Does it make a difference if our models of energy and the economy are overly simple? I would argue that it depends on what we plan to use the models for. If all we want to do is determine approximately how many years in the future energy supplies will turn down, then a simple model is perfectly sufficient. But if we want to determine how we might change the current economy to make it hold up better against the forces it is facing, we need a more complex model that explains the economy’s real problems as we reach limits. We need a model that tells the correct shape of the curve, as well as the approximate timing. I suggest reading my recent post regarding complexity and its effects as background for this post.

The common lay interpretation of simple models is that running out of energy supplies can be expected to be our overwhelming problem in the future. A more complete model suggests that our problems as we approach limits are likely to be quite different: growing wealth disparity, inability to maintain complex infrastructure, and growing debt problems. Energy supplies that look easy to extract will not, in fact, be available because prices will not rise high enough. These problems can be expected to change the shape of the curve of future energy consumption to one with a fairly fast decline, such as the Seneca Cliff.

Figure 1. Seneca Cliff by Ugo Bardi. This curve is based on writings in the 1st century C.E. by Lucius Anneaus Seneca, “It would be of some consolation for the feebleness of our selves and our works if all things should perish as slowly as they come into being; but as it is, increases are of sluggish growth, but the way to ruin is rapid.”

It is not intuitive, but complexity-related issues create a situation in which economies need to grow, or they will collapse. See my post, The Physics of Energy and the Economy. The popular idea that we extract 50% of a resource before peak, and 50% after peak will be found not to be true–much of the second 50% will stay in the ground.

Some readers may be interested in a new article that I assisted in writing, relating to the role that price plays in the quantity of oil extracted. The article is called, “An oil production forecast for China considering economic limits.” This article has been published by the academic journal Energy, and is available as a free download for 50 days.

A Simple Model Works If All We Are Trying to Do Is Make a Rough Estimate of the Date of the Downturn

Are we like the team that Dennis Meadows headed up in the early 1970s, simply trying to make a ballpark estimate of when natural resource limits are going to become a severe problem? (This analysis is the basis of the 1972 book, Limits to Growth.) Or are we like M. King Hubbert, back in 1956, trying to warn citizens about energy problems in the fairly distant future? In the case of Hubbert and Meadows, all that was needed was a fairly simple model, telling roughly when the problem might hit, but not necessarily in what way.

I have criticized Hubbert’s model for being deficient in some major respects: leaving out complexity, leaving out entropy, and assuming a nearly unlimited supply of an alternate fuel. Perhaps these issues were not important, however, if all he was trying to do was warn people of a distant future issue.

Figure 2. Slide 29 from my complexity presentation at the 2016 Biophysical Economics Conference. Hubbert’s model omitted complexity, entropy.

The model underlying the 1972 book, Limits to Growth, was also quite simple. Ugo Bardi has used this image by Magne Myrtveit to represent how the 1972 Limits to Growth model worked. It does not include a financial system or debt.

Figure 3. Image by Magne Myrtveit to summarize the main elements of the world model for Limits to Growth.

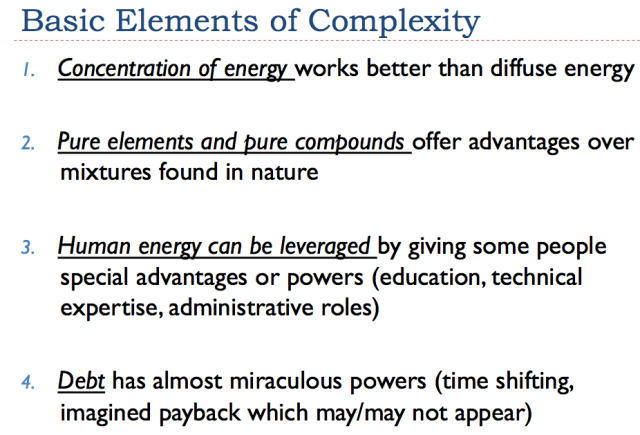

As such, this model does not reflect the major elements of complexity, which I summarized as follows in a recent post:

Figure 4. Slide 7 from my recent complexity presentation. Basic Elements of Complexity

Thus, the model does not forecast the problems that can be expected to occur with increasingly hierarchical behavior, including the problems that people who are at the bottom of the hierarchy can be expected to have getting enough resources for basic functions of life. These issues are important, because people at the bottom of the hierarchy are very numerous. They need to be fed, clothed, housed, and have transportation to work. All of these things take natural resources, including energy products. If the benefit of available natural resources doesn’t make it all of the way down to the bottom of the hierarchy, death rates spike. This is one of the forces that can be expected to change the shape of the curve.

Figure 5. Slide 17 from my complexity presentation. People at the bottom of a hierarchy are most vulnerable.

Dennis Meadows does not claim that the model that his group put together will show anything useful about the “shape” of the collapse. In fact, in an article about a year ago, I cut off part of the well-known Limits to Growth forecast to eliminate the part that is likely not particularly helpful–it just shows what their simple model indicates.

Figure 6. Limits to Growth forecast, truncated shortly after production turns down, since modeled amounts are unreliable after that date.

Anthropologist Joseph Tainter’s View of Collapse

If we read what anthropologist Joseph Tainter says in his book, the Collapse of Complex Societies, we find that he doesn’t consider “running out” to be the cause of collapse. Instead, he sees growing complexity to be what leads an economy to collapse. These are two of the points Tainter makes regarding complexity:

- Increased complexity carries with it increased energy costs per capita. In other words, increased complexity is itself a user of energy, and thus tends to drain away energy availability from other uses. Thus, in my opinion, complexity will make the system fail more quickly than the Hubbert model would suggest–the complexity part of the system will use part of the energy that the Hubbert model assumes will be available to fund the slow down slope of the economy.

- Increased investment in complexity tends to reach declining marginal returns. For example, the first expressway added to a highway system adds more value than the 1000th one. Eventually, if countries are trying to create economic growth where little exists, governments may use debt to fund the building of expressways with practically no expected users, simply to add job opportunities.

Ugo Bardi quotes Joseph Tainter as saying,

“In ancient societies that I studied, for example the Roman Empire, the great problem that these economies faced was that they eventually would incur very high costs just to maintain the status quo. They would need to invest very high amounts to solve problems that didn’t yield a net positive return; instead these investments simply allowed the economies to maintain the level that they were at. This increasing cost of maintaining the status quo decreased the net benefit of being a complex society.”

View of Collapse Based on a Modeling Approach

In the book Secular Cycles, Peter Turchin and Surgey Nefedov approach the problem of what causes civilizations to collapse using a modeling approach. According to their analysis, the kinds of things that caused civilizations to collapse very much corresponded to the symptoms of increasing complexity:

- Problems tended to develop when the population in an area outgrew its resource base–either the population rose too high, or the resources become degraded, or both. The leaders would adopt a plan, which we might consider adding “complexity,” to solve the problems. Such a plan might include raising taxes to be able to afford a bigger army, and using that army to invade another territory. Or it might involve a plan to build irrigation, so that the current land becomes more productive. A modern approach might be to increase tourism, so that the wealth obtained from tourists can be traded for needed resources such as food.

- According to Turchin and Nefedov, one problem that arises with the adoption of the new plan is increased wealth disparity. More leaders are needed for the new complex solutions. At the same time, it becomes more difficult for those at the bottom of the hierarchy (such as new workers) to obtain adequate wages. Part of the problem is the underlying problem of too many people for the resources. Thus, for example, there is little need for new farmers, because there are already as many farmers as the land can accommodate. Another part of the problem is that an increasing share of the output of the economy is taken by people in the upper levels of the hierarchy, leaving little for low-ranking workers.

- Food and other commodity prices may temporarily spike, but there is a limit to what workers can pay. Workers can only afford more, if they take on more debt.

- Debt levels tend to rise, both because of the failing ability of workers to pay for their basic needs, and because governments need funding for their major projects.

