we discover them ourselves rather than being told them explicitly’.

‘This is the basis for the flipped classroom described by physics professor Eric Mazuir in his book Peer Instruction. Mazur doesn’t lecture in his classes at Harvard. Instead, he asks the students difficult questions, based on their homework reading, that require them to pull together sources of information to solve a problem. Mazur doesn’t give them the answer; instead, he asks the students to break off into small groups and discuss the problem among themselves. Eventually, nearly everyone in the class gets the answer right, and the concepts stick with them because they had to reason their own way to the answer.’

I think of discovering the truth as a triangulation problem. Given multiple points of reference, can we intuit and then test a truth which is greater than that contained in any single point of reference? I have sometimes written in that style. Many people, I think, find it infuriating.

Mazur has the advantage that he controls something the Harvard students want…a passing grade in Physics. Therefore, no matter what they may think or how reluctant they are to be a guinea pig in his experiments, they have to go along. A commenter on the Internet simply doesn’t have the same control. People on the Internet are more like the children who are the target audience for Square Bob Sponge Pants…short attention spans. I (or any other author) controls nothing that most people want.

If what we authors have to offer is the satisfaction of figuring something out….I haven’t figured out how to provide that.

Don Stewart

The fact that you are lending money to someone else puts you in competition with the bank. The bank certainly would have the ability to give the potential investor money, created out of thin air. You, for some reason, have chosen to reduce your own spending to do this. If you look at the interest rates charged in Europe and Japan, you will not even ask that this person return your money with positive interest. Instead, this person can return 98% of it, or whatever, and call it “good enough.” I hope you like this person very well. The reason that such low interest rates are being offered is because few businesses can find investments with a positive return. Investing in something that doesn’t really yield a good return in considered OK in today’s markets.

I am not sure whether collateral is needed now. I receive spam phone calls, offering to lend my business (whatever it is) $250,000, with no fixed payback period, and no collateral. I think businesses are trying to lend money to anyone who can breathe.

With respect to savings, one definition I ran across is this:

I can understand how buying newly issued stock or newly-issued bonds would support business investment. But what does paying off a home mortgage do to further investment? It doesn’t get a new MacDonald’s built, or even a new house built. Buying a house with debt would seem to do a lot more to further investment in houses. Buying stock using debt would even seem to work for the purpose of giving the business money it can spend on capital goods.

I think that there is a reason why we are being told to “spend, spend, spend.” Investment no longer works well. If you spend, spend, spend, there is at least a chance that the business will have enough revenue to generate reasonable profits to use for whatever purposes the business chooses, including reinvestment.

Gail

Stephen Roach is beginning from the standpoint of the global economy…not from the position of the individual. For the individual, it is truly miraculous that the bank can create some digital money and they can buy a car with it. But looked at from the perspective of the global economy, someone has to postpone their own consumption so that the borrower can get an actual car, not a digital car. The ‘someone’ may be a collection of people, some postponing a lot of consumption and some postponing only a little, using old fashioned piggy banks. But, as Roach says, there are accounting identities involved.

I’m not going to try to write an Economics 101 treatise here. My main point is that expectations about the future heavily influence the willingness of people to postpone consumption in return for the promise of repayment with interest and dividends at some future point. Expectations about energy play a large role…but are certainly not the only thing. What we see when we look at corporate behavior is that corporations have cut way back on investments which can only pay off in a prosperous future. The result is that all the bank reserves that are created by the Central Banks are not finding their way into real investments by people who borrow from commercial banks or sell stocks or bonds to build real investment. And, currently, those who have invested in schemes such as shale oil and gas are losing their money.

This is not to argue that money is irrelevant. It is simply to argue that physical developments (depletion of resources, new discoveries, new processes, social cohesion or disintegration, etc.) are more likely to be the drivers of the ship than any purely monetary phenomenon. Which does not mean that really dumb monetary policy cannot screw things up. But, as we have seen in Japan for decades and now all of the OECD countries, permissive monetary policies don’t do much to change the physical factors.