- Systems tend to collapse because governments cannot tax the workers sufficiently to meet their expanded needs. Also, low-ranking workers become susceptible to epidemics because they cannot obtain adequate nutrition with low wages and high taxes.

How Do We Fix an Overly Simple Model?

The image shown in Figure 3 in some sense shows only one “layer” of our problem. There is also a financial layer to the system, which includes both debt levels and price levels. There are also some refinements needed to the system regarding who gets the benefit of energy products: Is it the elite of the system, or is it the non-elite workers? If the economy is not growing very quickly, one major problem is that the workers at the bottom of the hierarchy tend to get squeezed out.

Figure 7. Author’s depiction of changes to non-elite workers’ share of the output of economy, as costs for other portions of the economy keep rising. The relative sizes of the various elements may not be correct; the purpose of this chart is to show a general idea, not actual amounts.

Briefly, we have several dynamics at work, pushing the economy toward collapse, rather than the resources simply “running out”:

- Debt tends to rise much faster than GDP, especially as increasing quantities of capital goods are added. Added debt tends to reach diminishing returns. As a result, it becomes increasingly difficult to repay debt with interest, creating a major problem for the financial system.

- The cost of resource extraction tends to rise because of diminishing returns. Wages, especially of non-elite workers, do not rise nearly as quickly. These workers cannot afford to buy nearly as many homes, cars, motorcycles, and other consumer goods. Without this demand for consumer goods made with natural resources, prices of many commodities are likely to fall below the cost of production. Or prices may rise, and then fall back, causing serious debt default problems for commodity producers.

- Because of growing complexity of the system, the “overhead” of the system (including educational costs, medical costs, the wages of managers, the cost of government programs, and the cost of resource extraction) tends to increase, leaving less for wages for the many non-elite workers of the world. With lower wages, the non-elite workers can afford less. This dynamic tends to push the system toward collapse as well.

The following is a list of variables that might be added to the overly simple model.

- Debt. As capital goods are added to work around resource shortages, debt levels will tend to rise quickly, because workers need to be paid before the benefit of capital goods can be obtained. Debt levels also rise for other reasons, such as government spending without corresponding tax revenue, and funding of purchases deemed to have lasting value, such as college educations and investments in research and development.

- Interest rates are the major approach that politicians have at their disposal to try to influence debt levels. In general, the lower the interest rate, the cheaper it is to buy cars, homes, and factories on credit. Thus, the amount of debt can be expected to rise as politicians lower interest rates.

- Wages of non-elite workers. Non-elite workers play a dual role: (a) they are the primary creators of the goods and services of the system, and (b) they are the primary buyers of the goods that are made using commodities, such as food, clothing, homes, and transportation services. Thus, their wages tend to determine whether the economy can grow. In general, we would expect wages of workers to rise, if their wages are being supplemented by more and more fossil fuel energy in the form of bigger and better machinery to help the workers produce more goods and services. If the wages of non-elite workers fall too low, we would expect the economy to slow, and commodity prices to fall. To some extent, rising debt (through manipulation of interest rates, or through government spending in excess of tax revenue) can be used to supplement the wages of non-elite workers to allow the economy to continue to grow, even if wages are stagnating.

- The affordable price level for commodities in the aggregate depends primarily on the wage level of non-elite workers and debt levels. A particular commodity may increase in price, but in the aggregate, the total “package” of costs represented by commodity prices must remain affordable, considering wage and debt levels of workers. If wage levels of non-elite workers are rising, the overall affordable price level of commodities will tend to rise. But if wage levels of non-elite workers are falling, or if debt levels are falling, affordable price levels are likely to fall.

- The required price level for commodity production in the aggregate to continue to grow at the previous rate. This required price level will depend on many considerations, including: (a) the rising cost of extraction, considering the impacts of depletion, (b) wage levels, (c) tax requirements, and (d) other needs, including payment of interest and dividends, and required funding for new development. Clearly, if the affordable price level falls below the required price level for very long, we can eventually expect total commodity production to start falling, and the economy to contract.

- The energy needs of the “overhead” of the system. Increasing complexity tends to make the overhead of the system grow much faster than the system as a whole. Energy products of various kinds are needed to support this growing overhead, leaving less for other purposes, such as to increasingly leverage the labor of human workers. Some examples of growing overhead of the system include energy needed (a) to maintain the electric grid, internet, roads, and pipeline systems; (b) to fight growing pollution problems; (c) to support education, healthcare, and financial systems needed to maintain an increasingly complex society; (d) to meet government promises for pensions and unemployment insurance; and (e) to cover the rising energy cost of extracting energy products, water, and metals.

- Available energy supply based on momentum and previous price levels. A few examples explain this issue. If a large oil project was started ten years ago, it likely will be completed, whether or not the oil is needed now. Oil exporters will continue to pump oil, as long as the price available in the marketplace is above their cost of production, because their governments need at least some tax revenue to keep their economies from collapsing. Wind turbines and solar panels that have been built will continue to produce electricity at irregular intervals, whether or not the electric grid actually needs this electricity. Renewable energy mandates will continue to add more wind turbines and solar panels to the electric grid, whether or not this electricity is needed.

- Energy that can actually be added to the system, based on what workers can afford, considering wages and debt levels [demand based energy]. Because matching of supply and demand takes place on a short-term basis (minute by minute for electricity), in theory we need a matrix of quantities of commodities of various types that can be purchased at various price levels for short time-periods, given actual wage and debt levels. For example, if more electricity is dumped on the electric grid than is needed, how much impact will a drop in prices have on the quantity of electricity that consumers are willing to buy? The intersections of supply and demand “curves” will determine both the price and quantity of energy added to the system.

The output of the model would be three different estimates of whether we are reaching collapse:

- An analysis of whether repayment of debt with interest is reaching limits.

- An analysis of whether affordable commodity prices are falling below the level needed for commodity consumption to grow, likely leading to falling future commodity production.

- An analysis of whether net energy per capita is falling. This would reflect a calculation of the following amount over time:

If net energy per capita is falling, the ability to leverage human labor is falling as well. Thus productivity of human workers is likely to stop growing, or perhaps decline. The total amount of goods and services produced is likely to plateau or fall, leading to stagnating or declining economic growth.

If net energy per capita is falling, the ability to leverage human labor is falling as well. Thus productivity of human workers is likely to stop growing, or perhaps decline. The total amount of goods and services produced is likely to plateau or fall, leading to stagnating or declining economic growth.

The important thing about the added pieces to this model is that they emphasize the one-way nature of the system. The economy needs to grow, or it collapses. The price of energy products cannot rise much at all, because wages of workers don’t rise correspondingly. This means that any energy substitute must be very cheap. The system needs to keep adding debt, especially when capital goods are added. The benefit of this debt reaches diminishing returns. The combination of these diminishing returns with respect to investments made with debt, and the interest that needs to be paid on debt, means that it is very difficult for energy products based on capital goods to “save” the system.

Complexity Adds Unforeseen Problems

One issue that people working solely in the energy sector may not notice is that our current system for setting market-based electricity prices is not working very well, with the addition of feed-in tariffs and other subsidy programs. There is evidence that subsidizing renewable electricity tends to lead to falling wholesale electricity prices. In a sense, if we subsidize electricity prices for one type of electricity producer, we find it also necessary to subsidize electricity prices for other types of electricity producers. (Also in California.)

Figure 8. Residential Electricity Prices in Europe, together with Germany spot wholesale price, from http://pfbach.dk/firma_pfb/references/pfb_towards_50_pct_wind_in_denmark_2016_03_30.pdf

Inadequate prices for electricity producers and a need for ever-rising subsidies for electricity production could, by themselves, cause the system to fail. In a sense, this pricing problem is a complexity-related outcome that economists have overlooked. Their models are also too simple!

Conclusion

It is easy to rely on too-simple models. Perhaps the biggest issue that is missed is that energy prices can’t rise endlessly. Because of this, a large share of natural resources, including oil and other energy products, will be left in the ground. Furthermore, because prices do not rise very high, energy products that are expensive to produce can’t be expected to work, either, no matter how they are disguised. Substitutes that cannot be inexpensively integrated into the electric grid are not likely to work either.

I talked about low-ranking workers being a vulnerable part of the system. It is clear from Joseph Tainter’s comments that another vulnerable part of our current system is the various “connectors” that allow us to have our modern economy. These include the electric grid, roads and bridges, the pipeline systems, the water and sewer systems, the internet, the financial system, and the international trade system. Even government organizations such as the Eurozone might be considered vulnerable connecting systems. The energy cost of maintaining these systems can be expected to continue to rise. Rising costs for these systems are part of what makes it difficult to maintain our current economic system.

The focus on “running out” has led to a focus on finding ways to extend our energy supply with small quantities of high-priced alternatives. This approach doesn’t really get us very far. What we need to keep the economy from collapsing is a growing supply of cheap-to-produce energy and other natural resources. Ideally, these new resources should require little debt, and not cause pollution problems. These requirements are exceedingly difficult to meet in a finite world.

Pingback: An Updated Version of the 'Peak Oil' Story | Energy News

Pingback: Misunderstanding The Real Problem: An Updated Version Of The "Peak Oil" Story - U Do News

Pingback: An Updated Version of the 'Peak Oil' Story | Energy Traders

Pingback: Misunderstanding The Real Problem: An Updated Version Of The "Peak Oil" Story - BuzzFAQs

Pingback: Misunderstanding The Real Problem: An Updated Version Of The “Peak Oil” Story | Political American

Pingback: Misunderstanding The Real Problem: An Updated Version Of The "Peak Oil" Story | ValuBit

Pingback: Misunderstanding The Real Problem: An Updated Version Of The "Peak Oil" Story | Earths Final Countdown

Pingback: An Updated Version of the “Peak Oil” Story | Achaques e Remoques

Pingback: An Updated Version of the “Peak Oil” Story | Energy Traders

Oslo: 2016 January – June average = NOK 65200 = $ 7376 pr m2 – what gives?

Pingback: An Updated Version of the “Peak Oil” Story | Our Finite World

Ali Morteza Samsam Bakhtiari- peak oil theorist from Iran- was a well known commentator on peak oil for several years before his death in 2007.

“Bakhtiari (1946 – October 2007) was a senior expert employed by the National Iranian Oil Company (NIOC). He held a number of senior positions with this organisation since 1971. He was also an advisor to the Oil Depletion Analysis Centre.

He held a PhD in chemical engineering from the Swiss Federal Institute of Technology in Zurich, Switzerland. He had been a part-time lecturer for the Technical Faculty at Tehran University for many years. Bakhtiari wrote a number of short essays and is the author of Peaks and Troughs which is about the modern history of Iran.”

“Dr Bakhtiari suggested that it would require an act of god for the world to avoid warring over depleting energy resources. He also believed that a peak in natural gas would be more shocking than peak oil because natural gas is less fluid and requires pipelines and LNG facilities to export overseas.”

http://peakenergy.blogspot.com/2007/11/rip-ali-samsam-bakhtiari.html

I found that most interesting part of Dr. Bakhtiari’s work was his theory of peak oil transitions- T1, T2, T3, T4. In Bakhtiari’s scheme, peak oil would begin gently with the T1 transition and proceed to steepen in intensity into the catastrophic T4 transition where oil goes into serious collapse. Now, the timing of these transtions is not rigidly defined. Here are the transitions-

“The four Transition periods (T1, T2, T3, and T4) will roughly span the 2006-2020 era. Each Transition [will] cover, on average, three to four years.

The major palpable difference between the four Ts is their respective gradient of oil output decline — very small for T1, perceptible for T2, remarkable in T3, and rather steep for T4. In fact, this gradation in decline is a genuine blessing for those having to cope and adapt.

It should be borne in mind that these four Ts are only an overall theoretical structure for future global oil output. The structure is thus so orderly because [it is] predicted with ‘Pre-Peak’ methods, ‘Pre-Peak’ assumptions, and [a] ‘Pre-Peak’ set of rules.

The problem is that we now are in ‘Post-Peak’ mode, and that none of [the] above applies anymore.

The fact of being in ‘Post-Peak’ will bring about explosive disruptions we know little about, and which are extremely difficult to foresee. And the shock waves from these explosions rippling throughout the financial and industrial infrastructure could have myriad unintended consequences for which we have no precedent and little experience.

So the only Transition we can see rather clearly (or rather, we hope to be able to comprehend) is T1. It is clear that T1 will witness the tilting of the ‘Oil Demand’ and ‘Oil Supply’ scales — with the former dominant at the onset and the latter commanding toward the close (say, by 2009 or 2010).

But even during that rather benign T1, the unexpected might become the rule and the orderly ‘Pre-Peak’ rapidly give way to some chaotic ‘Post-Peak.’

In any instance, the overall structure of the ‘Four Transitions’ is a general guideline for the next 14 years or so — as far as global oil output is concerned. In practice, reality might prove to be worse than these theoretical Transitions; but certainly not better. ”

http://www2.energybulletin.net/node/19701

Still worth reading his stuff……………………

Currently in Slovakia: the court trial with the father who disconnected his son from artificial ventilation is going on.

The father who disconnected his son from medical devices: The mega trial was the care for him

(the article in Slovak)

http://presov.korzar.sme.sk/c/20235399/otec-ktory-syna-odpojil-od-pristrojov-mega-proces-bola-starostlivost-onho.html?ref=trz

Landscape looks good, in summer at least

https://www.rt.com/business/355067-russia-far-east-mortgage/

Erdogan is now a friend of Putin, but not of Al-Assad… What could he have in mind?

https://www.rt.com/news/354990-erdogan-turkey-russia-relations/

(RT says nothing about Erdogan’s view of Al-Assad, I got it from Le Monde, in french)

More doom and gloom setting into the Sydney property bubble. It finally seems poised to *pop*. I work with a lot of builders in my job and found this on my LinkedIn newsfeed this morning. Chinese buyers have been one of the major planks underpinning the crazy rise in prices seen during the past few years:

“The unthinkable has started to happen. The mass of Chinese property buyers who snapped up Australian apartments “off the plan” on the basis of a 10 per cent deposit have started to walk away from their agreements in Sydney.

Sydney’s largest apartment owner and developer Harry Triguboff has confirmed that this is happening and that by rescinding the contracts the Chinese lose their deposit and the agents must return the commissions.”

https://image-store.slidesharecdn.com/0a79f8c7-77e5-4f0d-8a8d-a84a2c9ccdf4-original.jpeg

Speaking of Energy Sources, Albert Bates resurrected one of his posts on Geothermal.

http://peaksurfer.blogspot.com/2016/08/hot-rockin.html

RE

https://oilprice.com/images/tinymce/Evan1/ada2407.jpg

These numbers are not precise but anyway…

The U.S drilled 35 000 wells in 2014. Each well cost $10 million to drill, complete and bring on line.

So it cost $350 billion to drill these wells.

The U.S produced 10 mbpd in 2014 or about 3,5 billion barrels in a year. The oil price was $100 per barrel.

The oil produced in 2014 was worth $350 billion.

So it cost just as much to just drill those wells are those wells produced.

The cost for Saudi Arabia on the other hand to drill 400 wells was only about $1 per barrel.

The cost for Russia to drill 8000 wells was $20 per barrel.

That is of course if it costs Saudi Arabia and Russia $10 million to drill a well.

So, Yoshua. What do you want us to conclude from this information?

Rig count is mainly used as a general reference to the state of the industry. For instance, if you were a geophycial contractor in the Wiliston Basin and you wanted to assess your business outlook for the next year or so- you might say-

“Holy Moly, the Williston Basin rig count has dropped from 200 working rigs down to 90 working rigs in the last 18 months. We need to cut costs and try to survive the downturn.

or

“Holy Moly, the Willston Basin rig count has gone from 175 working rigs up to 200 working rigs in the last 6 months. We need to step up hiring and get another team together to keep up with the expected work.”