Nobody doubts that what we have is a cart and a horse. But it is necessary to get the horse before the cart…not vice versa.

Don Stewart

Dear Gail and All

See Bill Gross’ article for a discussion of some of the issues:

http://www.zerohedge.com/news/2016-05-04/why-bill-gross-thinks-helicopter-money-imminent-politicians-bankers-will-choose-fly-

I will oversimplify his argument:

*Physical factors have stalled real growth (e.g., robots)

*Stalling real growth brings social disintegration

*Social disintegration carries huge costs

*Money can ease the social costs but not change the underlying physical factors (moving the deck chairs around)

*The politicians and Central Bankers will choose to print and distribute money to ease the social costs (the deck chairs will be moved)

*The price will be paid through inflation, which means that savings will evaporate (the Titanic is going to sink, but all the economicl classes will get the same shot at the few lifeboats)

On the latter point, I just received the financial report for my pension plan. On the surface, it all looks good. Because the government a couple of years ago permitted the plans to use historical, rather than current or expected, returns. But as an appendix, they also report what things look like if current returns are used. With that assumption, the plan has about half the assets that it needs to pay projected benefits.

My 401k currently has a guaranteed minimum benefit which is twice the value of the assets.

So, I would say that, if I am typical, the promises which have been made are woefully underfunded. And if Gross is right that the next choice by politicians is inflation, then the promises will become even more woefully underfunded in terms of real dollars. In short, we are broke!

Gross thinks that printing money can ameliorate some of the social problems, but he does not think it can change the physical conditions.

Don Stewart

The economy runs on a combination of (a) what is spent for today, plus its (b) expectation of what will be spent in the future.

Your decision regarding whether to spend money now or save money for the future depends on (a) the urgency of your current needs and (b) your perception of what money will be worth in the future.

As long as the economy is expanding rapidly, it makes sense to forgo current consumption for pieces of paper that say you will get even more in the future, because the economy will be growing, and you will get a piece of that growing economy.

Once the economy hits stall speed, the dynamics change. The expected return on your money is close to zero, or even negative, because diminishing returns lead to a huge number of projects not really having very good profit possibility. Also, if you stop and think things through, there is a very high probability that the paper documents you receive as payment forgoing current expenditure will not be worth the paper that they are printed on. They are simply promises that are contingent on BAU continuing.

Thus, the position of the horse and cart change.

If you want to read about the kinds of investments that are being made today, there is an article in today’s Wall Street Journal called Soft Power: China Backs Egypt’s New $45 Billion Capital.

As you will recall, Egypt is in dreadful financial condition, having lost its oil exports to depletion and having allowed its population to inflate to 90 million. The development is to be located in the desert, 30 miles east of Cairo, and is to include mixed income housing for seven million people. According to the article:

Gail

I think that the underlying horse/ cart relationship has always been about the physical world rather than the monetary world. But it is certainly true that perceptions of the future of the physical world are clouded and can easily lead to individual mistakes as well as ‘the madness of crowds’. The Mississippi Bubble burst when people figured out that it was not going to be easy to extract money from North America (unlike simply stealing gold from the Aztecs or the Inca). But during the time the Bubble was inflating, many people were under the illusion that money was driving the ship. In the final analysis, it was the physics.

Don Stewart

Don, Gail,

Adding a few words here because of Don’s last sentence “…many people under the illusion that money was driving the ship. In the finale analysis, it was the physics”.

As for the money, I very much like this definition by Frederick Soddy:

“Money is the nothing you get in return for something, before you can get anything”.

From: http://www.golemxiv.co.uk/2013/08/illogical-economics-guest-post-by-hawkeye/

(see also links at bottom of the page in the endnotes)

Then, of course, one must throw in the TIME variable, because it’s all about borrowing from the future, doing in the now what we think will be necessary later.