I just read that the U.S has 1.7 million wells in service for the oil and gas industry. The oil and gas industry is working very hard to produce oil and gas.

I also read that the giant Ghawar oil field in Saudi Arabia had 3000 wells in operation in 2012 and produced half of Saudi Arabia’s oil production. So Saudi Arabia might have 10.000 wells in operation today 2016.

The oil depletion rate in the U.S seems to be very high and the cost of production seems to be very high as well. With oil prices now down at $40 per barrel the oil industry in the U.S seems to struggling to survive.

If this continues…

“So, Yoshua. What do you want us to conclude from this information?”

It means we’re scraping the bottom of the barrel…

My point was that the rig count is mainly used a general indicator of activity in the oil & gas industry. Oil & gas drillers use the changing rig count numbers to get a feel for current and upcoming business conditions. It may affect business decisions for the driller ie should we put in an order for a new rig this year?

It’s just hard to draw a lot of sophisticated conclusions based on rig count numbers.

The council which banned sleeping

http://www.politics.co.uk/rwd-full-photos/unless-you-re-homeless-or-a-vulnerable-adult.21399349.jpg

“Something strange is happening in Gravesend town centre.

Fancy a lie-down in Woodlands Park during one of these balmy summer afternoons? Think again – it’s now a crime to lie down. Tired driver thinking of pulling over for a nap in your car? Better just to plough on – it could land you in court.

Unless you’re “homeless or a vulnerable adult”, you are banned from sleeping in any of the town’s open spaces – as well as in any vehicle, caravan or tent. (snip)

Kettering Borough Council has slapped a curfew on under-18s, who must now be home by 11pm or risk receiving fines or a criminal record. Bassetlaw District Council has banned under-16s from gathering in groups of three or more if they’re “causing annoyance”, unless a responsible adult is present. The council has defined neither “annoyance” nor “responsible” – so it’s impossible to know whether you’re at risk of offending or not. (snip)

The London Borough of Hillingdon has gone several steps further by criminalising the gathering of just two people – regardless of age – unless they’re waiting for the bus. This means it is now an offence in Hillingdon to meet up with anyone, whether you’re causing annoyance or not. (snip)”

Clearly overpopulation has driven the British stark raving bonkers, just like the rat lab experiments of the 70’s which documented deviant anti-social behaviour in overcrowded rat nests. Needless to say for the rats, after the madness, came the die-off.

I would add that one has to experience the truly vile anti-social behaviour of the English non-working class to appreciate what these measures are trying to address. Lots of fake ‘beggars, often demanding money with menaces (my favourite experience was of a thug demanding money, swearing, with a Bible in his hand!)

But otherwise, yes, over-crowding is driving everyone nuts in Britain!

well at least he didn’t have a gun in his hand

Latest Collapse Update LIVE with RE & Steve from Virginia

https://www.youtube.com/watch?v=gPfTFamqeJg

RE

“Afghanistan may hold 60 million tons of copper, 2.2 billion tons of iron ore, 1.4 million tons of rare earth elements such as lanthanum, cerium and neodymium, and lodes of aluminum, gold, silver, zinc, mercury and lithium. For instance, the Khanneshin carbonatite deposit in Afghanistan’s Helmand province is valued at $89 billion, full as it is with rare earth elements.

“Afghanistan is a country that is very, very rich in mineral resources,” Jack Medlin, a geologist and program manager of the U.S. Geological Survey’s Afghanistan project, told Live Science. “We’ve identified the potential for at least 24 world-class mineral deposits.” The scientists’ work was detailed in the Aug. 15 issue of the journal Science.”

http://www.livescience.com/47682-rare-earth-minerals-found-under-afghanistan.html

correct me if I’m wrong, but Afghanistan appears to be a warlord state. Helmand being the most lethal province.

Warlords are not the best folks to do business with long term, in the sense of investing $billions before material is extracted, then naively expecting aforementioned warlords to let you walk off with all the materials necessary to sustain an infidel economy, once those investments begin to pay off.

In addition to which, all those rare earths and such are useless without the necessary energy sources A) to extract them, and B) to make use of them in any end products

The war plotters in DC know that if the US military leaves Afghanistan, the Chinese and Russians are ready to consolidate economic and military power in the very heart of the Eurasian continent.

Let the Great Game Version2 begin….

dunno about the chinese, but i doubt if the russkis would want to get their fingers burnt there again

“China is fast seizing a substantial share of Afghanistan’s natural resources with the China Metallurgical Group Corp., Jiangxi Copper Corporation, and Zijin Mining Group Company winning a joint bid worth $3.5 billion meant to develop what’s touted to be the largest undeveloped copper field in the world.”

“Moreover, Afghanistan is home to large iron ore deposits stretching across Herat and the Panjsher Valley, and gold reserves in the northern provinces of Badakshan, Takhar and Ghazni. Employment opportunities for the Afghans has received a boost with the Chinese investment projects by virtue of electricity-generation projects for mining and extractions and a freight railroad passing from western China through Tajikistan and Afghanistan to Pakistan.”

http://www.sunday-guardian.com/analysis/china-is-expanding-its-footprint-in-afghanistan

“More than two decades after the Soviet withdrawal from Afghanistan, Moscow is once again seeking to play a major role in the country by boosting military and economic cooperation with Kabul. DW examines. ”

” after Russia’s relations with the West soured following the Ukraine conflict, Moscow decided to become active and expand its role in Afghanistan, said Omar Nessar, the director of the Moscow-based Center for Contemporary Afghan Studies (CISA). “Russia has sought closer ties with the Afghan government in a bid to help shape the events on the ground,” he told DW, pointing to Moscow’s military aid and economic investment in the country.”

http://www.dw.com/en/russias-new-role-in-afghanistan/a-19087432

I highly recommend listening to this. Listen carefully to Steve, He’s a brilliant and acerbic analyst of the modern scene, but also possessing exquisite judgement about the near future. (Or such is my opinion, anyway.)

Like me, Steve is a sort of sub-doomer. We believe people will come to their senses before we all get blown away. He mentions three examples of somewhat getting things together (when the chips are clearly down).

1) No nukes dropped in 70 years.

2) Relative repair of the ozone hole.

3) A modest global recognition and conversation (if nothing else) from Paris of the crisis presented by climate change.

He, like me, believes America is the only significant global player, sink or swim. We sink or swim depending on what America does or doesn’t do.

Like me, he thinks America could half its energy use without anyone even noticing. But I differ with his wholesale (no doubt simplified) attribution of our crisis to the car. I’m not sure what is meant by getting rid of the cars. He wants to keep BAU going just enough that people can accept less with equanimity. But BAU without cars requires a lot of things:

– Stopping land development of outlying land that require new roads and cars to get around.

– Public transportation that take us where we want to go when we want to get there.

– Getting to out-of-the-way places could require public, free cars that go back and forth from transit hubs.

– Concentrating population in cities where people can walk to work and to shop.

– Facilitating food supply, work and recreation where people live, so as to obviate much travel to meet basic needs.

How society gets the will and the wherewithal to do all these thing (much less much that I’ve omitted) is beyond me. Where do you start? I would consider prohibiting rural development first. Development there is at odds with scenic values that are essential for rural tourism. It also raises taxes, causing rural landowners to sell their land and move away–also antithetical to rural tourism, as well as independence. So there’s a clear, built-in contradiction within rural (real-estate) development.

But, as Steve suggests, what America needs is a conversation about these things. Maybe blogs like OFW are trying to start that conversation. Notwithstanding the difficulty for BAU of waking people up–causing widespread panic and severe economic dislocation–there is the need to begin this conversation.

Continental europe uses about half US energy per capita. But does not doing that requiring rebuilding US. I am sure someone would notice if US just banned cars.

How can we rebuild the US? The US has spent the last 70 years consolidating a massive system of far-spread infrastructure that requires an internal combustion vehicle for every participant- personal, business, or government. And we have used most of our energy/resource inheritance in doing so.