We therefore have to run things according to a model of the future reality, ie budget according to what we think the value(s) of parameter(s) will be say 1 year later. Of course they’re never 100% in-line with expectations ; some adjustments must be made to take the gaps into account, unless their accumulation may lead to disruptions, at least in periods when the general trend is downwards, as it is today. NB: general trend boils down to the evolution of available energy per capita.

My gut feeling* is that the latter is often preferred because hey one must eat every day, and the difference is only one more line -of debt- on the balance-sheet, who cares?

Eventually, business is running according to a modelized reality which is disconnected from real reality, separately and on its own, until the wake-up call.

*: and the supersize of the derivatives world?

So, it seems to me that a very important parameter to determine wether a setup will work or not is the general trend in the medium/long term, which in the horse/cart analogy could be represented by the slope of the path, maybe coupled with an always increasing weight of the cart (accumulation of the entropy we cannot get rid of).

Thinking out loud, sorry if boring.

Right. We need something to be pushing the economy upward. That something (debt/energy) can push the cart along, even with growing entropy. At some point, we lose the push, and there is no push on the cart any more. It becomes more difficult to go anywhere. (This is a little difficult to make work, because downhill is usually pulled by gravity.)

Gail

Zero-deposit mortgages -more or less – are back in Britain. And at 5.5 times combined salaries.

Spend, spend, spend, indeed!

Wow! I believe that in China, ratios to salaries are even higher, especially in big cities.

I know that most people tend to fixate on the current headline low interest rates, but it seems to me that the _average_ interest paid on debt is approaching ten percent pa in the US economy. Think of the debt everyone creates when they use a credit card. What is the rate on that debt? Even if I use a credit card and pay the purchase cost back in full within a month, although I do not pay interest, somebody does.

Thanks, Gail. I’m not sure about some content, but that may be because I prefer numbers when working with this stuff.

Also, I tend to see debt going to infinity – and beyond 😉

There is diminishing returns with respect to investments. It is hard to borrow money without a profitable investment. This brings business debt to zero. There aren’t many workers without business investment.

The question then is how much government debt you can create. Japan has tried to stretch the limit on this. China has a different sort of system, so it can stretch the limits as well. The key to debt falling has to do with the profitability of investments. Can you see profitability increasing, as we increasingly battle diminishing returns (become less and less efficient)?

I *think* my point was that debt (and credit – in a fiat system these are two sides of the same coin – pardon the pun) does not have the same limitation as, in particular, crude oil. Hence if people are prepared to give you stuff for IOU’s (I Promise to Pay … )

the process can continue indefinitely.

Unfortunately, our Central Bankers are pretty much stamping around in a minefield trying to find the limits while not destroying their owners – the big banks. Of course, this is destroying things like pension funds and people on fixed interest income, and history suggests that when governments get more than 180% of GDP in debt, things fall apart.

So, yes, it doesn’t work, or more precisely, not for the oil industry or main street.

In order to get crude oil indefinitely for IOUs, you would need to pay exporters a high enough amount to pay for their oil, plus give them a margin for taxes so that they can pacify their people. This amount is likely at least $100 per barrel now. Over time, the IEA estimates (in its BAU scenario) that this price will rise to $300 per barrel. If you do pay theses amounts for oil, your own economy will suffer. There is no way you can provide enough benefit for both. The fact that the two economies are co-dependent causes the problem.

Yes, though I’d see the $300 per barrel figure happening only as part of a crisis. I think that between $300 and $100 per barrel, lots of alternatives come into play. The net effect of these is to transfer investment to less efficient energy production, and if that happens the economy produces fewer goods, a lower GDP, and that shows up as a reduced per capita productivity. BTW, this:

http://www.zerohedge.com/news/2016-05-04/us-worker-productivity-slumps-worst-rate-23-years

“Despite a very modest beat of expectations US worker productivity fell for the 2nd quarter in a row (down 1.0% vs 1.3% QoQ), the two-quarter-average output per hour isdown 1.4% – the worst slump since 1993. Unit labor costs rose by a better than expected 4.1% (helped by a downwardly revised 2.7% rise in Q4), the highest since Q4 2014.”