Now we are on the steepening downside of the energy mountain and will soon be scrambling to keep all of that previously built infrastructure working.

And the downside keeps steepening. No wonder acquiring Russia’s resource base sounds to good to the neocons.

our current existence can be summed up in six words:

explosive force converted into rotary motion

there is no other way in which modern civilisation can be maintained.

if there is, and my home grown theory is wrong, I’d be delighted to hear about it

Norman,

I like your homemade summary.

Probably because I came to a very similar conclusion: for all the processes we’re using, we have to transform any form of energy into heat, before upgrading again, mostly into mechanical energy.

This mandatory passage through the most degraded form of energy is extremely wasteful, especially if you compare with the tiny expenses Nature makes, and keeping the energy in its chemical form, which allows storage (contrary to heat).

Now I have to compact the above in a short formula, such as yours.

(and apologize for tests of html signs)

“explosive force converted into rotary motion”

That’s certainly a good definition of what goes on in gasoline engines. It’s perhaps not quite so true in diesel where there is a relatively long burn from injected fuel. In big diesels, the kind that drive ships, it is so slow that we would not normally consider it an explosion.

Then you get to continuous burn turbo machines which are definitely not explosive but for sure convert fuel energy to rotary motion. And there are steam turbines and water turbines, and electric vehicles run off batteries, overhead wires or third rails. If you go back to railroad steam engines and similar, that’s another example that’s not explosions.

We could most likely get by without explosive engines, but they are really useful, particularly for vehicle power.

i will explain in more detail

If I throw a lump of coal on a fire—it burns. It is chemical combustion.

If I take a lump of coal, grind it to a powder, inject into a manufactured container, with the correct mixture of air and inject a spark—it burns with a bang. (Ask any coalminer) If I attach some kind of piston or whater to that container, I can make use of that energy output. Not very efficient, which why we don’t have coal engines, but the principle is sound.

Instead we throw coal into a steam boiler, the burning explosion is intense enough to create steam—and so on—so we do it that way instead.

You can do the same thing in a flourmill. If I throw a match into a bag of flour, it will go out, but not if I give the match a flour laden atmosphere–then it explodes.

Same thing with a pool of diesel–toss in a match, it will go out—vapourise it under pressure–it explodes

Subdividing our explosive forces into various applications of explosive and non explosive is a nonsense, explosions and burning are simply degrees of the same thing under different circumstances

Turbines also require explosive forces—you cannot make one without.

the only water turbine you can get without explosive forces is one made out of trees—and even then you need metal tools

Chinese fireworks and the apollo moonshots are versions of the same thing–burning/exploding chemicals,

that is what we have built our current existence on

@ hkeithhenson

“Then you get to continuous burn turbo machines which are definitely not explosive but for sure convert fuel energy to rotary motion. ”

I saw a video where a guy converted his gas engine so it could run on wood combustion–involving convoluted rigging in the back and lots of wood. Relatively pollution-free, I think. He just uses the gas engine to turn on the machine, then shuts it off, while the wood takes over.

————–

Maybe Don Stewart has given up on us, but he’s done incredible research that suggest more complex ways to look at energy. (Actually, he has a long comment at the end of the Bates article that RE posted above.)

But I disagree with the seemingly prevailing theory that energy is merely an automatic entity that can only be worked in the way it’s worked now. There is no end to the ways in which energy can be used less wastefully (and stupidly) than it is done under current BAU.

those wood combustion rigs were used during WW2 in Europe

wood is heated, (not burned) this gasifies it. The gas is then used in the engine to provide the explosive force that delivers rotary motion

there are lots of examples if you want to google it

As to ways in which energy can be used in alternative ways, I really would like some meaningful examples

Take a ton of coal, and bottle of gas and a gallon of petrol…take a long look at those three things. Handle them, test them if you know how

i might well have missed a trick here, but without conversion into another chemical form or compound, i can’t figure out a serious use for any of them.

Open the can of petrol and it will dissipate of its own accord—as will the gas.

Coal will sit there a few years, but that too will deteriorate.

None of them will actually DO anything without our intervention. And that means change into something else.

If we want to extract “work” from them, the change must necessarily be violent.—You cannot shift a 40 ton truck or 500 ton train with a gentle puff of wind.. That violence must therefore be explosive, and explosion means heat application to deliver rotary motion

There might be wild and wacky (unproven, untried) theories about energy use out there, but my contention is that our need is here and now—-and urgent.

we may use energy less wastefully, but entropy cannot be denied

” in which energy can be used less wastefully”

That’s true, or close enough to true. But it doesn’t help with the big problems such as pumping water up hill or making fresh water out of salt that are thermodynamically constrained. Nor does it cope with lifting a large fraction of the human race out of energy poverty or the energy cost of taking CO2 out of the atmosphere (if we decide to do that).

No doubt, the scope of the problem is daunting. I use the current world primary energy use, around 15 TW as the target to replace with clean solar energy from space. The only reason this makes sense is an energy payback time around 3 months.

To continue from another post, we need about 3000 5 GW power satellites (that’s measured at the place where a rectenna connects to the grid). A 30,000 ton power satellite takes takes about 2500 launches of a 15 ton payload rocket plane. That included the reaction mass needed to move the power satellite (parts or the completed power satellite) to GEO. At a peak launch rate of around a million flights per year that would take 7.5 to ten years, depending on maintenance overhead, replacement and resupply of station keeping reaction mass.

“(and stupidly) than it is done under current BAU.”

There might be less stupid than you would think. Energy efficiency is very important in a lot of places. Energy is, for example, close to half the cost of commercial air traffic.

BAU has a lot going for it. For example, if you own a home, it makes sense to put in better windows because you will get it back in energy savings. If you rent, the landlord (unless they are paying for the heat) has no reason to put in more efficient windows so low heating cost benefits renters, who are also most often the poorest people.

Pass laws and force landlords to put in energy saving features? Of course the landlords will have to raise the rent to get back their investment. The rent increase may be less than the renter’s savings, or they may be more, in which case the renters have to give up something, like preventative medical care. It’s a complicate problem, but lowering the cost of energy seems like a way to cut across a lot of these kinds of problems.

If power satellites are done at all, I doubt lowering energy cost will be the driver. Climate change from CO2 might be. The problem now is that this approach is not on the short list (mostly wind and ground solar) for solving climate problems. But there is a rising awareness that renewable energy of this kind may not be enough to get humans off fossil fuels.

“He who burns most energy, wins”

There are plenty of less wasteful and stupid ways of using different forms of energy, but unfortunately none of them seems able to deliver the huge amounts of instantaneous power that is required to be successful in all situations.

(hence the big centralized systems Norman talks about, too, instead of a multitude of tiny steps)

We need to burn, and as much as possible, and at an ever increasing rate, or we die (or perhaps survive, but in a totally different form, certainly less hegemonic).

Looks like even efficiency is secondary.

i didn’t mean to infer big centralised systems—my rotary motion hypothesis is applicable at any level and in any context i think.

my other energy law, which applies to all nations:

(which I call the law of collective survival)

———if a nation doesn’t produce enough indigenous surplus energy to support the demands of its people, they must beg, buy, borrow or steal it from somewhere else, or face eventual collapse and starvation until their numbers reach a sustainable level.———

Stick the above rule against Japan for example. You’ll find it fits precisely at every stage. Japan has worked through those 4 options, now their economy is collapsing.

The USA is being hit by the same law. Producing 10mbd and using 18Mbd means energy deficit–they are working through the above options too.

Different nations are at different stages, and it may not be apparent, but the end result is inflexible and terminal.

This links to my rotary motion hypothesis, because we have to keep finding energy sources to feed the machines at an ever faster rate in order to ensure collective survival in the context that meets our expectations. (now and in the infinite future)

Again—I’d like to be proved wrong. But hopium induced 35000 ton satellites are, I fear, not going to change things in time

Keith,

If it is rational for a home owner to install new windows it would be rational for the landlord also rent – expenses = profit.