“With hindsight we know that finance did more harm than good so we can conservatively deduct finance from the GDP calculations and by doing so we essentially end up with no growth per capita at all over a timespan of more than 15 years! US real GDP per capita less contribution from finance increased by an annual average of 0.3 per cent from 2000 to 2015. From 2008 the annual average has been negative 0.5 per cent!”

And returning to the discussion, because there are fewer things to buy, the system may tend toward price inflation, instead of deflation, depending.

With the present price of oil struggling to get above $50, even the $100 per barrel figure looks like a stretch. I’d take that as a sign that alternatives are fast disappearing, if not already gone, though that depends, to some extent on the strength of the US $ vs other currencies.

Of course, it is “worker productivity,” not productivity enabled by capital goods made possible by fossil fuels.

I like #3 “a temporary false valuation of the benefit of energy products”. This applies at the largest scale without BAU oil and all the products of industrial life have little value.

I also love the concept of peak debt. Hard to exactly say when we are there as we can enter hyperinflation with notionally has higher debt but in real term has declining debt. We may be at peak debt today.

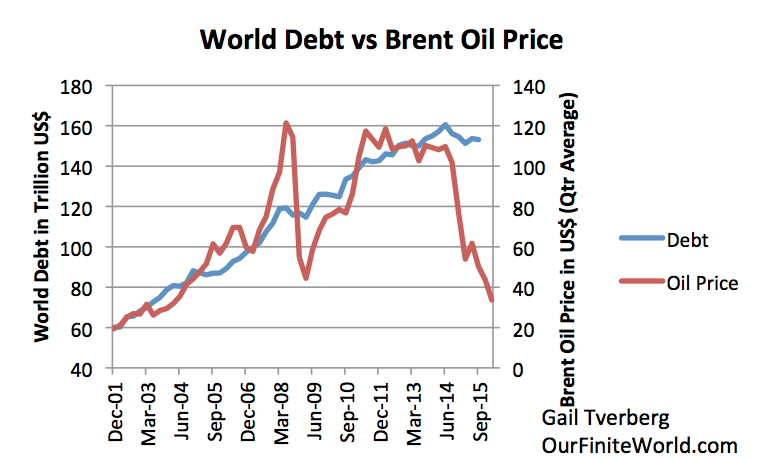

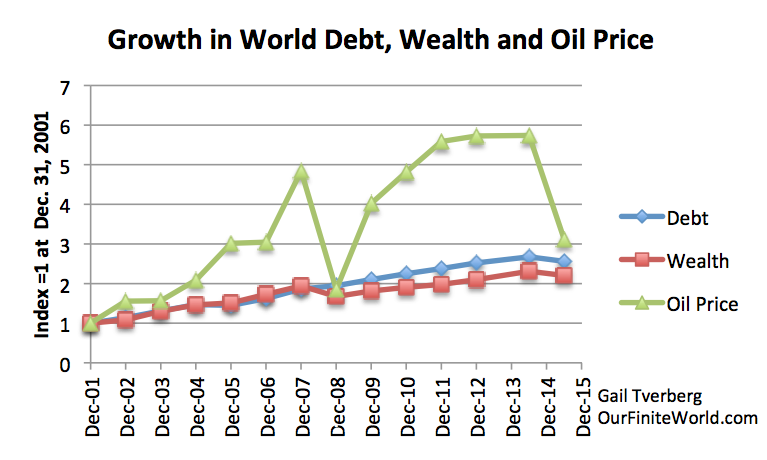

Peak world debt measured in dollars may have come at June 30, 2014, when commodity prices began to drop. In my post preceding the current one, I showed this image.

Note the drop in debt in US $ terms at precisely the time that oil prices turned downward. Of course, it is possible that more dollar debt will be issued by the US government, because no one has faith in the US dollar, but that would be different.

Economically, while it may pull consumption forward, I’m not convinced that government debt investing in energy grows the economy over the long term.

Government “investment” in bombs and bomb technology does little for anyone except the owners of bomb factories. Government investment in hydroelectric and sensible roads and ports does add future value.

Both the computer chip and the internet were funded or developed by the US Department of Defense.

Interguru and ed

roads and ports represent embodiment of energy, which then cannot be used again.

their function depends on constant inputs of still more energy—vehicles and ships etcthe internet and computer chip also require massive energy input to produce and keep functioning

the do not actually produce anything in themselves

Good points!

The US government (of some variety) aided in shale extraction research. I don’t remember the details. It may have been more eliminating antitrust rules, so that company scientists could work together on the project.

If a county can conquer another country, and expand its access to arable land and minerals, then the bombs can be viewed as a successful investment (less the case in a world with trade).

…and if a country is bombed back to the stone age it will be consuming less energy

Economic growth is short-lived, just as lives of humans are short-lived.

We have convinced ourselves that economies can grow forever, but an examination of history shows that an awfully lot have collapsed. The ones who have not collapsed are ones who were able to find a work-around, such as conquering new territory or discovering how to use fossil fuels for their own benefit. Physics seems to say that economies are dissipative structure, just as plants and animals, and hurricanes are. All start from small beginnings, dissipate energy over their lifetimes, and eventually collapse. This is a related post: https://ourfiniteworld.com/2016/02/08/the-physics-of-energy-and-the-economy/

“If you will hunt for food, I will gather plant food and care for the children.”

Is this really a promise among men and women? Men hunt because it gives them status to fell the largest deer and so on, and the best hunter might share his part among the tribe to show generosity, so that he can get a double status; a good hunter and a generous man with respect among the other tribe members. Women tend to flock around the men with status. So you can just as much say that men hunt for status and not for the food itself.

Men are too better to capture motion and to orient themselves in difficult terrain. Women have better color vision because they like to gather plants together with other women while talking gossip, discussing which man they think is the best hunter and so on.

An academic paper by Michael Guren and Kim Hill gives these reasons for the division of labor:

“Finally, successful hunting requires at least 15–20 years of experience to obtain maximum return rates.”

Yes, that’s why women often prefer older men. Then they laid down bigger and more game, now older men often have thicker pocket books. And an older and more experienced hunter has more status, giving the young women better security.

Men with high socioeconomically status often remarry when their original woman is not fertile anymore. Serial polygamy is significantly rising in Norway. This is too much because more women than men enter university now, and they want a husband with a matching status to their degree.

I discovered that in China, the “one child” policy is (or was) per woman. I met several men who had divorced their first wives and moved on to a second, younger wife.

Dear Eyvind Holmstad;

Sorry, you got that entirely wrong. Women, when given the opportunity hunt, run the tribe/country, and so on.

“WOUNDS FROM A BATTLE-AXE IN THE SKULL AND A bent bronze arrowhead embedded in the knee. Obviously this warrior had died in battle. Two iron lances were plunged into the ground at the grave’s entrance and two more spears lay beside the skeleton inside. A massive armored leather belt with iron plaques lay next to a quiver and twenty bronze-tipped arrows with red-striped wooden shafts. Other grave goods included glass beads, pearls, bracelets of silver and bronze, a bronze mirror, a lead spindle-whorl, a needle, an iron knife, and a wooden tray of food. A typical Scythian warrior’s grave of the fourth century BC. Except that this particular warrior was a young woman.”

Mayor, Adrienne (2014-09-22). The Amazons: Lives and Legends of Warrior Women across the Ancient World (p. 63). Princeton University Press. Kindle Edition.