It depends on who is paying for heating or cooling.

I assumed “heated rent”, you probably “cold rent”. Ok, no disagreement.

property rental is now almost the only source of investment left that can provide an income..

here in the Uk—and I assume many other places with high population densities, landlords are screwing tenants in such a way that rent is getting closer and closer to total income, until we shall reach the point where tenants have no money for anything else.

Norman,

What if the rents represent true cost? (And true cost approaches the whole salary).

In Sweden rental is now cheaper than condos and new condos costs about the same as second hand. And the listed building companies only has a profit margin of 1-2%.

I believe current rents represent about true cost for current standard of living.

@DJ – I had begun to write a reply along the lines of Norman’s rant against landlords, but it would take too long, and was too directed toward government policies to post. Blame the tax system and the way we account for inflation.

a house represents embodied energy—nothing more

thus if you buy a house you are buying the energy output of the men and material that put it together.

if you live in that house as an occupier, you take on the costs of entropy, and its losses, and accrue the increased market value—hopefully the latter is greater than the former.

If on the other hand you rent it out—you are making a profit on the embodied energy that the house represents.–The house becomes your private oilwell—your source of money-energy

Given that in the present economic climate almost no other form of embodied energy investment is accruing profit like a house is, then a landlord will screw every penny out of a tenant irrespective of the long term consequences–if it leaves the tenant in poverty, or ultimately homeless—its not his problem.

Someone will always be available to pay the rent no matter what it is—so it keeps going up, while wages stay static.

This is what’s happening as we drain the world of energy resources, the same driving forces apply whatever the scale

As they get closer and closer, the tenant has a choice of a roof or food.

This is happening right now in UK cities, London in particular.

Read up on the conditions in Victorian London and elsewhere—history is repeating itself

I’m still not convinced that renters are any more screwed than owners. 🙂

Two-room condo in small city 8 years taxed salary AND then rent every month, modest house excluding the property 12 years salary. Utterly unaffordable if not because it is assumed it could be sold for more.

oh—theyr’e not

just a different timescale that’s all—ultimately owners will run out of renters in exactly the same way that oil producers will run out of users

it’s basically the same thing

I don’t see the need to rebuild America. Most of what is here now can be used in different ways. Bus Rapid Transport (BRT) is being widely applied throughout the country. It merely requires painting a special lane for the buses so they can travel more directly and quickly.

One problem of public transportation (PT) is that in our spread-out metropolitan regions, PT doesn’t take you most places you want to go, or get you there with the same timeliness as a car. But Park and Ride schemes where you park in one of the endless paved over places, and a series of buses take you where you need to go (usually a downtown hub or a large event) is on the rise. I think this kind of PT can grow, but maybe it ultimately requires free cars that you borrow and return at PT hubs.

If PT promises to take us where and when we want to travel, we’d find it easier to give up our cars. Maybe the “government” could buy up those cars at a set price, and pay workers to maintain them…then use them toward PT. It’s a chicken and egg situation. The whole process has to be thought through from start to finish.

You have to find out why americans use the double amount of energy of west europeans.

And then figure out how to cut this in half.

Without “rebuilding” US.

Let me also add that these european countries are already considered having higher standard of living than US. So any minor inconvenience caused by your changes (one hour extra commute, no home heating) is a big deal.

DJ,

I’m a poor scholar. I’ve come across the history pertaining to to America’s squandering of resources (as compared to Europe). Having seemingly endless land to sprawl out into could have something to do with it. But I haven’t retained the long list of reasons I’ve come across. I could reconstitute some of them, but that’s more work than I’m up for just now.

There’s an intense anti-Europe bias here, strangely combined with the almost fawning obsequiousness vis a vis European culture. Strange. America is built on the land of the Indian. And although no one talks about it, that Indian heritage also makes a difference.

But you have raised excellent points, and I want to keep them in mind.

“Like me, he thinks America could half its energy use without anyone even noticing.” Not a chance in hades…..I mean without anyone noticing. You have not been paying attention. Your assumption again is one of BAU lite, that is everything remains the same but we use less energy, and you have the temerity to suggest it can be halved. Maybe you could forward some big examples of energy use being halved and nothing affected. Maybe we could start at the armed services, education, energy production, food production and distribution, mining, transport……….about the only thing that could halve its energy use would be banking and finance, maybe that’s what you are thinking.

It has been explained perhaps 1000x why this is not possible …. yet people insist on insisting that it is….

Simple Definition of delusion

: a belief that is not true : a false idea

: a false idea or belief that is caused by mental illness

I don’t think you understand how NEEDLESSLY destructive, blind and dumb land use planning and development are.

Some people insist that every bit of stupidity is necessary for civilization to work. I call total balderdash on that. Choices are always being made. Like the choice to close the ozone hole. Why did that not end BAU? If reducing energy use is so bad, why not INCREASE it then? I can think of any number of mind bogglingly dumb things for you to add to the ones already in place.

For the short term there is indeed benefits of organizing the energy consumption to produce more economic output per unit of energy input. I.e. increasing the per capita GO/BTU ratio.

The other extreme would be to set fire on the oil directly as it exits the wells in the Saudi desert and think it somehow contributes to keep BAU cranking along. Who in their right mind would think of that as doing any good at all?

The “man” should just have kept those oil wells burning for the sake of can kicking. We all “know” that, right? 😉

http://earthtrust.org/impossiblemissions/wp-content/uploads/sites/4/2013/12/kuwaitfires7_640400.jpg

Quite so!

“Your assumption again is one of BAU lite, that is everything remains the same but we use less energy…”

This makes zero bloody sense! NO. Everything would NOT remain the same. Everything would be DIFFERENT. Don’t let me bore you with a list of all the projects that are crying out to be done. Different things from trawling up the few remaining fish in the bottom of the sea. There’s nothing lite about that. Yes. Much less fossil energy and much more muscle and intelligence would be used. If you think that somehow throws the oil economy into a spin, maybe it’s just about time for it to go off into the sunset, damn its hide! But it needn’t go off into the sunset just yet. It simply needs to change, just as does society.

De-lusional thinking at its finest

Paul Craig Roberts tells the truth about US unemployment and other stats. Your government lies to you: http://www.unz.com/proberts/another-phony-jobs-report/

https://marketrealist.imgix.net/uploads/2015/11/World-Rig-count.jpg?w=660&fit=max&auto=format

What is your point? Why do we need to endlessly analyze all these rig counts, etc?

http://peakoilbarrel.com/wp-content/uploads/2016/06/Total-World-Rig-Count.jpg

Welcome to the beginning of the end of the oil age, folks. But don’t despair; seeing the end of something is just as interesting as seeing the beginning.

Humanity is about to be smacked silly. How great is that. The nations and races will go to war. The bankers will lose billions. The politicians will be overthrown. The vapid celebrities will be out of work and picking up shovels.

Embrace it! Alright, not that I believe this entirely, but one can dream.

The end of the oil age is going on forever. Forever is very long period, especially towards the end.

And we all get to eat boiled rat …. be careful what you wish for

Hopefully one with pizza clinging to its jaws!

https://m.youtube.com/watch?v=UPXUG8q4jKU

Cut a piece of salt pork or sowbelly into small dice and cook it slowly to extract the fat. Drain the mice, dredge them thoroughly in a mixture of flour, pepper, and salt, and fry slowly in the rendered fat for about 5 minutes. Add a cup of alcohol and 6 to 8 cloves, cover and simmer for 15 minutes.

Cooking Rats and Mice

bertc.com/subfive/recipes/cookingrats.htm

why kill and cook them, when they can be trained to bring home food? don’t forget to reward the rat for it’s hard work.

How would I go about setting up a mice-based survival system?

This has real possibilities.

don’t forget the “industrial infrastructure” as we are pleased to call it, it really just a giant hamster wheel

http://image.shutterstock.com/display_pic_with_logo/540268/97810154/stock-photo-mouse-in-danger-surrounded-by-mouse-traps-97810154.jpg

Wonder where you got all that cheese…

Cheesus ! I didn’t think of that.

http://www.tradingeconomics.com/charts/og.png?url=/united-states/crude-oil-production

http://www.tradingeconomics.com/charts/og.png?url=/saudi-arabia/crude-oil-production

https://oilprice.com/images/tinymce/2016/Austhr.jpg

These are mostly development wells. We are not talking about bold new geoscience adventures in the desert.

http://static5.businessinsider.com/image/56f41e6352bcd05c658b87aa-1200-900/3-24-16-oil-rigs-chart.png

That’s what the fracking bubble bursting looks like when graphed. Nice one, Yosh.

I wonder what the percentage of drilled but not fracked wells is. The drill count has collapsed after the QE ended, but the production has only declined a little in two years. Thousands of drilled wells might just be waiting to be fracked.

“…but the production has only declined a little in two years.”

It’s declined 2 million barrels a day! That’s a lot.

http://srsroccoreport.com/wp-content/uploads/U.S.-vs-Saudi-Arabia-Oil-Production-Per-Drilling-Rig.png

thats the chart that says it all

the chart the US politicos choose to ignore, along with the morons who shout the “make America great again” mantra..

we are running our world economy on legacy oilfields

The SA rigs are mostly field development drilling in established legacy fields.

The US rigs are a mixed bunch- frack rigs drilling large areas of sub-permeable target zones, small stripper wells, offshore in Gulf, small operators drilling in niche plays etc etc.

Apples & oranges.

The US has a boatload of small oil operations hitting small pockets here and there that when combined adds up.

The U.S actually had a higher rig count than the rest of the world combined in 2014. So I guess comparing the U.S to Saudi Arabia gives a somewhat odd picture.

https://g.foolcdn.com/editorial/images/172046/schlumberger-limited-saudi-arabia_large.jpg

Yes that is where we were in 2014. What is your point? The interesting action is taking place after this period.

No Seneca Cliff only a Seneca Plateau.

http://peakoil.com/consumption/is-food-the-last-thing-to-worry-about-3

Interesting analysis

Radical delusionism= lacking in rigor , pseudoscience, magical thinking , illusion of control , cognitive dissonance and many other evils.

Oh, I forgot , the author is of permaculture .

DJ, thanks for the link . I laughed a lot.

The author seems to not understand that when petrochemical fertilizers are no longer available… there will be next to no food grown anywhere… because the soil will be dead.

Epic ignorance on display

And some people seem to not understand the power of military. I bet they never have even visited a military base

Sell books, teaching courses , lectures, solar panels , batteries … selling hope is a very ugly thing . If you understand the reality of the facts , you do not attend classes but are looking for your church, mosque or Pub .

This is why the “ignorance” of some.

Its methodology is very disturbing. It is based on calculating the energy expenditure of current food production in the US . As it is not excessive there will be not many problems to feed the population. Of course food production needs all the necessary amount of system complexity, but he does not know ( or do not want to know).

Surely he loves to Joan Baez .

Maybe he is just saying all that in the hope of getting a date with Joan…

Instead of dismissing the analysis out of hand, you might try to counter with a similar level of analytical competence. You sound like the repetitive cursing posters in the comment thread there. Boring.

I have done that – on Finite World.

I generally do not post on other sites because they are littered with hordes of Koombayaists, Green Groupies, and Delusistanis who are completely out to lunch.

And if I were to engage these fools in a discussion that would make me a fool – because they do not deal in facts or logic. They are *&^% idiots.

The person who wrote that post is a *&^%$#$ idiot. I could explain the reality of this and he would refuse to accept the logic or facts because he is a *&^%$# idiot.

All that would happen is I’d be met with a deluge of *&^%$# idiots with their fingers blocking their ears hammering away in anger at me for intruding on their world of idiocy.

FW is home to the perhaps 20 people in the world who actually get it. I can learn from these people. I prefer not to associate with or waste my time in the company of idiots.

This is why you amend your garden beds and yard now with compost and other organic fertilizers. By the time collapse happens you’ll be able to grow anything you want in those beds. Nuclear radiation watermelons anyone?

7.3+ billion are not doing what you suggest — and they will be looking to those who have set up organic gardens — to feed them.

And when you refuse – they will take.

Organic gardens are going to be the equivalent of a Black Friday Stampede at Walmart … but with guns and no police… in fact the police will be the ones at the front of the stampede demanding to be fed

Prepping is Futile (that’s the bumper sticker on my truck)

FE you appear to have an extremely peculiar understanding of human nature, If you suppose a stampeding horde of people will attack at any given time. Are you assuming somebody (starving or just hungry) that knows you have food, will tell everyone else and organize an assault, or maybe an assault will simply spontaneously manifest itself. Either way, a lot would get very little. Maybe you think they will become zombies.

What I think is that if my garden has a crop in it when the grocery stores that my neighbours who do not have gardens will be lined up at my door begging for food … women… young children … I would also be concerned that cousins and aunts and uncles and friends would pull up the driveway knowing I grow food — and asking me to share…

I would also be concerned that the 7000 or so people who live in the town 10k down the road will realize that the farming areas are where the food is… and that they will be headed our way…

There are also 500k within a tank of gas of here…. they will know that this area is a big food production place — they will not likely realize that there will be very little food here because the farms need petro chemical fertilizers… so they will head this way expecting to be fed… what they will find is a small number of people like me who can’t even grow enough food to support 4 people….

And they will be asking to be fed —- and when I cannot feed them them will be demanding to be fed… they will be walking into the gardens taking what they want…. if I shoot them they will come back at night and conduct their food raids.

All it take is one successful foray into the garden by a few dozen people and I starve.

I can imagine this will be a global problem….

I’m counting on this. That’s why I live on a secluded hill with only one way in, several long-range guns, and the ability to hit a can of soda from 1/2 mile off the deck of the house. The first few people who stop outside the gate are going to become souvenirs. I was thinking a string of ears hanging on the gate may persuade most to look elsewhere.

If you are able to fend people off…. then comes the radiation …. there would also be the issue of a crop failure — pests do destroy crops from time to time….drought happens…. there will also be no medicines available so the simplest disease or illness kills you …. stockpiles run out … tools bust and wear out….

I really so no point in trying to survive the end of BAU … it will not be Little House on the Prairie… it would be a life of suffering….

The doomsday types have made this out to be an adventure… it will be anything but….

And the funds could be used on prepping could be used enjoying the final years of BAU….

I don’t plan on outliving anyone or being the next “Adam” or anything. I merely think it will be interesting to see how it plays out and if things go as predicted. I realize I probably won’t make it more than a year or two, if that. Something real ironic will kill me too that I didn’t see coming, like tetanus, the flu, or choking on my food because I forgot to put enough ketchup in my Doomsday pantry.

Likewise… I have filled a 20ft container with enough stuff to get a look at what post BAU looks like… when things get really rough I will run the car into a wall of rock….

“fertilizer”

http://peakoil.com/consumption/amid-economic-hard-times-venezuelans-turn-to-city-farming

government boasts that in the last three months, some 135,000 Venezuelans have produced 273 tonnes of vegetables, fruits and herbs in urban settings

Vast swathes of arable land are underused.

The land can be repaired within a couple of years timeframe as well. I’ve been repairing my rocky, nasty soil here with food-scrap compost and natural amendments like gypsum, hummus, leaves, horse manure, and others.

I’m certain that when collapse comes peeps will curb their hunger pangs for the two years it gets them to produce a crop. /sarc

I’m not suggesting anything of the sort. When collapse happens it’s likely 5 or 6 billion die relatively quickly. But if there are survivors anything outside of a very small population will have to be growing food. If you don’t already have a garden or farm you definitely won’t after collapse unless you seize it, which doesn’t necessarily mean you can produce on it. The time to fix/amend soil is now while BAU is in full gear and amendments can be had for dirt cheap and in super large quantities.