Sincerely,

Pintada

A few women with stronger male characteristics might do so. While some males have a more female character. Exceptions confirming the rule.

NATO vs. Russia, explained in one picture…

https://pbs.twimg.com/media/Cf3CePHXIAApFHm.jpg

psile, wonderful.

Viking shield-maidens having a break for coffee and a chat?

I suggest the Russian chap should try to break out of the stereotype he’s fallen into. This is the 21st century after all!

Maybe he should join the NATO mothers club instead? He could be Mrs Nesbitt?

http://i.imgur.com/q7dZu5I.gif

This should be settled in a civilized matter. Those five in the mud wrestling cage.

A defensive operation:

“Obama Requests Military Support for Possible War Against Russia”

The Nobel Peace Prize winner

http://russia-insider.com/sites/insider/files/encirclement_0_3.jpg

http://russia-insider.com/en/obama-requests-military-support-possible-war-against-russia/ri14043

If the Neocons are crazy enough to start a global thermonuclear war then that’s what will happen. But then again crazed neocon Bill Crystal has gone on record saying: “what good are nuclear weapons if you don’t use them.”

There is no indication there war is intended. Rather it appears to be increased defensive measures. And Russia is not encircled as the article describes. German forces in WWII in Stalingrad – that was encirclement.

Rather strange!

S-500 operational this year. If its any good as deployment numbers build the monopoly on space and all of the extreme military advantages that monopoly provides ends. Draw your own conclusions.

Pingback: Debt: The Key Factor Connecting Energy & The Economy

Pingback: Debt: The Key Factor Connecting Energy & The Economy | Political American

Bring back the big bills https://en.wikipedia.org/wiki/Large_denominations_of_United_States_currency

Gets rid of problems like this.

The largest bill is now $100. This is equivalent to $10 in 1948 according to the CPI inflation indicator. .

As time goes on, I doubt ( barring runaway inflation ), the US will print larger bills, so the $100 will become less and less.

During the Iraq war, the US airlifted $12 billion of $100 bills, which a weighed in at 363 tons. This shows that cash is no longer useful for large transactions already.

As a side note: most of it was untracked, and melted away. I know of a distant relative who worded as contractor and returned home to Turkey with suitcases full of cash.

Pingback: Debt: The Key Factor Connecting Energy & The Economy | Since 1998 Hitrust.net = Privacy and Protection

Gail –

I cannot agree with your thesis, as you state:

“The situation we are facing today is one in which growing debt has been holding up oil prices and other commodity prices for a long time. We are now reaching limits on this process, as evidenced by growing wealth disparity, low commodity prices, and the frantic actions of governments leaders around the world regarding slow economic growth and the need for more stimulus.”

You may not have heard of Joseph Tainter’s work on Complex Societies, but I find his thesis to resonate more strongly with me than your correlation of energy and debt.. In “The Collapse of Complex Societies”, Tainter wrote:

++++++++++++++++++++++++++++++++++++++++++++

Sociopolitical organizations constantly encounter problems that require increased investment merely to preserve the status quo. This investment comes in such forms as increasing size of bureaucracies, increasing specialization of bureaucracies, cumulative organizational solutions, increasing costs of legitimizing activities, and increasing costs of internal control and external defense. All of these must be borne by levying greater costs on the support population, often to no increased advantage. As the number and costliness of organizational investments increases, the proportion of a society’s budget available for investment in future economic growth must decline.

Thus, while initial investment by a society in growing complexity may be a rational solution to perceived needs, that happy state of affairs cannot last. As the least costly extractive, economic, information-processing, and organizational solutions are progressively exhausted, any further need for increased complexity must be met by more costly responses. As the cost of organizational solutions grows, the point is reached at which continued investment in complexity does not give a proportionate yield, and the marginal return begins to decline. The added benefits per unit of investment start to drop. Ever greater increments of investment yield ever smaller increments of return.

A society that has reached this point cannot simply rest on its accomplishments, that is, attempt to maintain its marginal return at the status quo, without further deterioration. Complexity is a problem-solving strategy. The problems with which the universe can confront any society are, for practical purposes, infinite in number and endless in variety. As stresses necessarily arise, new organizational and economic solutions must be developed, typically at increasing cost and declining marginal return. The marginal return on investment accordingly deteriorates, at first gradually, then with accelerated force. At this point, a complex society reaches the place where it becomes increasingly vulnerable to collapse.

Two general factors can make such a society liable to collapse. First, as the marginal returns on investment in complexity declines, a society invests ever more heavily in a strategy that yields proportionately less. Excess productive capacity and accumulated surpluses may be allocated to current operating needs. When major stress surges (major adversities) arise there is little or no reserve with which they may be countered. Stress surges must be dealt with out of the current operating budget. This often proves ineffectual. Where it does not, the society may be economically weakened and made more vulnerable to the next crisis.

Once a complex society enters a stage of declining marginal returns, collapse becomes a mathematical likelihood, requiring little more than sufficient passage of time to make probable an insurmountable calamity. So if Rome had not been toppled by Germanic tribes, it would have been later by Arabs or Mongols or Turks. A calamity that proves disastrous to an older, established society might have been survivable when the marginal return on investment in complexity was growing. . . .

Secondly, declining marginal returns make complexity an overall less attractive strategy, so that parts of a society perceive increasing advantage to a policy of separation or disintegration. When the marginal cost of investment in complexity becomes noticeably too high, various segments increase passive or active resistance, or overtly attempt to break away. The insurrections of the Bagaudae in late Roman Gaul are a case in point.

At some point along the declining portion of a marginal return curve, a society reaches a state where the benefits available for a level of investment are no higher than those available for some lower level. Complexity at such a point is decidedly disadvantageous, and the society is in serious danger of collapse from decomposition or external threat.

– Tainter, The Collapse of Complex Societies, p. 195/196.

++++++++++++++++++++++++++++++++++++++

What you are attempting to describe is Western Civilization’s looming collapse, from declining marginal returns on investment in complexity.

Thanks for posting.

Jim, the overall debt-nexus Gail describes is very much part of the complexity as per Tainter. I think it is quite clear from her latest article as well (paragraph on nature of debt), perhaps you might persuade her to write it more explicitly next time..

None of what you quoted contradicts Gail. It is simply a different level of analysis.

You will notice that my link under “more complex society” is to the book “The Collapse of Complex Societies,” by Joseph Tainter.

I know Joseph Tainter reasonably well. We spent nearly a week together in Barcelona, when Charlie Hall, Joseph Tainter, and I were all speaking at conference there in 2010. This is a photo I took of him.

Oklahoma-based Midstates Petroleum Company and Texas based Ultra Petroleum have now filed for bankruptcy, citing combined debts of more than US$5.8 billion blamed on a long run of low commodity prices that have led to irreparable financial damage.

… … …

Since early last year, some 70 North American oil and gas companies

have filed for bankruptcy. The numbers aren’t stark: They only account

for about 1 percent of U.S. output, but there are fears the trend could

pick up pace.

According to a recent Deloitte analysis, which examined 500 oil and natural gas exploration and production companies worldwide, 175 of the companies (or around 35 percent) were at high risk of going bankrupt. Together, these companies have more than $150 billion in debt. The report added that the situation is “precarious” for 50 of these companies due to negative equity or leverage ratio above 100.

One view of the situation is that the oil company debt isn’t very much, and it is well spread out, with insurance companies and pension plans holding some of it. Of course, as this article points out, there is a lot more waiting in the wings. There are a lot of other kinds of debt that are defaulting as well–Puerto Rico comes to mind, as do countries with debt in dollars whose currency has dropped. There are also the many Eurozone problems.

Debt figured in pre-fossil-fuel economies such as the Hebrew bible, Rome and renaissance Italy. What was it role then.