Death rate in venezuela not up yet. They could very well recieve outside help for two years while starting up their own agriculture.

But I don’t think it will happen that way.

+++++++++

I imagine they will try to curb their hunger pangs by eating everything that moves… which will of course delay the soil repairs for lack of manure….

Global overshoot day for 2016 is not far off – enjoy it while it lasts 🙂

“As of 8 August 2016, the world will be living on environmental credit for the rest of the year. This is five days earlier than last year and more than four months earlier than in 1987 when the Global Footprint Network started calculating what has become known as the Earth’s Overshoot Day.”

http://eandt.theiet.org/news/2016/aug/overshoot-day.cfm

Oh, good. It’s still a long way off till January 1st is Overshoot Day. In the meantime, for two thirds of the year we are not in overshoot, so our glass is still more than half full and things will be looking rosy for quite some time.

LOL! We can only hope and pray that’s how it works out. More and more signs of climate collapse are happening each week. It’s sort of strange that the economy, the political environment, and biosphere are all terminally failing simultaneously.

Aristoteles hated money, especially he hated the idea of lending money against interest, but then again, he was Greek.

Although he admitted that money had a practical purpose: if he went to the market with his cow and started to carve out a piece from the cow for a pair of sandals, then another piece for a vase of olive oil…

– What you don’t like beef ?

– You are a vegetarian ?

– Are you nuts ?

– How about a pair of sandals ?

… anyway, it was easies to just sell the whole cow for gold monies and then do his shopping.

If the society is too big for barter and gift exchange, it’s too big.

Excellent!

Things can be more complex. Inca and Aztech empires counted 15-20 millions subjects each at the time of the conquest. These were stone age societies, and they had many different ways to make goods to move around.

150 could be fine for Orlov, but it shouldn’t necessarily to be the case. In fact I expect that, in case the number of humans ever fall to only 1%, it can easily boom thereafter ten fold

Orlov was looking at studies of small-group societies all over the world. Turns out that knowing everyone in your community made people more accountable. But I’ve wondered how some larger groups manage to do well for a long time. A large city that I know a little about is NYC. When I lived there, neighborhoods were very strong. I actually think many blocks had a sort of autonomy, including protection from outsiders wondering in or making trouble. Haven’t really studied Inca or Aztec societies. I know that centralized Mayan civilization collapsed but that its people then spread out across the land, much of that dispersed culture still alive today.

It’s consoling to imagine that salvation lies in small groups where everyone knows one another, but when they go wrong one longs for the anonymity of the city! Every day you’ll be coming across your enemies….

Here’s an example from my village(been here 16 years, long enough to make enemies and friends, and to get to know some of the workings – it’s not really an agricultural place anymore, by the way. )

The local farmers all seem to be cousins: the family I am most friendly with also have a high-end car dealership, and for many years gave a new car every New Year to one of the farmer cousins in return for some regular favour (I think it was access to land.)

All went on nicely until in 2008 the car business went horribly wrong; they told the farmer that regretfully they couldn’t supply a new car that year. The reaction was unreasoning outrage, and when the farmer had a heart-attack soon after, it was blamed on my friends and I believe it came to blows. Anyway, from good relations with kin to an unending feud fuelled by bitter memories: this will never heal.

This story was brought to mind by an incident in a book about Inuit, when a family found themselves ostracised due to an incident (death of their child) which was not their fault: but the community (mentally-impaired as far as I could tell) decided they were guilty and that was that.

Another advantage of a small community is that you get to know exactly who the bad apples are, and so never trust them with the smallest thing. In a crisis, that can save your life I should have thought.

Playing word association, with ‘village life’ I would immediately match: ‘malice’!

“Another advantage of a small community is that you get to know exactly who the bad apples are, and so never trust them with the smallest thing.”

+1

I live in a village too. Smaller than yours maybe. It’s what remains of a very populous company town from decades ago. Squatters lived here and there in the ruins for some time after a period of abandonment. Then new people intent on serious settlement moved in and bought single lots.

A lot of this complex history pervades the small modern version of the village. Apart from the squatter era, it has always been a grudging part of the system. Cell phone reception is poor, but land lines work fine. We’re connected to the grid. The county has routinely been stingy with services, given how independent the place is.

My spouse and I tend to be very private. We drive 20 miles to town to shop, as do most residents. We don’t socialize here hardly at all (except when I attend public meetings). Our umbilical cords are tied to the city, to which we are directly connected by a main highway. This sounds like suburbia, I guess, but it’s also a rough and ready town (that some describe as a hybrid of hippie and cowboy) with lots of history. Hardly anyone is rich. There is a sense of community, but you can also be as detached as you please.

This place is sort of urban and rural at the same time. It’s a hybrid such as I would prescribe for most quasi metropolitan areas. I’m much more keen to see if BAU can be done better than I am to see it go altogether. But I’m not trying to influence anyone. I could care less what people decide to do.

For the 150 thing to work you need isolation I believe.

You HAVE to accept your 150 even if you don’t like 10 of them and don’t care much about 50-100.

In a city you just move to 13th floor after made enemies with everyone on 17th.

In an isolated world it is hard to leave the group. Alone in the wilderness or trying to associate with another group that may just beat the shit out of you, the stranger.

I’m sticking with 4 years. Not really a quick and total collapse, but a very clear sign that we are on the other side of growth. Several more nations will be jettisoned and the U.S. Military will become increasingly active. I’m not exactly sure what happens after that.

I think you’re confused. We’re already reached this phase…

Maybe Kurt means that the world will KNOW we’re on the downside of growth, not just some of us on blogs. And he talks about gradual increase in military activity (even though it’s super active already). And MORE nations being jettisoned, even though they are being jettisoned already…

When real unemployment is in the region of 20% for most countries… worse for under 25’s…. when people are living in the back seat of their cars.. up their ears in debt…. deep down they know something is not ‘right’…. that the future is bleak…. the stress levels must be sky high….

But the thing is…. they would not understand why things are as they are…. they probably think that the right politician can fix things… they continue to have hope…

But make no mistake — for hundreds of millions of people their once cushy lives are already no more…. desperation and despair have set in….

I must be living in Utopia. Here everything is wonderful for everyone. Debts are high of course, but there is no reason to die with a positive net worth so it is silly talking about paying off debt.

And if the debts are heritable by your children, grand-children, as in some jurisdictions now? Not quite so good.

No worry in Utopia. If there is debts left when all assets are sold they are cancelled.

You and I may be living in the same place.

The unemployment rate in my town right now is 3.6%!! It’s an absurd number. I happen to be in one of those bubble places where everyone is working and spending, traffic is up, residential and commercial development is going on everywhere (3 cranes working in this mid-sized town right now), they keep having to staff-up the planning and building department just to keep up with all the reviews and inspections.

I see solar panels going up on rooftops and new Nissan Leafs on the street all the time- because people are doing so well they can afford to spend the extra cash on these luxury items.

Even the small areas of low-income housing are seeing all kinds of infrastructure improvements installed by the local government- street rebuilds with wide sidewalks and shade trees, new parks, fixing old stormwater issues.

I’d say for most of the community here this is an absolutely golden time, probably better than 10 years ago before the housing bubble burst. If anyone in this town read the things we talk about here it would sound like its from Neptune.

If Delusistan has a capital, this might be it.

@Frogman

Kind of the same here where I live… and it’s all backed by an export-heavy automotive industry…. and of course an additional very-low-wage income sector in contrast to the ones that directly work in den automotive industry, either as 1st tier or in the 2nd tier as dependent suppliers.

Crazy, especially if the euro should go bust or the world economy tanks. But I have these notions since 2009…. and all the time the central planners / bankers keep the whole thing going…. infusions… infusions… infusions….

” that the future is bleak”

This isn’t the first time. It happened about once a generation for the last million years or so. Long enough that humans have a wired in coping mechanism that worked just fine in the stone age. Now, not so well.